Clearwire 2007 Annual Report Download - page 65

Download and view the complete annual report

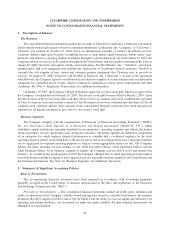

Please find page 65 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.incurred; and requires the acquirer to disclose to investors and other users all of the information they need to

evaluate and understand the nature and financial effect of the business combination. SFAS No. 141(R) is effective

for annual periods beginning on or after December 15, 2008. Accordingly, any business combinations we engage in

will be recorded and disclosed following existing GAAP until January 1, 2009. We expect SFAS No. 141(R) will

have an impact on our consolidated financial statements when effective, but the nature and magnitude of the specific

effects will depend upon the nature, terms and size of the acquisitions we consummate after the effective date.

SFAS No. 160 — In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated

Financial Statements (“SFAS No. 160”).SFAS No. 160 amends Accounting Research Bulletin No. 51, Consol-

idated Financial Statements, and requires all entities to report noncontrolling (minority) interests in subsidiaries

within equity in the consolidated financial statements, but separate from the parent shareholders’ equity.

SFAS No. 160 also requires any acquisitions or dispositions of noncontrolling interests that do not result in a

change of control to be accounted for as equity transactions. Further, SFAS No. 160 requires that a parent recognize

a gain or loss in net income when a subsidiary is deconsolidated. SFAS No. 160 is effective for annual periods

beginning on or after December 15, 2008. We are currently evaluating whether the adoption of SFAS No. 160 will

have a material impact on our financial statements.

SFAS No. 159 — In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial

Assets and Financial Liabilities (“SFAS No. 159”). SFAS No. 159 permits entities to choose, at specified election

dates, to measure eligible items at fair value (“fair value option”) and to report in earnings unrealized gains and

losses on those items for which the fair value option has been elected. SFAS No. 159 also requires entities to display

the fair value of those assets and liabilities on the face of the balance sheet. SFAS No. 159 establishes presentation

and disclosure requirements designed to facilitate comparisons between entities that choose different measurement

attributes for similar types of assets and liabilities. SFAS No. 159 is effective as of the beginning of an entity’s first

fiscal year beginning after November 15, 2007. We do not believe the adoption of this pronouncement will have a

material impact on our financial statements.

SFAS No. 157 — In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS No. 157”).

SFAS No. 157 defines fair value, establishes a framework for measuring fair value and expands disclosure of fair value

measurements. SFAS No. 157 applies under other accounting pronouncements that require or permit fair value

measurements and accordingly, does not require any new fair value measurements. SFAS No. 157 is effective for

financial statements issued for fiscal years beginning after November 15, 2007. In February 2008, the effective date of

SFAS No. 157 was delayed for one year by Final FASB Staff Position (FSP) No. FAS 157-2, Effective Date of FASB

Statement No. 157, for certain non-financial assets and non-financial liabilities, except those that are recognized or

disclosed at fair value in the financial statements on a recurring basis (at least annually). The Company is currently

evaluating the impact of this pronouncement on its financial statements.

ITEM 7A. Quantitative and Qualitative Disclosures About Market Risk

Market risk is the potential loss arising from adverse changes in market rates and prices, such as interest rates,

foreign currency exchange rates and changes in the market value of investments.

Interest Rate Risk

Our primary interest rate risk is associated with our new senior term loan facility. We have a total outstanding

balance on our senior term loan facility of $1.25 billion at December 31, 2007. The rate of interest for borrowings under

the senior term loan facility is the Eurodollar rate plus 6.00% or the alternate base rate plus 5.00%, with interest payable

quarterly with respect to alternate base rate loans, and with respect to Eurodollar loans, interest is payable in arrears at the

end of each applicable period, but at least every three months. The weighted average interest rate under this facility was

11.06% at December 31, 2007. A one percent increase in the interest rate on the outstanding principal balance at

December 31, 2007, would increase our annual interest expense by approximately $12.5 million per year.

In an effort to reduce interest expense on our senior term loan facility, in January 2008, the Company entered

into two interest rate swaps to hedge its forward three-month LIBOR indexed variable interest payments in an effort

to reduce interest expense. The first swap was entered on January 4, 2008, effective March 5, 2008, to pay a fixed

57