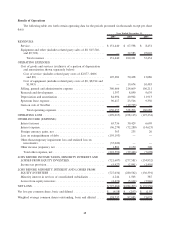

Clearwire 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$300.0 million for two years. In accordance with Statement of Financial Accounting Standards (“SFAS”) No. 133,

Accounting for Derivative Instruments and Hedging Activities (SFAS No. 133),its amendments and related

guidance, we will treat the interest rate swaps as “cash-flow hedges” and will record the fair value of the swaps at the

end of each calendar quarter, beginning March 31, 2008.

At December 31, 2007, we held available for sale short-term and long-term investments with a fair value of a

total of $155.6 million and a cost of $162.9 million, of which investments with a fair value of $88.6 million and a

cost of $95.9 million were in auction rate securities and an investment with a fair value of $7.5 million and a cost of

$7.5 million was in commercial paper issued by a structured investment vehicle for which an insolvency event has

been declared. We recorded an other-than-temporary impairment loss on this investment of $2.5 million during

2007.

Auction rate securities are variable rate debt instruments whose interest rates are reset approximately every

30 or 90 days through an auction process. Beginning in August 2007, the auctions failed to attract buyers and sell

orders could not be filled. Current market conditions do not allow us to estimate when the auctions will resume.

While we continue to earn interest on these investments at the maximum contractual rate, until the auctions resume,

the investments are not liquid and we may not have access to these funds until a future auction on these investments

is successful. At December 31, 2007, the estimated fair value of these auction rate securities no longer approximates

cost and we recorded other-than-temporary impairment losses and realized losses on our auction rate securities of

$32.3 million for the year ended December 31, 2007. For certain other auction rate securities, we recorded an

unrealized loss of $7.3 million in other comprehensive income reflecting the decline in the estimated fair value of

these securities. We consider these declines in fair value to be temporary given our consideration of the collateral

underlying these securities and our conclusion that the declines are related to changes in interest rates rather than

any credit concerns related to the underlying assets. Additionally, we believe we have the intent and ability to hold

the investments until maturity or for a period of time sufficient to allow for any anticipated recovery in market value.

Business Segments

The Company complies with the requirements of SFAS No. 131, Disclosures about Segments of an Enterprise

and Related Information, which establishes annual and interim reporting standards for an enterprise’s operating

segments and related disclosures about its products, services, geographic areas and major customers. Operating

segments are defined as components of an enterprise for which separate financial information is available that is

evaluated regularly by the chief operating decision makers in deciding how to allocate resources and in assessing

performance. Operating segments can be aggregated for segment reporting purposes so long as certain aggregation

criteria are met. The Company defines the chief operating decision makers as our Chief Executive Officer,

Chief Operating Officer and Chief Financial Officer. As our business continues to mature, the Company assesses

how it views and operates the business. As a result, in the fourth quarter of 2007 the Company was organized into

two reportable business segments: the United States and the International business. See Note 16, Business

Segments, for further discussion.

Critical Accounting Policies

Our discussion and analysis of our financial condition and results of operations are based upon our financial

statements, which have been prepared in accordance with accounting principles generally accepted in the

United States. The preparation of these consolidated financial statements requires us to make estimates and

judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of

contingent assets and liabilities. On an ongoing basis, we evaluate our estimates used, including those related to

investments, long-lived assets, goodwill and intangible assets, including spectrum, share-based compensation, and

deferred tax asset valuation allowance.

Our accounting policies require management to make complex and subjective judgments. By their nature,

these judgments are subject to an inherent degree of uncertainty. These judgments are based on our historical

experience, terms of existing contracts, observance of trends in the industry, information provided by our customers

and information available from other outside sources, as appropriate. Additionally, changes in accounting estimates

41