Clearwire 2007 Annual Report Download - page 58

Download and view the complete annual report

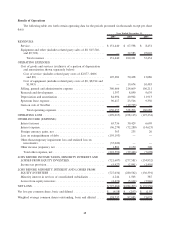

Please find page 58 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Selling, general and administrative expense. Selling, general and administrative expense primarily includes:

salaries and benefits, sales commissions, travel expenses and related facilities costs for the following personnel:

sales, marketing, network deployment, executive, finance, information technology, human resource and legal. It

also includes costs associated with advertising, trade shows, public relations, promotions and other market

development programs and third-party professional service fees.

Selling, general and administrative expense was $360.7 million for the year ended December 31, 2007 as compared

to $214.7 million in the year ended December 31, 2006. The increase of $146.0 million was due primarily to a

$98.6 million increase in employee compensation and related costs, including facilities costs, resulting from higher

employee headcount of approximately 1,990 employees at December 31, 2007 compared to approximately

1,240 employees at December 31, 2006. These additional employees were hired as a result of bringing customer care

in-house, new market deployments, and to support the overall growth of our business. In addition for the year ended

December 31, 2007 as compared to the year ended December 31, 2006, there was a $13.1 million increase in professional

fees, due to expenses for business development projects and compliance efforts with Sarbanes Oxley; a $10.8 million

increase in advertising expenses related to the expansion of our business and new market launches; an $8.9 million

increase in third party commissions as we sold more services through third party providers; and an increase of

$5.1 million associated with bad debt and collection fees and bank fees. The remaining increase of $9.5 million resulted

from increases in other miscellaneous expenses primarily arising out of growth in our business.

As a result of expense controls, slower growth in headcount and fewer planned market launches in 2008, we

expect that our selling, general, and administrative expenses will begin to flatten over the course of the year. We

expect that any increases will primarily be related to marketing expenses necessary to support our growth and our

efforts to build brand awareness through advertising and promotional activities, and our network expansion.

Research and development. Research and development expenses consist of salaries and related benefits for

our development personnel. Research and development expense was $1.4 million and $8.9 million for the years

ended December 31, 2007 and 2006, respectively. This decrease was due to prior period expenses related to NextNet

product research that were not recurring in 2007 due to the sale of NextNet in August 2006. Research and

development expenses may increase in 2008 as a result of system and technical development efforts related to

implementation of mobile WiMAX.

Depreciation and amortization. Depreciation and amortization expense increased to $84.7 million for the year

ended December 31, 2007 from $40.9 million for the year ended December 31, 2006. This increase was primarily due to

the additional network build-out and the cost of CPE related to our expansion into new markets and associated subscriber

growth. Capital expenditures for depreciable property, plant and equipment increased to $361.9 million for the year

ended December 31, 2007 from $191.7 million for the year ended December 31, 2006. The majority of these

expenditures relate to the construction of our network and purchases of base station equipment.

Spectrum lease expense. Spectrum lease expense increased by $72.9 million to $96.4 million for the year

ended December 31, 2007 from $23.5 million for the year ended December 31, 2006. Total spectrum lease expense

increased as a direct result of a significant increase in the number of spectrum leased held by us, including the

additional spectrum from the BellSouth transaction, as well as an increase in the cost of new spectrum leases. As

certain of our leases include escalation clauses, we are required to record expense on a straight-line basis over the

term of these leases, including renewal periods where appropriate, which in combination with the significant lease

obligation paid up front results in significant non-cash lease expenses. We expect spectrum lease expense to

continue to increase.

Gain on sale of NextNet. In August 2006 we sold our NextNet operations and recorded a gain on sale of

$19.8 million.

Interest income. We recognized $65.7 million of interest income for the year ended December 31, 2007

compared to $30.4 million for the year ended December 31, 2006. This increase of $35.3 million was primarily due

to the higher balances of short-term and long-term investments held during 2007 compared to 2006.

Interest expense. We incurred $96.3 million of interest expense in year ended December 31, 2007 compared

to $72.3 million for the year ended December 31, 2006. This increase in interest expenses was primarily due to an

increase in debt, as debt increased by $611.2 million to $1.26 billion at December 31, 2007 from $645.7 million at

50