Clearwire 2007 Annual Report Download - page 74

Download and view the complete annual report

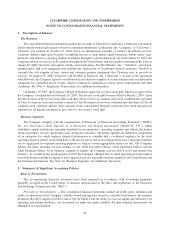

Please find page 74 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Use of Estimates — The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America (“GAAP”) requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses

during the reporting period. Due to the inherent uncertainty involved in making those estimates, actual results could

materially differ.

Significant estimates inherent in the preparation of the accompanying financial statements include the

application of purchase accounting including the valuation of acquired assets and liabilities, valuation of invest-

ments, the valuation of the Company’s common stock, the amortization period of prepaid spectrum license fees,

allowance for doubtful accounts, depreciation and equity granted to third parties and employees.

Cash and Cash Equivalents — Cash and cash equivalents consist of time deposits and highly liquid short-term

investments with original maturities of three months or less. Cash and cash equivalents exclude cash that is

contractually restricted for operational purposes. The Company maintains cash and cash equivalent balances with

financial institutions that exceed federally insured limits. The Company has not experienced any losses related to

these balances, and management believes its credit risk related to these balances to be minimal.

Restricted Cash — Restricted cash is classified as a current or noncurrent asset based on its designated

purpose. As of December 31, 2007, the Company had restricted cash of $12.7 million. The majority of this restricted

cash related primarily to the Company’s outstanding letters of credit.

Investments — SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities, and Staff

Accounting Bulletin (“SAB”) No. 59, Accounting for Non-current Marketable Equity Securities, provide guidance

on determining when an investment is other-than-temporarily impaired. The Company classifies marketable debt

and equity securities that are available for current operations as short-term available-for-sale investments, and these

securities are stated at fair value. Unrealized gains and losses are recorded as a separate component of accumulated

other comprehensive income (loss). Losses are recognized when a decline in fair value is determined to be other-

than-temporary. Realized gains and losses are determined on the basis of the specific identification method. The

Company reviews its short-term and long-term investments on an ongoing basis for indicators of other-than-

temporary impairment, and this determination requires significant judgment.

The Company has an investment portfolio comprised of marketable debt and equity securities including

commercial paper, corporate bonds, municipal bonds, auction rate securities and other securities. The value of these

securities is subject to market volatility during the period the investments are held and until their sale or maturity.

The Company recognizes realized losses when declines in the fair value of our investments below their cost basis

are judged to be other-than-temporary. In determining whether a decline in fair value is other-than-temporary, the

Company considers various factors including market price (when available), investment ratings, the financial

condition and near-term prospects of the issuer, the length of time and the extent to which the fair value has been less

than the cost basis, and the Company’s intent and ability to hold the investment until maturity or for a period of time

sufficient to allow for any anticipated recovery in market value. The Company makes significant judgments in

considering these factors. If it is judged that a decline in fair value is other-than-temporary, the investment is valued

at the current estimated fair value and a realized loss equal to the decline is reflected in the consolidated statement of

operations.

In determining fair value, the Company uses quoted prices in active markets where such prices are available, or

models to estimate the fair value using various methods including the market, income and cost approaches. For

investments where models are used to estimate fair value in the absence of quoted market prices, the Company often

utilizes certain assumptions that market participants would use in pricing the investment, including assumptions

about risk and or the risks inherent in the inputs to the valuation technique. These inputs are readily observable,

market corroborated, or unobservable Company inputs.

66

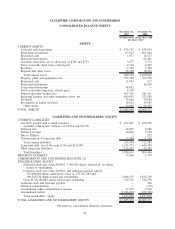

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)