Entergy 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2007

4

We ranked number one in total

shareholder return over the nine-year

period from Dec. 31, 1998 to

Dec. 31, 2007.

CORPORATE

opportunity with a unique base rate path and earnings per

share growth prospect. e utilities’ investment opportunities to

reduce fuel cost and volatility are substantial relative to their own

balance sheet. In that regard, we will not take on more than we can

handle. Innovative nancing with structures allowing for third-

party investment or nancing in specic projects (e.g., nuclear)

will be extensively evaluated and implemented if it contributes

to maintaining a strong credit rating, lowering customers’ bills

or protecting shareholder value. rough this transformation,

Entergy Classic aspires to a “real” decrease in customer rates, with

a base rate path less than projected ination, while simultaneously

growing earnings per share six to eight percent through 2012,

creating value for all stakeholders.

It is rare to uncover an opportunity with the potential to deliver

substantial value to all stakeholders. Moreover, as an Entergy

shareholder, we clearly expect that you will be advantaged by both

the value of SpinCo and the enhanced value of Entergy Classic.

We will continue to take the necessary actions, including seeking

requisite regulatory approvals, in order to complete the transaction

around the end of the third quarter of 2008.

Unlocking Value Through Operations – Our 2007 Results

Even as we continue to evaluate opportunities to realize the value

inherent in our existing assets, our 14,300 employees remain focused

on creating value through industry-leading performance in our

ongoing operations. As a result of their eorts, Entergy delivered

total shareholder return of 32.5 percent in 2007, placing us once

again in the top quartile of our peer companies.

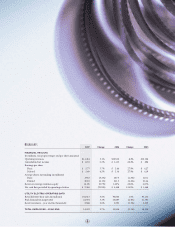

We achieved our $1 per share operational earnings growth aspiration

and did so in a challenging economic climate. Entergy’s operational

earnings were $5.76 per share, up 22 percent from $4.72 per share

in 2006. As-reported earnings were $5.60 per share, up 4.5 percent

from $5.36 per share in 2006. We initiated a new $1.5 billion stock

repurchase program in 2007, and returned nearly $1 billion of cash

to our owners through that program, doubling our repurchase

aspiration of $500 million. In addition, our Board of Directors

increased the dividend for the rst time since the last increase in

2004, consistent with our aspiration to achieve a 60 percent target

payout ratio. And our operational return on invested capital

increased, moving towards our 10 percent nancial aspiration.

ese nancial accomplishments were realized without sacricing

our solid credit metrics. We never lose sight of our point of view

that a strong balance sheet is a fundamental component of long-

term nancial success.

A more detailed description of the performance of our Corporation,

Utility and Nuclear Businesses – as well as our point of view on a

carbon policy to address the climate change issue – can be found

later in this report. Highlights include:

IN OUR UTILITY BUSINESS, we made solid progress in executing

our portfolio transformation strategy in 2007 – announcing the

acquisitions of the 789-megawatt Ouachita Power Facility in

northern Louisiana and the 322-megawatt Calcasieu Generating

Facility in southwestern Louisiana and receiving regulatory

approval to proceed with the Little Gypsy Unit 3 repowering project.

We continue to pursue buy, build and contract power purchase

options through our portfolio transformation initiative in order to

procure the right generating technologies for our customers in the

most ecient manner possible. In addition, we’re preserving our

option to invest in the next, simpler, more ecient generation of

nuclear plants, with potential new nuclear development at our Grand

Gulf Nuclear Station and River Bend Station.

We essentially reached closure on the regulatory recovery

process for the unprecedented devastation of the 2005 storm

season. In May, Entergy New Orleans emerged from bankruptcy,

We are pursuing our portfolio

transformation strategy to meet

demand, diversify our fleet and create

opportunities to lower costs for

our customers.

UTILITIES