Clearwire 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

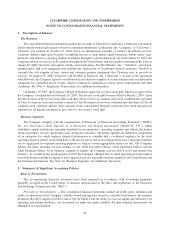

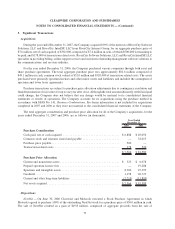

3. Significant Transactions

Acquisitions

During the year ended December 31, 2007, the Company acquired 100% of the interests of RiverCity Software

Solutions, LLC and RiverCity IntraISP, LLC from RiverCity Internet Group, for an aggregate purchase price of

$7.6 million, net of cash acquired of $361,000, comprised of $7.4 million in cash, of which $500,000 is remaining to

be paid, and $178,000 of transaction related costs. RiverCity Software Solutions, LLC and RiverCity IntraISP, LLC

specialize in providing billing, online support services and customer relationship management software solutions to

the communications and services industry.

For the year ended December 31, 2006, the Company purchased various companies through both asset and

share purchase agreements. The total aggregate purchase price was approximately $81.6 million comprised of

$49.1 million in cash, common stock valued at $32.0 million and $520,000 of transaction related costs. The assets

purchased were primarily spectrum licenses and other minor assets and liabilities and included the assumption of

spectrum and tower lease agreements.

Purchase transactions are subject to purchase price allocation adjustments due to contingency resolution and

final determination of fair values for up to one year after close. Although the total amount ultimately settled and paid

could change, the Company does not believe that any change would be material to its consolidated financial

statements or results of operations. The Company accounts for its acquisitions using the purchase method in

accordance with SFAS No. 141, Business Combinations. Pro-forma information is not included for acquisitions

completed in 2007 and 2006 as they were not material to the consolidated financial statements of the Company.

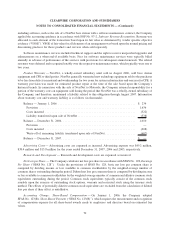

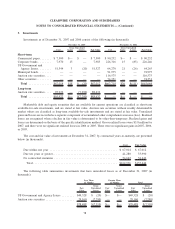

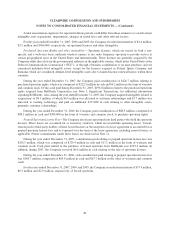

The total aggregate consideration and purchase price allocation for all of the Company’s acquisitions, for the

years ended December 31, 2007 and 2006, are as follows (in thousands):

2007 2006

Year Ended

December 31,

Purchase Consideration

Cash paid, net of cash acquired ................................... $6,888 $ 49,056

Common stock and warrants issued and payable ....................... — 32,013

Purchase price payable .......................................... 500 —

Transaction-related costs......................................... 178 520

$ 7,566 $ 81,589

Purchase Price Allocation

Current and noncurrent assets ..................................... $ 323 $ 6,078

Prepaid spectrum license fees ..................................... — 19,288

Spectrum and intangible assets .................................... 8,300 47,395

Goodwill .................................................... 1,158 20,723

Current and other long-term liabilities ............................... (2,215) (11,895)

Net assets acquired ............................................. $7,566 $ 81,589

Dispositions

NextNet — On June 30, 2006 Clearwire and Motorola executed a Stock Purchase Agreement in which

Motorola agreed to purchase 100% of the outstanding NextNet stock for a purchase price of $50.0 million in cash.

The sale of NextNet resulted in a gain of $19.8 million, comprised of aggregate proceeds from the sale of

73

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)