Clearwire 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our owned spectrum licenses in the United States, Belgium and Ireland have indefinite useful lives, and were

evaluated for impairment testing purposes as a single unit of accounting for each country, in accordance with

EITF Issue No. 02-7, Unit of Accounting for Testing Impairment of Indefinite-Lived Intangible Assets.

We complete a two-step process to determine the amount of goodwill impairment. The first step involves

comparison of the fair value of the reporting unit to its carrying value to determine if any impairment exists. If the

fair value of the reporting unit is less than the carrying value, goodwill is considered to be impaired and the second

step is performed. The second step involves comparison of the implied fair value of goodwill to its carrying value.

The implied fair value of goodwill is determined by allocating fair value to the various assets and liabilities within

the reporting unit in the same manner goodwill is recognized in a business combination. In calculating an

impairment charge, the fair value of the impaired reporting units are estimated using a discounted cash flow

valuation methodology or by reference to recent comparable transactions. In making our assessment, we rely on a

number of factors, including operating results, business plans, economic projections, and anticipated future cash

flows. There are inherent uncertainties related to these factors and judgment in applying these factors to our

goodwill impairment test. We performed our annual impairment tests of goodwill as of October 1, 2007, and

concluded that there was no impairment of our goodwill.

Our intangible assets with indefinite useful lives in the United States and Internationally consist mainly of our

spectrum licenses originally issued by the FCC, trade names and trademarks. The impairment test for intangible

assets with indefinite useful lives consists of a comparison of the fair value of an intangible asset with its carrying

amount. If the carrying amount of an intangible asset exceeds its fair value, an impairment loss will be recognized in

an amount equal to that excess. The fair value is determined by estimating the discounted future cash flows that are

directly associated with, and that are expected to arise as a direct result of the use and eventual disposition of, the

asset. We performed our annual impairment test of indefinite lived intangible assets for each country of operation as

of October 1, 2007, and concluded that there was no impairment of these intangible assets.

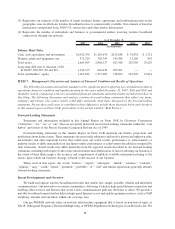

Share-Based Compensation

We account for our share-based compensation in accordance with SFAS No. 123(R), Share-Based Payment

(“SFAS No. 123(R)”), which requires the measurement and recognition of compensation expense for all share-

based awards made to employees and directors based on estimated fair values. We recognize compensation costs,

net of a forfeiture rate, for those shares expected to vest on a graded vesting schedule over the requisite service

period of the award, which is generally the option vesting term of four years. We recognized $42.8 million,

$14.2 million, and $2.5 million of stock-based compensation expense for the years ended December 31, 2007, 2006

and 2005, respectively. As of December 31, 2007, there was $88.6 million of total unrecognized stock-based

compensation cost, the majority of which will be recognized over approximately the next 2 years. Going forward,

stock-based compensation expenses may increase as we issue additional equity-based awards to continue to attract

and retain key employees.

We issue incentive awards to our employees through stock-based compensation consisting of stock options and

restricted stock units, or RSUs. The value of RSUs is determined using the fair value method, which in this case, is

based on the number of shares granted and the quoted price of our common stock on the date of grant. In

determining the fair value of stock options, we use the Black-Scholes valuation model, or BSM, to estimate the fair

value of stock options which requires complex and judgmental assumptions including estimated stock price

volatility, employee exercise patterns (expected life of the option) and future forfeitures. The computation of

expected volatility is based on an average historical volatility from common shares of a group of our peers as well as

our own historical volatility. The expected life of options granted is based on the simplified calculation of expected

life, described in SAB No. 107, Share-Based Payment, due to lack of option exercise history. If any of the

assumptions used in the BSM change significantly, share-based compensation expense may differ materially for

future grants as compared to the current period. See Note 13, Share-Based Payments, of our consolidated financial

statements for additional information.

SFAS No. 123(R) also requires that we recognize compensation expense for only the portion of stock options

or RSUs that are expected to vest. Therefore, we apply estimated forfeiture rates that are derived from historical

44