Entergy 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

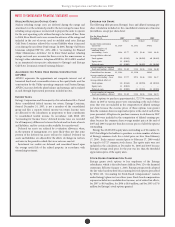

surcharge over a two-month period and agrees that the incremental

capacity recovery rider will be set to collect $21 million on an annual

basis eective February 2008. Amounts collected through the rider

and interim surcharge are subject to nal reconciliation.

In October 2007, Entergy Texas led a request with the PUCT to

refund $45.6 million, including interest, of fuel cost recovery over-

collections through September 2007. In January 2008, Entergy Texas

led with the PUCT a stipulation and settlement agreement among the

parties that updated the over-collection balance through November

2007 and establishes a refund amount, including interest, of $71

million. e refund is to be made over a two-month period beginning

February 2008. e PUCT approved the agreement in February 2008.

Amounts refunded through the interim fuel refund are subject to nal

reconciliation in a future fuel reconciliation proceeding.

In March 2007, Entergy Texas led a request with the PUCT to

refund $78.5 million, including interest, of fuel cost recovery over-

collections through January 2007. In June 2007 the PUCT approved

a unanimous stipulation and settlement agreement that updated the

over-collection balance through April 2007 and established a refund

amount, including interest, of $109.4 million. e refund was made

over a two-month period beginning with the rst billing cycle in July

2007. Amounts refunded through the interim fuel refund are subject

to nal reconciliation in a future fuel reconciliation proceeding.

e Entergy Texas rate ling made with the PUCT in September

2007, which is discussed below, includes a request to reconcile $858

million in fuel and purchased power costs on a Texas retail basis

incurred over the period January 2006 through March 2007.

In May 2006, Entergy Texas led with the PUCT a fuel and purchased

power reconciliation case covering the period September 2003 through

December 2005 for costs recoverable through the xed fuel factor rate

and the incremental purchased capacity recovery rider. Entergy Texas

sought reconciliation of $1.6 billion of fuel and purchased power

costs on a Texas retail basis. A hearing was conducted before the ALJs

in April 2007. In July 2007, the ALJs issued a proposal for decision

recommending that Entergy Texas be authorized to reconcile all of

its requested xed fuel factor expenses and recommending a minor

exception to the incremental purchased capacity recovery calculation.

e ALJs also recommended granting an exception to the PUCT rules

to allow for recovery of an additional $11.4 million in purchased power

capacity costs. In September 2007, the PUCT issued an order, which

armed the ultimate result of the ALJs’ proposal for decision. Upon

motions for rehearing, the PUCT added additional language in its order

on rehearing to further clarify its position that 30% of River Bend should

not be regulated by the PUCT. Two parties led a second motion for

rehearing, but the PUCT declined to address them. e PUCT’s decision

has been appealed to the Travis County District Court.

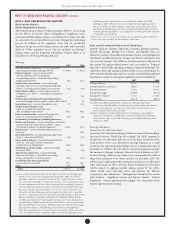

Entergy Gulf States Louisiana and Entergy Louisiana

In Louisiana, Entergy Gulf States Louisiana and Entergy Louisiana

recover electric fuel and purchased power costs for the upcoming

month based upon the level of such costs from the prior month.

Entergy Gulf States Louisiana’s purchased gas adjustments include

estimates for the billing month adjusted by a surcharge or credit that

arises from an annual reconciliation of fuel costs incurred with fuel

cost revenues billed to customers, including carrying charges.

In August 2000, the LPSC authorized its sta to initiate a proceeding

to audit the fuel adjustment clause lings of Entergy Louisiana

pursuant to a November 1997 LPSC general order. e time period

that is the subject of the audit is January 1, 2000 through December

31, 2001. In September 2003, the LPSC sta issued its audit report and

recommended a disallowance with regard to an alleged failure to uprate

Waterford 3 in a timely manner. is issue was resolved with the March

2005 global settlement. Subsequent to the issuance of the audit report,

the scope of this docket was expanded to include a review of annual

reports on fuel and purchased power transactions with aliates and

a prudence review of transmission planning issues and to include the

years 2002 through 2004. Hearings were held in November 2006. In

December 2007 the ALJ issued a proposed recommendation and dra

order that, with minor exceptions, found in Entergy Louisiana’s favor

on the issues. e LPSC has not issued a decision in this proceeding.

In January 2003, the LPSC authorized its sta to initiate a proceeding

to audit the fuel adjustment clause lings of Entergy Gulf States

Louisiana and its aliates pursuant to a November 1997 LPSC general

order. e audit will include a review of the reasonableness of charges

owed by Entergy Gulf States Louisiana through its fuel adjustment

clause in Louisiana for the period January 1, 1995 through December

31, 2002. Discovery is underway, but a detailed procedural schedule

extending beyond the discovery stage has not yet been established, and

the LPSC sta has not yet issued its audit report. In June 2005, the

LPSC expanded the audit period to include the years through 2004.

Entergy Mississippi

Entergy Mississippi’s rate schedules include an energy cost recovery

rider which is adjusted quarterly to reect accumulated over- or

under-recoveries from the second prior quarter.

Entergy New Orleans

Entergy New Orleans’ electric rate schedules include a fuel

adjustment tari designed to reect no more than targeted fuel and

purchased power costs, adjusted by a surcharge or credit for deferred

fuel expense arising from the monthly reconciliation of actual fuel

and purchased power costs incurred with fuel cost revenues billed to

customers, including carrying charges. In June 2006, the City Council

authorized the recovery of all Grand Gulf costs through Entergy New

Orleans’ fuel adjustment clause (a signicant portion of Grand Gulf

costs was previously recovered through base rates), and continued

that authorization in approving the October 2006 formula rate plan

ling settlement.

Entergy New Orleans’ gas rate schedules include an adjustment

to reect estimated gas costs for the billing month, adjusted by

a surcharge or credit similar to that included in the electric fuel

adjustment clause, including carrying charges. In October 2005, the

City Council approved modication of the current gas cost collection

mechanism eective November 2005 in order to address concerns

regarding its uctuations, particularly during the winter heating

season. e modications are intended to minimize uctuations in

gas rates during the winter months.