Clearwire 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

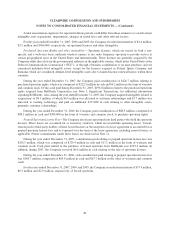

The Company’s investments in auction rate securities represent interests in collateralized debt obligations

supported by preferred equity securities of small to medium sized insurance companies and financial institutions

and asset backed capital commitment securities supported by high grade, short term commercial paper and a put

option from a monoline insurance company. These auction rate securities were rated AAA/Aaa or AA/Aa by

Standard & Poors and Moody’s rating services at the time of purchase and their ratings have not changed as of

December 31, 2007. With regards to the asset backed capital commitment securities, both rating agencies have

placed the issuer’s ratings under review for possible downgrade.

As issuers and counterparties to the Company’s investments announce financial results in the coming quarters,

it is possible that the Company may record additional losses and realize losses that are currently unrealized. The

Company will continue to monitor its investments for substantive changes in relevant market conditions,

substantive changes in the financial condition and performance of the investments’ issuers and other substantive

changes in these investments.

The stated maturity of these securities is longer than 10 years; however, because we considered them to be

highly liquid and available for operations, our convention was to use the next auction date, which occurs every 30 to

90 days, as the effective maturity date and these securities were recorded as short-term investments. Current market

conditions do not allow the Company to estimate when the auctions for its auction rate securities will resume. As a

result, during 2007 the Company reclassified its auction rate securities from short-term investments to long-term

investments.

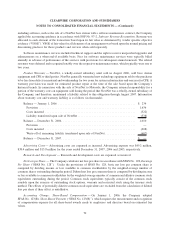

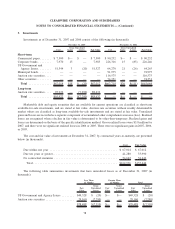

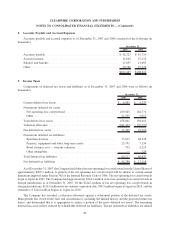

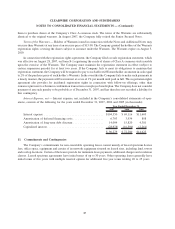

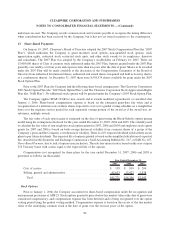

6. Property, Plant and Equipment

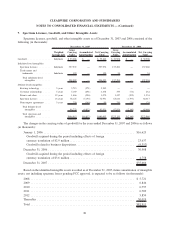

Property, plant and equipment as of December 31, 2007 and 2006 consisted of the following (in thousands):

2007 2006

December 31,

Network and base station equipment .............................. $305,635 $161,875

Customer premise equipment ................................... 89,120 47,700

Furniture, fixtures and equipment ................................ 55,548 20,546

Leasehold improvements ...................................... 13,488 8,340

Construction in progress ....................................... 233,120 112,669

696,911 351,130

Less: accumulated depreciation.................................. (124,582) (48,332)

$ 572,329 $302,798

The Company follows the provisions of SFAS No. 34 with respect to its owned FCC licenses and the related

construction of its network infrastructure assets. Capitalization commences with pre-construction period admin-

istrative and technical activities, which includes obtaining leases, zoning approvals and building permits, and ceases

when the construction is substantially complete and available for use generally when a market is launched.

Interest capitalized for the years ended December 31, 2007 and 2006 was $29.0 million and $16.6 million,

respectively. Depreciation expense for the years ended December 31, 2007, 2006 and 2005 was $80.3 million,

$38.5 million and $10.9 million, respectively.

80

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)