Clearwire 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Recent Accounting Pronouncements

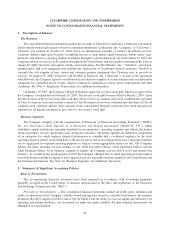

SFAS No. 141(R) — In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combi-

nations (“SFAS No. 141(R)”). In SFAS No. 141(R), the FASB retained the fundamental requirements of

SFAS No. 141 to account for all business combinations using the acquisition method (formerly the purchase

method) and for an acquiring entity to be identified in all business combinations. However, the new standard

requires the acquiring entity in a business combination to recognize all (and only) the assets acquired and liabilities

assumed in the transaction; establishes the acquisition-date fair value as the measurement objective for all assets

acquired and liabilities assumed; requires transaction costs to be expensed as incurred; and requires the acquirer to

disclose to investors and other users all of the information they need to evaluate and understand the nature and

financial effect of the business combination. SFAS No. 141(R) is effective for annual periods beginning on or after

December 15, 2008. Accordingly, any business combinations will be recorded and disclosed following existing

GAAP until January 1, 2009. The Company expects that SFAS No. 141(R) will have an impact on its consolidated

financial statements when effective, but the nature and magnitude of the specific effects will depend upon the

nature, terms and size of the acquisitions consummated after the effective date.

SFAS No. 160 — In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated

Financial Statements (“SFAS No. 160”).SFAS No. 160 amends Accounting Research Bulletin No. 51, Consol-

idated Financial Statements, and requires all entities to report noncontrolling (minority) interests in subsidiaries

within equity in the consolidated financial statements, but separate from the parent shareholders’ equity.

SFAS No. 160 also requires any acquisitions or dispositions of noncontrolling interests that do not result in a

change of control to be accounted for as equity transactions. Further, SFAS No. 160 requires that a parent recognize

a gain or loss in net income when a subsidiary is deconsolidated. SFAS No. 160 is effective for annual periods

beginning on or after December 15, 2008. The Company is currently evaluating whether the adoption of

SFAS No. 160 will have a material impact on its consolidated financial statements.

SFAS No. 159 —In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial

Assets and Financial Liabilities (“SFAS No. 159”). SFAS No. 159 permits entities to choose, at specified election

dates, to measure eligible items at fair value (“fair value option”) and to report in earnings unrealized gains and

losses on those items for which the fair value option has been elected. SFAS No. 159 also requires entities to display

the fair value of those assets and liabilities on the face of the balance sheet. SFAS No. 159 establishes presentation

and disclosure requirements designed to facilitate comparisons between entities that choose different measurement

attributes for similar types of assets and liabilities. SFAS No. 159 is effective as of the beginning of an entity’s first

fiscal year beginning after November 15, 2007. The Company does not believe the adoption of this pronouncement

will have a material impact on its consolidated financial statements.

SFAS No. 157 — In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements

(“SFAS No. 157”). SFAS No. 157 defines fair value, establishes a framework for measuring fair value and

expands disclosure of fair value measurements. SFAS No. 157 applies under other accounting pronouncements that

require or permit fair value measurements and accordingly, does not require any new fair value measurements.

SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007. In

February 2008, the effective date of SFAS No. 157 was delayed for one year by Final FASB Staff Position

No. FAS 157-2, Effective Date of FASB Statement No. 157, for certain non-financial assets and non-financial

liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring basis

(at least annually). The Company is currently evaluating the impact of this pronouncement on its financial

statements.

72

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)