Clearwire 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

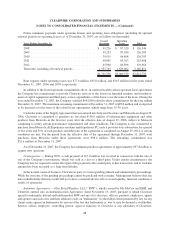

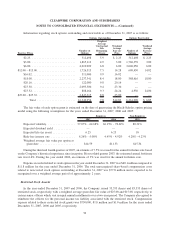

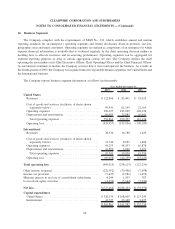

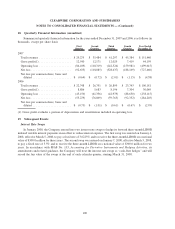

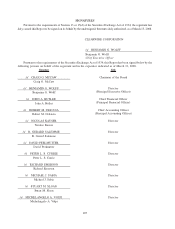

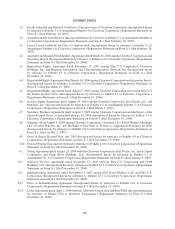

16. Business Segments

The Company complies with the requirements of SFAS No. 131, which establishes annual and interim

reporting standards for an enterprise’s operating segments and related disclosures about its products, services,

geographic areas and major customers. Operating segments are defined as components of an enterprise for which

separate financial information is available that is evaluated regularly by the chief operating decision makers in

deciding how to allocate resources and in assessing performance. Operating segments can be aggregated for

segment reporting purposes so long as certain aggregation criteria are met. The Company defines the chief

operating decision makers as its Chief Executive Officer, Chief Operating Officer and the Chief Financial Officer.

As our business continues to mature, the Company assesses how it views and operates the business. As a result, in

the fourth quarter of 2007, the Company was organized into two reportable business segments: the United States and

the International business.

The Company reports business segment information as follows (in thousands):

2007 2006 2005

Year Ended December 31,

United States

Revenues ..................................... $122,906 $ 83,401 $ 32,025

Cost of goods and services (exclusive of items shown

separately below) ............................. 94,541 61,145 22,165

Operating expenses .............................. 389,227 183,029 108,328

Depreciation and amortization ...................... 69,095 35,083 10,641

Total operating expenses ........................ 552,863 279,257 141,134

Operating loss.................................. (429,957) (195,856) (109,109)

International

Revenues ..................................... 28,534 16,780 1,429

Cost of goods and services (exclusive of items shown

separately below) ............................. 12,740 8,967 1,404

Operating expenses .............................. 69,253 44,253 16,878

Depreciation and amortization ...................... 15,599 5,819 1,272

Total operating expenses ........................ 97,592 59,039 19,554

Operating loss.................................. (69,058) (42,259) (18,125)

Total operating loss............................... (499,015) (238,115) (127,234)

Other income (expense) ............................ (222,592) (39,466) (7,698)

Income tax provision .............................. (5,427) (2,981) (1,459)

Minority interest in net loss of consolidated subsidiaries .... 4,244 1,503 387

Losses from equity investees ......................... (4,676) (5,144) (3,946)

Net loss ........................................ $(727,466) $(284,203) $(139,950)

Capital expenditures

United States .................................. $320,134 $ 168,607 $ 123,249

International ................................... 41,727 23,140 9,475

$ 361,861 $ 191,747 $ 132,724

96

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)