Entergy 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

Entergy Corporation and Subsidiaries 2007

Notes to Consolidated Financial Statements continued

NOTE 2. RATE AND REGULATORY MATTERS

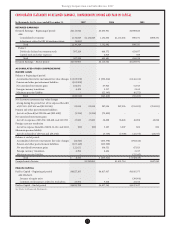

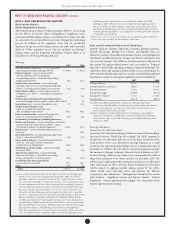

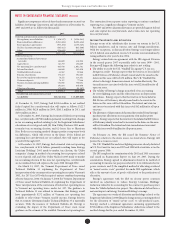

RE G U L AT O R Y AS S E T S

Other Regulatory Assets

e Utility business is subject to the provisions of SFAS 71, “Accounting

for the Eects of Certain Types of Regulation.” Regulatory assets

represent probable future revenues associated with certain costs that

are expected to be recovered from customers through the ratemaking

process. In addition to the regulatory assets that are specically

disclosed on the face of the balance sheets, the table below provides

detail of “Other regulatory assets” that are included on Entergy’s

balance sheets and the Registrant Subsidiaries’ balance sheets as of

December 31, 2007 and 2006 (in millions):

Entergy

2007 2006

Asset Retirement Obligation - recovery dependent

upon timing of decommissioning (Note 9)(b) $ 334.9 $ 303.2

Deferred capacity - recovery timing will be

determined by the LPSC in the formula

rate plan lings (Note 2 - Retail Rate Proceedings -

Filings with the LPSC) 86.4 127.5

Deferred fuel - non-current - recovered through

rate riders when rates are redetermined periodically

(Note 2 - Fuel and purchased power cost recovery) 32.8 43.4

Depreciation re-direct - recovery begins at start of

retail open access (Note 1 - Transition to Competition

Liabilities)(b) – 79.1

DOE Decommissioning and Decontamination Fees -

recovered through fuel rates until December 2007 (Note 9) – 9.1

Gas hedging costs - recovered through fuel rates 9.7 47.6

Pension & postretirement costs

(Note 11 - Qualied Pension Plans and

Non-Qualied Pension Plans)(b) 675.1 700.7

Postretirement benets - recovered through 2012

(Note 11 - Other Postretirement Benets)(b) 12.0 14.4

Provision for storm damages, including Hurricanes

Katrina and Rita costs - recovered through securitization,

insurance proceeds, and retail rates (Note 2 - Storm

Cost Recovery Filings with Retail Regulators)(a) 1,339.8 827.4

Removal costs - recovered through depreciation rates

(Note 9)(b) – 113.2

River Bend AFUDC - recovered through August 2025

(Note 1 – River Bend AFUDC) 31.8 33.7

Sale-leaseback deferral - recovered through June 2014

(Note 10 – Sale and Leaseback Transactions –

Grand Gulf Lease Obligations)(c) 103.9 114.0

Spindletop gas storage facility - recovered through

December 2032(c) 37.4 39.0

Transition to competition - recovered through

February 2021 (Note 2 – Retail Rate Proceedings -

Filings with the PUCT and Texas Cities) 112.9 117.8

Unamortized loss on reacquired debt -

recovered over term of debt 137.1 150.1

Other 57.6 48.2

Total $2,971.4 $2,768.4

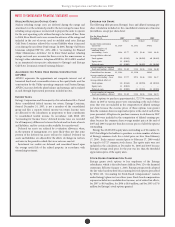

(a) As a result of Hurricane Katrina and Hurricane Rita that hit Entergy’s

Utility service territories in August and September 2005, the Utility

operating companies recorded accruals for the estimated storm restora-

tion costs and originally recorded some of these costs as regulatory assets

because management believes that recovery of these prudently incurred

costs through some form of regulatory mechanism is probable. Entergy is

pursuing a broad range of initiatives to recover storm restoration costs.

