Entergy 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2007

28

Entergy operates primarily through two business segments: Utility

and Non-Utility Nuclear.

n UTILITY generates, transmits, distributes, and sells electric power in

a four-state service territory that includes portions of Arkansas,

Mississippi, Texas, and Louisiana, including the City of New

Orleans; and operates a small natural gas distribution business.

n NON-UTILITY NUCLEAR owns and operates six nuclear power

plants located in the northern United States and sells the electric

power produced by those plants primarily to wholesale customers.

is business also provides services to other nuclear power

plant owners.

In addition to its two primary, reportable, operating segments, Entergy

also operates the non-nuclear wholesale assets business. e non-

nuclear wholesale assets business sells to wholesale customers the

electric power produced by power plants that it owns while it focuses

on improving performance and exploring sales or restructuring

opportunities for its power plants. Such opportunities are evaluated

consistent with Entergy’s market-based point-of-view.

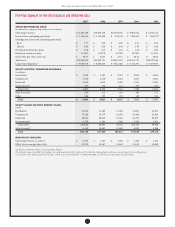

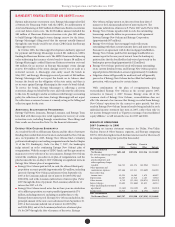

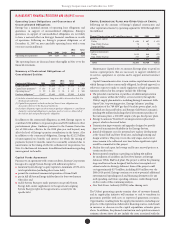

Following are the percentages of Entergy’s consolidated revenues

and net income generated by its operating segments and the percentage

of total assets held by them:

% of Revenue

Segment 2007 2006 2005

Utility 80 84 84

Non-Utility Nuclear 18 14 14

Parent Company &

Other Business Segments 2 2 2

% of Net Income

Segment 2007 2006 2005

Utility 60 61 73

Non-Utility Nuclear 48 27 31

Parent Company &

Other Business Segments (8) 12 (4)

% of Total Assets

Segment 2007 2006 2005

Utility 78 81 82

Non-Utility Nuclear 21 17 16

Parent Company &

Other Business Segments 1 2 2

PLAN TO PURSUE SEPARATION OF NON-UTILITY NUCLEAR

In November 2007, the Board approved a plan to pursue a separation

of the Non-Utility Nuclear business from Entergy through a tax-free

spin-o of Non-Utility Nuclear to Entergy shareholders. SpinCo, the

term used to identify the new company that is yet to be named, will

be a new, separate, and publicly-traded company. In addition, under

the plan, SpinCo and Entergy are expected to enter into a nuclear

services business joint venture, with 50% ownership by SpinCo and

50% ownership by Entergy. e nuclear services business board of

directors will be comprised of equal membership from both Entergy

and SpinCo and may include independent directors.

Upon completion of the spin-o, Entergy Corporation’s shareholders

will own 100% of the common equity in both SpinCo and Entergy.

Entergy expects that SpinCo’s business will be substantially comprised

of Non-Utility Nuclear’s assets, including its six nuclear power plants,

and Non-Utility Nuclear’s power marketing operation. Entergy

Corporation’s remaining business will primarily be comprised of the

Utility business. e nuclear services business joint venture is expected

to operate the nuclear assets owned by SpinCo. e nuclear services

business is also expected to oer nuclear services to third parties,

including decommissioning, plant relicensing, and plant operation

support services, including the services currently provided for the

Cooper Nuclear Station in Nebraska.

Entergy Nuclear Operations, Inc., the current Nuclear Regulatory

Commission (NRC)-licensed operator of the Non-Utility Nuclear

plants, led an application in July 2007 with the NRC seeking indirect

transfer of control of the operating licenses for the six Non-Utility

Nuclear power plants, and supplemented that application in December

2007 to incorporate the planned business separation. Entergy Nuclear

Operations, Inc. will remain the operator of those plants aer

the separation. Entergy Operations, Inc., the current NRC-licensed

operator of Entergy’s ve Utility nuclear plants, will remain a wholly-

owned subsidiary of Entergy and will continue to be the operator of

the Utility nuclear plants. In the December 2007 supplement to the

NRC application, Entergy Nuclear Operations provided additional

information regarding the spin-o transaction, organizational structure,

technical and nancial qualications, and general corporate information.

e NRC published a notice in the Federal Register establishing a period

for the public to submit a request for hearing or petition to intervene in

a hearing proceeding. e NRC notice period expired on February 5,

2008 and two petitions to intervene in the hearing proceeding were led

before the deadline. Each of the petitions opposes the NRC’s approval

of the license transfer on various grounds, including contentions that

the approval request is not adequately supported regarding the basis for

the proposed structure, the adequacy of decommissioning funding, and

the adequacy of nancial qualications. Entergy will submit answers to

the petitions, and the NRC or a presiding ocer designated by the NRC

will determine whether a hearing will be granted. If a hearing is granted,

the NRC is expected to issue a procedural schedule providing for

limited discovery, written testimony and a legislative-type hearing. e

NRC will continue to review the application and prepare a Safety

Evaluation Report.

On January 28, 2008, Entergy Nuclear Vermont Yankee and Entergy

Nuclear Operations, Inc. requested approval from the Vermont Public

Service Board for the indirect transfer of control, consent to pledge

assets, guarantees and assignments of contracts, amendment to

certicate of public good to reect name change, and replacement of

guaranty and substitution of a credit support agreement for Vermont

Yankee. A prehearing conference scheduled for February 27, 2008 was

postponed due to weather.

On January 28, 2008, Entergy Nuclear FitzPatrick, Entergy Nuclear

Indian Point 2, Entergy Nuclear Indian Point 3, Entergy Nuclear

Operations, and corporate aliate NewCo (also referred to as SpinCo)

led a petition with the New York Public Service Commission (NYPSC)

requesting a declaratory ruling regarding corporate reorganization or

in the alternative an order approving the transaction and an order

approving debt nancing. Petitioners also requested conrmation

that the corporate reorganization will not have an eect on Entergy

Nuclear FitzPatrick’s, Entergy Nuclear Indian Point 2’s, Entergy

Nuclear Indian Point 3’s, and Entergy Nuclear Operations, Inc.’s

status as lightly regulated entities in New York, given that they will

continue to be competitive wholesale generators. e deadline for

parties to le comments or request intervention is April 7, 2008.

Pursuant to Federal Power Act Section 203, on February 21, 2008, an

application was led with the FERC requesting approval for the indirect

disposition and transfer of control of jurisdictional facilities of a public

utility. e review of the ling by FERC will be focused on determining

that the transaction will have no adverse eects on competition,

wholesale or retail rates, and on federal and state regulation. Also, the

FERC will seek to determine that the transaction will not result in

Management’s Financial Discussion and Analysis