Clearwire 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

milestones are met. The Company records common stock and warrants payable to recognize the timing difference

when consideration has been received by the Company, but it has not yet issued securities to the counterparty.

13. Share-Based Payments

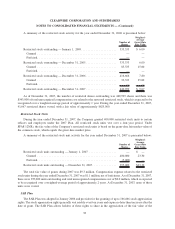

On January 19, 2007, Clearwire’s Board of Directors adopted the 2007 Stock Compensation Plan (the “2007

Plan”), which authorizes the Company to grant incentive stock options, non-qualified stock options, stock

appreciation rights, restricted stock, restricted stock units, and other stock awards to its employees, directors

and consultants. The 2007 Plan was adopted by the Company’s stockholders on February 16, 2007. There are

15,000,000 shares of Class A common stock authorized under the 2007 Plan. Options granted under the 2007 Plan

generally vest ratably over four years and expire no later than ten years after the date of grant. Shares to be awarded

under the 2007 Plan will be made available at the discretion of the Compensation Committee of the Board of

Directors from authorized but unissued shares, authorized and issued shares reacquired and held as treasury shares,

or a combination thereof. At December 31, 2007 there were 8,558,574 shares available for grant under the 2007

Stock Option Plan.

Prior to the 2007 Plan, the Company had the following share-based arrangements: The Clearwire Corporation

2003 Stock Option Plan (the “2003 Stock Option Plan”) and The Clearwire Corporation Stock Appreciation Rights

Plan (the “SAR Plan”). No additional stock options will be granted under the Company’s 2003 Stock Option Plan.

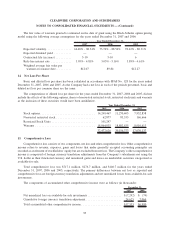

The Company applies SFAS 123(R) to new awards and to awards modified, repurchased, or cancelled after

January 1, 2006. Share-based compensation expense is based on the estimated grant-date fair value and is

recognized net of a forfeiture rate on those shares expected to vest over a graded vesting schedule on a straight-line

basis over the requisite service period for each separately vesting portion of the award as if the award was, in-

substance, multiple awards.

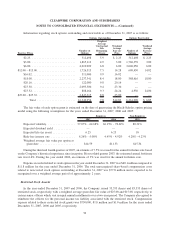

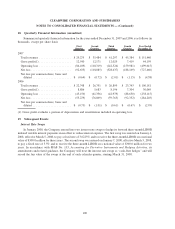

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing

model using the assumptions disclosed for the years ended December 31, 2007, 2006 and 2005. The volatility used

to calculate the fair value of non-employee stock option grants for 2007, 2006 and 2005 and employee stock option

grants for 2007 and 2006 is based on both average historical volatility from common shares of a group of the

Company’s peers and the Company’s own historical volatility. There is a 0% expected dividend yield as there are no

plans to pay future dividends. The expected life of options granted is based on the simplified calculation of expected

life, described in the Securities and Exchange Commission’s Staff Accounting Bulletin No. 107, or SAB No. 107,

Share-Based Payment, due to lack of option exercise history. The risk-free interest rate is based on the zero-coupon

U.S Treasury bond, with a term equal to the expected life of the options.

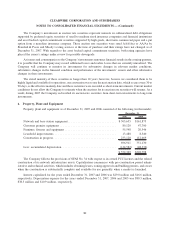

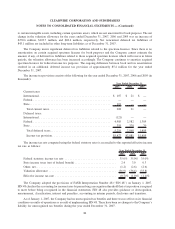

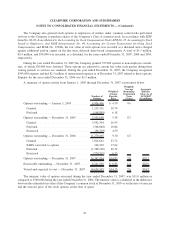

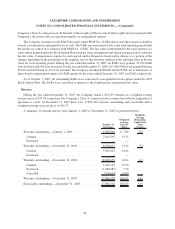

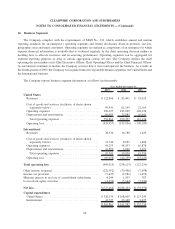

Compensation cost recognized for these plans for the year ended December 31, 2007, 2006 and 2005 is

presented as follows (in thousands):

2007 2006 2005

Year Ended December 31,

Cost of service ........................................ $ 138 $ 819 $ 204

Selling, general and administrative .......................... 42,633 13,427 2,338

Total .............................................. $42,771 $14,246 $2,542

Stock Options

Prior to January 1, 2006, the Company accounted for share-based compensation under the recognition and

measurement provisions of APB 25. Stock options granted at prices below fair market value at the date of grant were

considered compensatory, and compensation expense has been deferred and is being recognized over the option

vesting period using the graded vesting method. Compensation expense is based on the excess of the fair market

value of the underlying common stock at the date of grant over the exercise price of the option.

90

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)