Clearwire 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

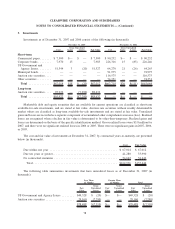

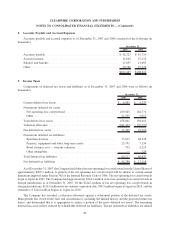

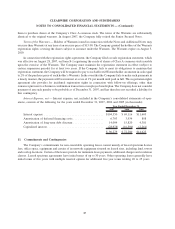

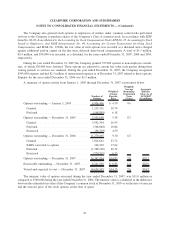

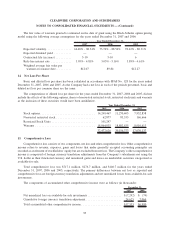

Future minimum payments under spectrum license and operating lease obligations (including all optional

renewal periods on operating leases) as of December 31, 2007, are as follows (in thousands):

Years Ending December 31,

Leased

Spectrum

Operating

Lease Total

2008 ........................................ $ 39,226 $ 87,320 $ 126,546

2009 ........................................ 39,253 87,030 126,283

2010 ........................................ 39,915 86,868 126,783

2011 ........................................ 40,045 85,363 125,408

2012 ........................................ 45,068 84,896 129,964

Thereafter, including all renewal periods.............. 1,557,749 1,629,062 3,186,811

$1,761,256 $2,060,539 $3,821,795

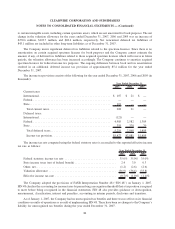

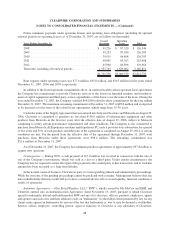

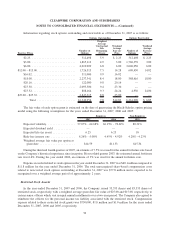

Rent expense under operating leases was $77.6 million, $35.0 million, and $10.5 million for the years ended

December 31, 2007, 2006 and 2005, respectively.

In addition to the leased spectrum commitments above, in connection with various spectrum lease agreements

the Company has commitments to provide Clearwire services to the lessors in launched markets, and reimburse-

ment of capital equipment and third-party service expenditures of the lessors over the term of the lease. During the

year ended December 31, 2007, the Company satisfied $642,000 related to these commitments for the year ending

December 31, 2007. The maximum remaining commitment at December 31, 2007 is $89.8 million and is expected

to be incurred over the term of the related lease agreements, which range from 15-30 years.

Under the terms of the Supply Agreement that was entered into between Clearwire and Motorola on August 29,

2006, Clearwire is committed to purchase no less than $150.0 million of infrastructure equipment and other

products from Motorola in the first two years after the effective date of August 29, 2006, subject to Motorola

continuing to satisfy certain performance requirements and other conditions. The Company is also committed to

purchase from Motorola, all Expedience modems and Expedience PC cards it provides to its subscribers for a period

of five years and 51% of such products until the term of the agreement is completed on August 29, 2014, if certain

conditions are met. For the period from the effective date of the agreement through December 31, 2007, total

purchases from Motorola under these agreements were $98.4 million. The remaining commitment was

$51.6 million at December 31, 2007.

As of December 31, 2007, the Company has minimum purchase agreements of approximately $57.8 million to

acquire new spectrum.

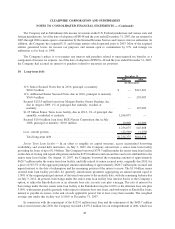

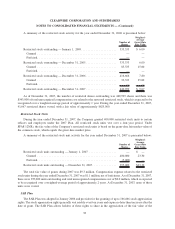

Contingencies — During 2007, a cash payment of $17.0 million was received in connection with the sale of

one of the Company’s investments, which was sold at a loss to a third party. Under certain circumstances, the

Company may be required to return all or part of the payment to the counterparty to this transaction, and as such this

amount has been recorded as a long-term liability.

In the normal course of business, Clearwire is party to various pending judicial and administrative proceedings.

While the outcome of the pending proceedings cannot be predicted with certainty, Management believes that any

unrecorded liability that may result will not to have a material adverse effect on our liquidity, financial condition or

results of operations.

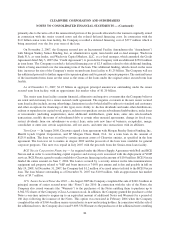

Indemnity Agreements — Flux Fixed Wireless, LLC (“FFW”), wholly owned by Mr. McCaw and ERH, and

Clearwire entered into an Indemnification Agreement, dated November 13, 2003, pursuant to which Clearwire

agreed to indemnify, defend and hold harmless FFW and any of its directors, officers, partners, employees, agents

and spouses and each of its and their affiliates (each, an “Indemnitee”) to the fullest extent permitted by law for any

claims made against an Indemnitee by reason of the fact that Indemnitee is, was or may be deemed a stockholder,

director, officer, employee, controlling person, agent or fiduciary of Clearwire or any subsidiary of Clearwire.

88

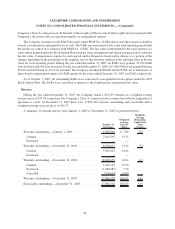

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)