Clearwire 2007 Annual Report Download - page 87

Download and view the complete annual report

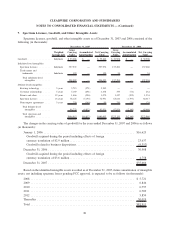

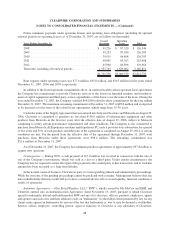

Please find page 87 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2007, the Company held available for sale short-term and long-term investments with a total

fair value of $155.6 million and a cost of $162.9 million. During the year ended December 31, 2007, the Company

incurred other-than-temporary impairment losses and realized losses of $35.0 million related to a decline in the

estimated fair values of a number of short-term and long-term investment securities. Included in the Company’s

investments were auction rate securities with a fair value of $88.6 million and a cost of $95.9 million. Auction rate

securities are variable rate debt instruments whose interest rates are reset approximately every 30 or 90 days through

an auction process. The auction rate securities are classified as available for sale and are recorded at fair value.

Beginning in August 2007, the auctions failed to attract buyers and sell orders could not be filled. Due to

current market conditions, the Company is unable to estimate when the auctions will resume. When an auction fails,

the security resets to a maximum rate as determined in the security documents. These rates vary from LIBOR +

84 basis points to LIBOR + 100 basis points. While the Company continues to earn interest on these investments at

the maximum contractual rate, until the auctions resume, the investments are not liquid and it may not have access to

these funds until a future auction on these investments is successful. At December 31, 2007, the estimated fair value

of these auction rate securities no longer approximates cost and the Company recorded other-than-temporary

impairment losses and realized losses on its auction rate securities of $32.3 million for the year ended December 31,

2007. For certain other auction rate securities, the Company recorded an unrealized loss of $7.3 million in other

comprehensive income reflecting the decline in the estimated fair value of these securities. The Company considers

these declines in fair value to be temporary given its consideration of the collateral underlying these securities and

its conclusion that the declines are related to changes in interest rates rather than any credit concerns related to the

underlying assets. Additionally, the Company has the intent and ability to hold the investments until maturity or for

a period of time sufficient to allow for any anticipated recovery in market value.

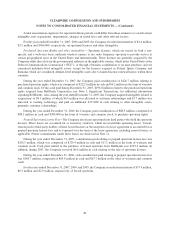

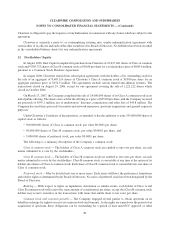

In addition to the above mentioned securities, the Company holds one commercial paper security issued by a

structured investment vehicle that was placed in receivership in September 2007 for which an insolvency event was

declared by the receiver in October 2007. The Issuer invests in residential and commercial mortgages and other

structured credits including sub-prime mortgages. At December 31, 2007, the estimated fair value of this security

was $7.5 million based on the Company’s internally generated pricing models. During 2007 the Company

recognized losses of $2.5 million related to this commercial paper security. A restructuring plan for this security

is expected by mid 2008.

The Company estimated the fair value of these securities using internally generated pricing models that require

various inputs and assumptions and the Company also uses various methods including market, income and cost

approaches. Based on these approaches, the Company often utilizes certain assumptions that market participants

would use in pricing the investment, including assumptions about risk and or the risks inherent in the inputs to the

valuation technique. These inputs are readily observable, market corroborated, or unobservable. The Company

maximizes the use of observable inputs to the pricing models where quoted market prices from securities and

derivatives exchanges are available and reliable. The Company typically receives external valuation information for

U.S. Treasuries, other U.S. Government and Agency securities, as well as certain corporate debt securities, money

market funds and certificates of deposit. The Company also uses certain unobservable inputs that cannot be

validated by reference to a readily observable market or exchange data and relies, to a certain extent, on

management’s own assumptions about the assumptions that market participant would use in pricing the security.

In these instances, fair value is determined by analysis of historical and forecasted cash flows, default probabilities

and recovery rates, time value of money and discount rates considered appropriate given the level of risk in the

security and associated investor yield requirements. Extrapolation or other methods are applied to observable

market or other data to estimate assumptions that are not observable. The internally derived values are compared to

values received from brokers for reasonableness. The Company’s internally generated pricing models may include

its own data and require us to use judgment in interpreting relevant market data, matters of uncertainty and matters

that are inherently subjective in nature. The use of different judgments and assumptions could result in different

presentations of pricing and security prices could change significantly based on market conditions.

79

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)