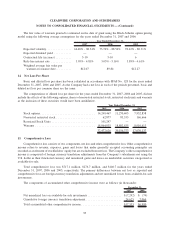

Clearwire 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Clearwire is obligated to pay the expenses of any Indemnitee in connection with any claims which are subject to the

agreement.

Clearwire is currently a party to, or contemplating entering into, similar indemnification agreements with

certain other of its officers and each of the other members of its Board of Directors. No liabilities have been recorded

in the consolidated balance sheets for any indemnification agreements.

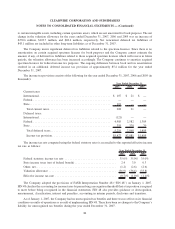

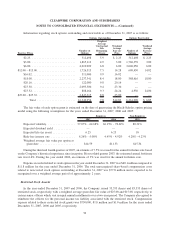

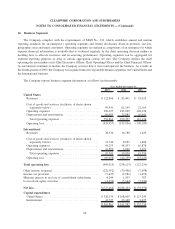

12. Stockholders’ Equity

In August 2006, Intel Capital completed its purchase from Clearwire of 23,427,601 shares of Class A common

stock and 9,905,732 shares of Class B common stock at $18.00 per share for a total purchase price of $600.0 million,

pursuant to a Common Stock Purchase Agreement.

In August 2006, Clearwire entered into subscription agreements with the holders of its outstanding stock for

the sale of an aggregate of 8,603,116 shares of Clearwire’s Class A common stock at $18.00 per share for an

aggregate purchase price of $154.9 million. The agreements include certain limited anti-dilution features. The

transactions closed on August 29, 2006, except for one agreement covering the sale of 1,222,222 shares which

closed in October 2006.

On March 13, 2007, the Company completed the sale of 24,000,000 shares of its Class A common stock in its

initial public offering. The shares were sold in the offering at a price of $25.00 per share, and the Company received

net proceeds of $555.2 million, net of underwriters’ discount, commissions and other fees of $44.8 million. The

Company has used these proceeds for market and network expansion, spectrum acquisitions and general corporate

purposes.

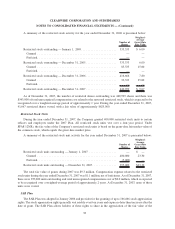

Under Clearwire’s Certificate of Incorporation, as amended, it has the authority to issue 355,000,000 shares of

capital stock as follows:

• 300,000,000 shares of Class A common stock, par value $0.0001 per share;

• 50,000,000 shares of Class B common stock, par value $0.0001 per share; and

• 5,000,000 shares of preferred stock, par value $0.0001 per share.

The following is a summary description of the Company’s common stock:

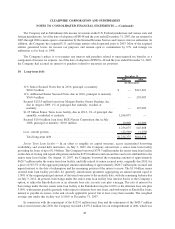

Class A common stock — The holders of Class A common stock are entitled to one vote per share, on each

matter submitted to a vote by the stockholders.

Class B common stock — The holders of Class B common stock are entitled to ten votes per share, on each

matter submitted to a vote by the stockholders. Class B common stock is convertible at any time at the option of its

holders into shares of Class A common stock. Each share of Class B common stock is convertible into one share of

Class A common stock.

Preferred stock — May be divided into one or more series. Each series will have the preferences, limitations

and relative rights as determined by the Board of Directors. No series of preferred stock have been designated by the

Board of Directors.

Ranking — With respect to rights on liquidation, dissolution or similar events, each holder of Class A and

Class B common stock will receive the same amount of consideration per share, except that Class B common stock

holders may receive securities in the transactions with terms that entitle them to ten votes per share.

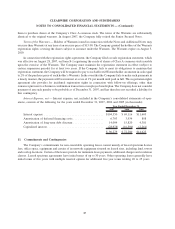

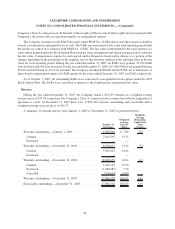

Common stock and warrants payable — The Company engaged several parties to obtain spectrum on its

behalf in exchange for rights to receive its common stock and warrants. As the rights are earned over the period of an

acquisition of spectrum, these obligations can be outstanding for a period of time until FCC approval or other

89

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)