Clearwire 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

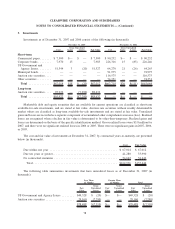

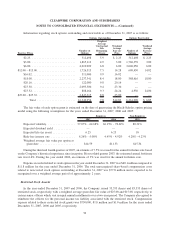

to certain intangible assets, including certain spectrum assets, which are not amortized for book purposes. The net

change in the valuation allowance for the years ended December 31, 2007, 2006 and 2005 was an increase of

$270.6 million, $103.7 million, and $48.4 million, respectively. Net noncurrent deferred tax liabilities of

$43.1 million are included in other long-term liabilities as of December 31, 2007.

The Company incurs significant deferred tax liabilities related to the spectrum licenses. Since there is no

amortization on certain acquired spectrum licenses for book purposes and the Company cannot estimate the

amount, if any, of deferred tax liabilities related to those acquired spectrum licenses which will reverse in future

periods, the valuation allowance has been increased accordingly. The Company continues to amortize acquired

spectrum licenses for federal income tax purposes. The ongoing difference between book and tax amortization

resulted in an additional deferred income tax provision of approximately $5.4 million for the year ended

December 31, 2007.

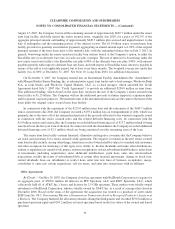

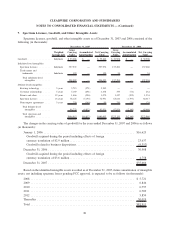

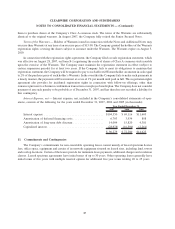

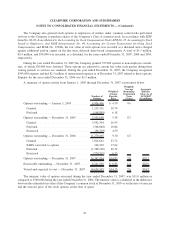

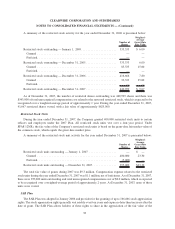

The income tax provision consists of the following for the year ended December 31, 2007, 2006 and 2005 (in

thousands):

2007 2006 2005

Year Ended December 31,

Current taxes:

International ............................................ $ 107 $ 21 $ —

Federal ................................................ — — —

State .................................................. 101 — —

Total current taxes ...................................... 208 21 —

Deferred taxes:

International ............................................ (121) — —

Federal ................................................ 4,985 2,582 1,389

State .................................................. 355 378 70

Total deferred taxes ..................................... 5,219 2,960 1,459

Income tax provision .................................... $5,427 $2,981 $1,459

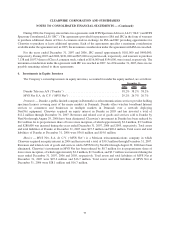

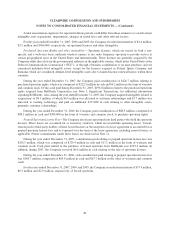

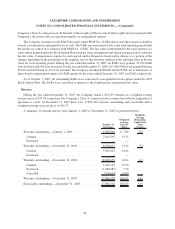

The income tax rate computed using the federal statutory rates is reconciled to the reported effective income

tax rate as follows:

2007 2006 2005

Year Ended December 31,

Federal statutory income tax rate ................................ 35.0% 35.0% 35.0%

State income taxes (net of federal benefit) .......................... 2.4 3.0 0.3

Other, net.................................................. (1.2) (2.6) (2.6)

Valuation allowance .......................................... (36.9) (36.4) (33.8)

Effective income tax rate ...................................... (0.7)% (1.0)% (1.1)%

The Company adopted the provisions of FASB Interpretation Number 48 (“FIN 48”) on January 1, 2007.

FIN 48 clarifies the accounting for income taxes by prescribing a recognition threshold that a tax position is required

to meet before being recognized in the financial statements. FIN 48 also provides guidance or derecognition,

measurement, classification, interest and penalties, accounting in interim periods, disclosure and transition.

As of January 1, 2007, the Company had no unrecognized tax benefits and there was no effect on its financial

condition or results of operations as a result of implementing FIN 48. There have been no changes to the Company’s

liability for unrecognized tax benefits during the year ended December 31, 2007.

84

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)