Initiatives include obtaining reimbursement of certain costs covered by

insurance, obtaining assistance through federal legislation for Hurricanes

Katrina and Rita including Community Development Block Grants

(CDBG), pursuing recovery through existing or new rate mechanisms

regulated by the FERC and local regulatory bodies, and securitization.

Entergy Gulf States Louisiana, Entergy Louisiana, Entergy Mississippi,

Entergy New Orleans, and Entergy Texas have received approval

from state regulators for recovery of a portion of the storm restoration

costs. In addition, these companies have received insurance proceeds

and Entergy New Orleans has received $180.8 million of CDBG

funding in 2007. The cost recovery mechanisms and approvals are

discussed below. In 2007, Entergy Gulf States Louisiana reclassified

$81 million and Entergy Louisiana reclassified $364 million of storm-

related capital expenditures to a regulatory asset based on the outcome

of regulatory proceedings.

(b) Does not earn a return on investment, but is offset by related liabilities.

(c) Does not earn a return on investment at this time.

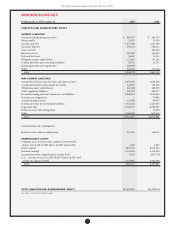

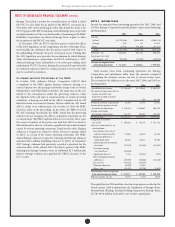

Fuel and Purchased Power Cost Recovery

Entergy Arkansas, Entergy Gulf States Louisiana, Entergy Louisiana,

Entergy Mississippi, Entergy New Orleans, and Entergy Texas are

allowed to recover certain fuel and purchased power costs through fuel

mechanisms included in electric and gas rates that are recorded as fuel

cost recovery revenues. e dierence between revenues collected and

the current fuel and purchased power costs is recorded as “Deferred

fuel costs” on the Utility operating companies’ nancial statements. e

table below shows the amount of deferred fuel costs as of December 31,

2007 and 2006 that Entergy expects to recover or (refund) through fuel

mechanisms, subject to subsequent regulatory review (in millions):

2007 2006

Entergy Arkansas $114.8 $ 2.2

Entergy Gulf States Louisiana(a) $105.8 $ 73.9

Entergy Louisiana(a) $ 19.2 $114.3

Entergy Mississippi $( 76.6) $(95.2)

Entergy New Orleans(b) $ 17.3 $ 19.0

Entergy Texas $ (67.3) $(45.7)

(a) 2007 and 2006 include $100.1 million for Entergy Gulf States

Louisiana and $68 million for Entergy Louisiana of fuel, purchased

power, and capacity costs that are expected to be recovered over a

period greater than twelve months.

(b) Not included in “Deferred Fuel Costs” on Entergy’s consolidated

financial statements in 2006 due to the deconsolidation of Entergy

New Orleans effective in 2005. Entergy reconsolidated Entergy New

Orleans in 2007.

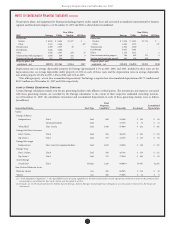

Entergy Arkansas

Production Cost Allocation Rider

In its June 2007 decision on Entergy Arkansas’ August 2006 rate ling,

discussed below in “Retail Rate Proceedings”, the APSC approved a

production cost allocation rider for recovery from customers of the

retail portion of the costs allocated to Entergy Arkansas as a result

of the System Agreement proceedings, but set a termination date of

December 31, 2008 for the rider. ese costs are the primary reason for

the increase in Entergy Arkansas’ deferred fuel cost balance in 2007,

because Entergy Arkansas pays them over seven months but collects

them from customers over twelve months. In December 2007, the

APSC issued a subsequent order stating the production cost allocation

rider will remain in eect, and any future termination of the rider

will be subject to eighteen months advance notice by the APSC,

which would occur following notice and hearing. See Entergy

Corporation and Subsidiaries’ “Management’s Financial Discussion

And Analysis - Signicant Factors and Known Trends - Federal

Regulation - System Agreement Proceedings” for a discussion of the

System Agreement proceedings.