Clearwire 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

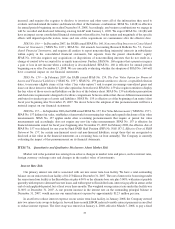

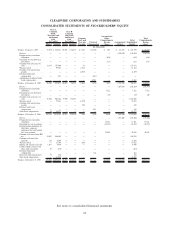

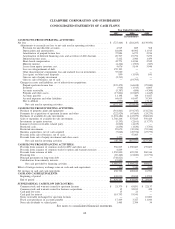

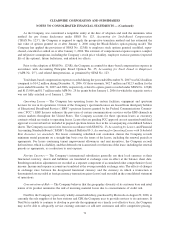

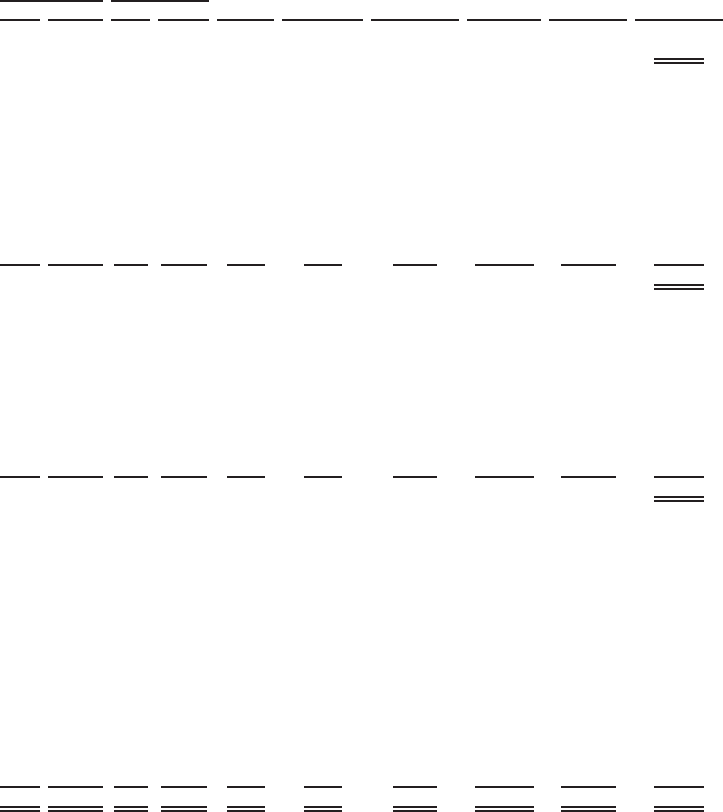

CLEARWIRE CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

Shares Amounts Shares Amounts

Common

Stock and

Warrants

Payable

Deferred

Compensation

Accumulated

Other

Comprehensive

Income

(Loss)

Accumulated

Deficit

Total

Stockholders’

Equity

Total

Comprehensive

Income

(Loss)

Class A

Common

Stock,

Warrants and

Additional

Paid

In Capital

Class B

Common

Stock and

Additional

Paid

In Capital

(In thousands)

Balances at January 1, 2005 . . . . . 43,053 $ 218,411 18,691 $ 56,073 $ 3,354 $(2,320) $ 265 $ (34,413) $ 241,370 $ (32,777)

Net loss. . . . . . . . . . . . . . . — — — — — — — (139,950) (139,950) (139,950)

Foreign currency translation

adjustment . . . . . . . . . . . . — — — — — — (636) — (636) (636)

Unrealized loss on short-term

investments . . . . . . . . . . . — — — — — — (111) — (111) (111)

Common stock issued, net of

costs . . . . . . . . . . . . . . . 13,133 157,600 — — 78 — — — 157,678

Warrants issued . . . . . . . . . . — 59,563 — — 2,541 — — — 62,104

Common stock and warrants

payable . . . . . . . . . . . . . — — — — (4,305) — — — (4,305)

Deferred stock-based

compensation . . . . . . . . . . — 881 — — — (881) — — —

Amortization of deferred stock-

based compensation . . . . . . . — — — — — 2,542 — — 2,542

Balances at December 31, 2005 . . . 56,186 436,455 18,691 56,073 1,668 (659) (482) (174,363) 318,692 (140,697)

Net loss. . . . . . . . . . . . . . . — — — — — — — (284,203) (284,203) (284,203)

Foreign currency translation

adjustment . . . . . . . . . . . . — — — — — — 7,522 — 7,522 7,522

Unrealized loss on short-term

investments . . . . . . . . . . . — — — — — — (50) — (50) (50)

Common stock issued, net of

costs . . . . . . . . . . . . . . . 53,056 946,766 9,906 178,303 — — — — 1,125,069

Warrants issued . . . . . . . . . . — 77,261 — — (1,851) — — — 75,410

Common stock and warrants

payable . . . . . . . . . . . . . — — — — 349 — — — 349

Deferred stock-based

compensation . . . . . . . . . . — — — — — 543 — — 543

Stock-based compensation . . . . . 83 14,277 — — — — — — 14,277

Balances at December 31, 2006 . . . 109,325 1,474,759 28,597 234,376 166 (116) 6,990 (458,566) 1,257,609 (276,731)

Net loss. . . . . . . . . . . . . . . — — — — — — — (727,466) (727,466) (727,466)

Foreign currency translation

adjustment . . . . . . . . . . . . — — — — — — 17,561 — 17,561 17,561

Unrealized loss on investments . . — — — — — — (42,238) — (42,238) (42,238)

Reclassification adjustment for

other-than- temporary

impairment loss and realized

loss on investments . . . . . . . — — — — — — 35,020 — 35,020 35,020

Common stock issued from IPO,

net . . . . . . . . . . . . . . . . 24,000 556,005 — — — — — 556,005

Common stock issued for

spectrum . . . . . . . . . . . . . 233 4,200 — — — — — — 4,200

Warrants issued . . . . . . . . . . — 17,194 — — (166) — — — 17,028

Options and warrants exercised . . 1,937 4,849 — — — — — — 4,849

Cashless option exercises and

other stock transactions . . . . . 39 (618) — — — — — — (618)

Deferred stock-based

compensation . . . . . . . . . . — — — — 116 — — 116

Restricted stock compensation . . 33 286 286

Share-based compensation . . . . . — 41,480 — — — — — 41,480

Balances at December 31, 2007 . . . 135,567 $2,098,155 28,597 $234,376 $ — $ — $ 17,333 $(1,186,032) $1,163,832 $(717,123)

See notes to consolidated financial statements.

63