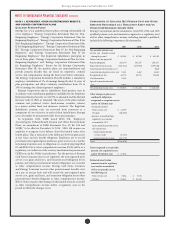

Entergy 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

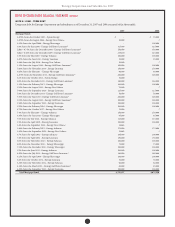

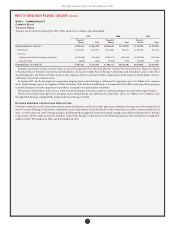

2007 2006

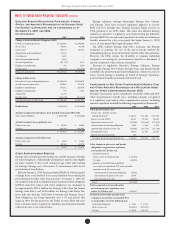

Governmental Bonds(a):

5.45% Series due 2010, Calcasieu Parish – Louisiana(g) $ 22,095 $ 22,095

6.75% Series due 2012, Calcasieu Parish – Louisiana(g) 48,285 48,285

6.7% Series due 2013, Pointe Coupee Parish – Louisiana(g) 17,450 17,450

5.7% Series due 2014, Iberville Parish – Louisiana(g) 21,600 21,600

5.8% Series due 2015, West Feliciana Parish – Louisiana(g) 28,400 28,400

7.0% Series due 2015, West Feliciana Parish – Louisiana(g) 39,000 39,000

5.8% Series due 2016, West Feliciana Parish – Louisiana(g) 20,000 20,000

6.3% Series due 2016, Pope County – Arkansas(b) 19,500 19,500

4.6% Series due 2017, Jeerson County – Arkansas(b) 54,700 54,700

6.3% Series due 2020, Pope County – Arkansas 120,000 120,000

5.0% Series due 2021, Independence County – Arkansas(b) 45,000 45,000

5.875% Series due 2022, Mississippi Business Finance Corp. 216,000 216,000

5.9% Series due 2022, Mississippi Business Finance Corp. 102,975 102,975

Auction Rate due 2022, avg. rate 3.63%, Independence County – Mississippi(b) 30,000 30,000

4.6% Series due 2022, Mississippi Business Finance Corp.(b) 16,030 16,030

6.2% Series due 2026, Claiborne County – Mississippi 90,000 90,000

6.6% Series due 2028, West Feliciana Parish – Louisiana(g) 40,000 40,000

Auction Rate due 2030, avg. rate 3.66%, St. Charles Parish – Louisiana(b) 60,000 60,000

Total Governmental Bonds 991,035 991,035

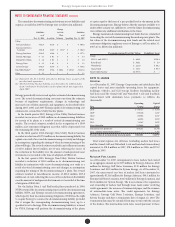

Other Long-Term Debt:

Note Payable to NYPA, non-interest bearing, 4.8% implicit rate $ 217,676 $ 297,289

5 year Bank Credit Facility, weighted avg rate 5.524% (Note 4) 2,251,000 820,000

Bank term loan, Entergy Corporation, avg rate 5.43%, due 2010 60,000 60,000

Bank term loan, Entergy Corporation, avg rate 3.08%, due 2008 – 35,000

6.17% Notes due March 2008, Entergy Corporation 72,000 72,000

6.23% Notes due March 2008, Entergy Corporation 15,000 15,000

6.13% Notes due September 2008, Entergy Corporation 150,000 150,000

7.75% Notes due December 2009, Entergy Corporation 267,000 267,000

6.58% Notes due May 2010, Entergy Corporation 75,000 75,000

6.9% Notes due November 2010, Entergy Corporation 140,000 140,000

7.625% Notes initially due February 2011, Entergy Corporation(c) 500,000 500,000

7.06% Notes due March 2011, Entergy Corporation 86,000 86,000

Long-term DOE Obligation(d) 176,904 168,723

Waterford 3 Lease Obligation 7.45% (Note 10) 247,725 247,725

Grand Gulf Lease Obligation 5.13% (Note 10) 322,005 345,340

5.51% Series Senior Secured, Series A due October 2013, Entergy Gulf States

Reconstruction Funding 93,500 –

5.79% Series Senior Secured, Series A due October 2018, Entergy Gulf States

Reconstruction Funding 121,600 –

5.93% Series Senior Secured, Series A due June 2022, Entergy Gulf States

Reconstruction Funding 114,400 –

Unamortized Premium and Discount – Net (5,596) (5,991)

Other 30,446 40,542

Total Long-Term Debt 10,724,892 8,979,663

Less Amount Due Within One Year 996,757 181,576

Long-Term Debt Excluding Amount Due Within One Year $ 9,728,135 $ 8,798,087

Fair Value of Long-Term Debt(e) $ 9,351,702 $ 8,106,540

(a) Consists of pollution control revenue bonds and environmental revenue bonds.

(b) The bonds are secured by a series of collateral first mortgage bonds.

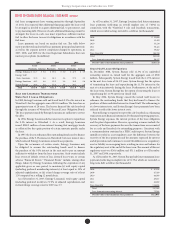

(c) In December 2005, Entergy Corporation sold 10 million equity units with a stated amount of $50 each. An equity unit consists of (1) a note, initially

due February 2011 and initially bearing interest at an annual rate of 5.75%, and (2) a purchase contract that obligates the holder of the equity unit

to purchase for $50 between 0.5705 and 0.7074 shares of Entergy Corporation common stock on or before February 17, 2009. Entergy will pay the

holders quarterly contract adjustment payments of 1.875% per year on the stated amount of $50 per equity unit. Under the terms of the purchase

contracts, Entergy Corporation will issue between 5,705,000 and 7,074,000 shares of common stock in the settlement of the purchase contracts

(subject to adjustment under certain circumstances).

(d) Pursuant to the Nuclear Waste Policy Act of 1982, Entergy’s nuclear owner/licensee subsidiaries have contracts with the DOE for spent nuclear fuel

disposal service. The contracts include a one-time fee for generation prior to April 7, 1983. Entergy Arkansas is the only Entergy company that

generated electric power with nuclear fuel prior to that date and includes the one-time fee, plus accrued interest, in long-term debt.

(e) The fair value excludes lease obligations and long-term DOE obligations, and includes debt due within one year. It is determined using bid prices

reported by dealer markets and by nationally recognized investment banking firms.

(f) Pending developments in the Entergy New Orleans bankruptcy proceeding, Entergy deconsolidated Entergy New Orleans and reported its financial

position and results under the equity method of accounting in 2005 and 2006. Entergy reconsolidated Entergy New Orleans in 2007.

(g) Entergy Gulf States Louisiana remains primarily liable for all of the long-term debt issued by Entergy Gulf States, Inc. that was outstanding on

December 31, 2007. Under a debt assumption agreement with Entergy Gulf States Louisiana, Entergy Texas assumed approximately 46% of this

long-term debt.