Clearwire 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company also granted stock options to employees of entities under common control who performed

services to the Company to purchase shares of the Company’s Class A common stock. In accordance with EITF

Issue No. 00-23, Issues Related to the Accounting for Stock Compensation Under APB No. 25, Accounting for Stock

Issued to Employees, and FASB Interpretation No. 44, Accounting for Certain Transactions Involving Stock

Compensation, and SFAS No. 123(R), the fair value of such options was recorded as a dividend and a charged

against additional paid-in capital on the line item, deferred share-based compensation. A total of $1.5 million,

$2.4 million, and $34,000 was recorded, as a dividend, for the years ended December 31, 2007, 2006 and 2005,

respectively.

During the year ended December 31, 2007 the Company granted 727,000 options to non-employee consult-

ants, of which 250,000 were forfeited. These options are adjusted to current fair value each quarter during their

vesting periods as services are rendered. During the year ended December 31, 2007, the Company recognized

$345,000 expense and had $2.3 million of unamortized expense as of December 31, 2007 related to these options.

Expense for the year ended December 31, 2006 was $1.3 million.

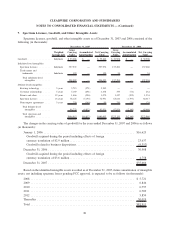

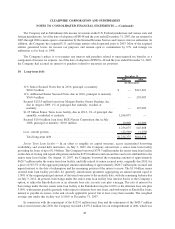

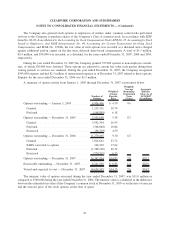

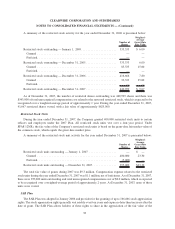

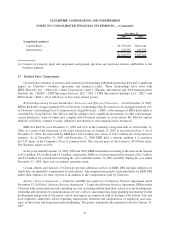

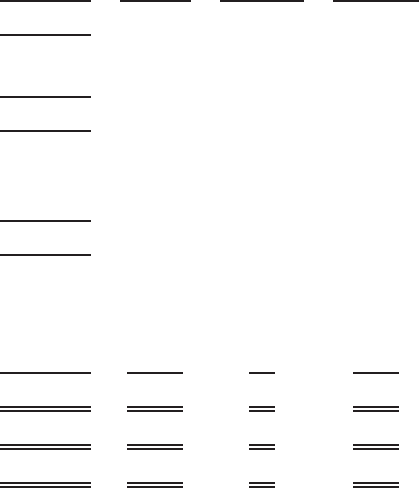

A summary of option activity from January 1, 2005 through December 31, 2007 is presented below:

Number of

Options

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

(Years)

Aggregate

Intrinsic

Value As of

12/31/2007

(In millions)

Options outstanding — January 1, 2005 .......... 6,906,406 $ 4.59 9.6

Granted ................................ 1,215,311 10.74

Forfeited ............................... (168,859) 6.18

Options outstanding — December 31, 2005 ....... 7,952,858 5.58 8.7

Granted ................................ 3,942,304 16.95

Forfeited ............................... (568,048) 10.84

Exercised .............................. (56,709) 4.59

Options outstanding — December 31, 2006 ....... 11,270,405 9.30 8.3

Granted ................................ 7,014,662 23.72

SARS converted to options ................. 106,302 17.64

Forfeited ............................... (1,328,100) 20.32

Exercised .............................. (720,315) 6.55

Options outstanding — December 31, 2007 ....... 16,342,954 $14.83 7.8 $55.2

Exercisable outstanding — December 31, 2007..... 6,261,909 $ 6.85 6.4 $46.0

Vested and expected to vest — December 31, 2007. . 14,656,393 $14.15 7.6 $54.5

The intrinsic value of options exercised during the year ended December 31, 2007, was $11.0 million as

compared to $760,000 during the year ended December 31, 2006. The intrinsic value is calculated as the difference

between the estimated fair value of the Company’s common stock at December 31, 2007 or on the date of exercise

and the exercise price of the stock options on the date of grant.

91

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)