Entergy 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Coming Attractions

hen executed, the spin-o of our non-utility nuclear assets will

create three entities – Entergy Classic, SpinCo and the Nuclear

Services joint venture. Each company in this value trilogy will

continue to aspire individually to deliver superior value to its owners.

e nancial aspirations for 2008 through 2012 for each

business are:

n Entergy Classic aspires to 6 to 8 percent annualized growth in

earnings per share, a 70 to 75 percent dividend payout ratio target

and the capacity for a new share repurchase program targeted

at $2.5 billion beginning aer the completion of the spin-o. In

January 2008, the Entergy Board of Directors authorized $0.5 billion

of this program. e balance is expected to be authorized and to

commence following completion of the spin-o.

n SpinCo aspires to $2 billion in 2012 earnings before interest, taxes,

depreciation and amortization generating cash ow for ongoing

acquisitions and/or distribution capacity through share repurchases

in the range of $0.5 billion to $1.0 billion annually. Subject to market

terms and conditions, SpinCo expects to execute approximately

$4.5 billion of debt nancing.

n To be owned equally by Entergy Classic and SpinCo, the Nuclear

Services joint venture aspires to safe, secure and industry-leading

nuclear operational performance. e joint venture will operate

SpinCo’s plants and the Cooper Nuclear Station and will provide

certain technical services and the Chief Nuclear Ocer to Entergy

Classic following the spin. In addition, the joint venture expects to

pursue growth opportunities by oering nuclear services including

plant operations, decommissioning and relicensing to third parties.

We will be working diligently throughout 2008 to execute our

plans and complete the spin-o of our non-utility nuclear assets to

our shareholders. We have established a steering committee to lead

the overall spin-o process and make nal recommendations on all

major business and operational issues. We also established a project

management oce to coordinate all aspects of the spin-o process

across multiple functional areas, including nuclear operations, support

services, regulatory aairs and nancial planning and execution. We

will continue to take the necessary actions, including seeking requisite

regulatory approvals, in order to complete the transaction around the

end of the third quarter of 2008.

W

Entergy Corporation and Subsidiaries 2007

25

Financial Review

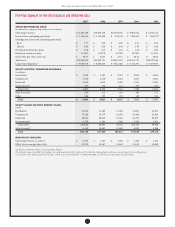

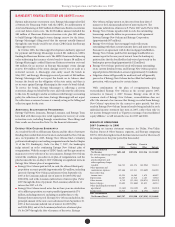

27 Five-Year Summary of Selected Financial and

Operating Data

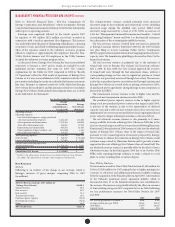

28 Management’s Financial Discussion

and Analysis

52 Report of Management

53 Reports of Independent Registered Public

Accounting Firm

53 Internal Control Over Financial Reporting

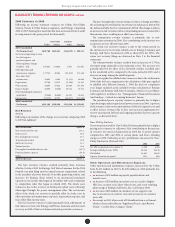

54 Consolidated Statements of Income

55 Consolidated Statements of Retained Earnings,

Comprehensive Income and Paid-In Capital

56 Consolidated Balance Sheets

58 Consolidated Statements of Cash Flows

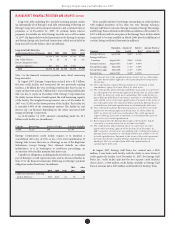

60 Notes to Consolidated Financial Statements