Clearwire 2007 Annual Report Download - page 75

Download and view the complete annual report

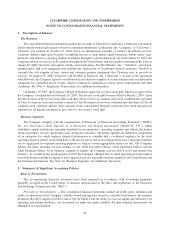

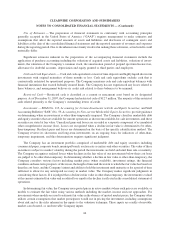

Please find page 75 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company estimates the fair value of securities without quoted market prices using internally generated

pricing models that require various inputs and assumptions. The Company believes that its pricing models, inputs

and assumptions are what market participants would use in pricing the securities. The Company maximizes the use

of observable inputs to the pricing models where quoted market prices from securities and derivatives exchanges are

available and reliable. The Company typically receives external valuation information for U.S. Treasuries, other

U.S. Government and Agency securities, as well as certain corporate debt securities, money market funds and

certificates of deposit. The Company also uses certain unobservable inputs that cannot be validated by reference to a

readily observable market or exchange data and relies, to a certain extent, on management’s own assumptions about

the assumptions that market participant would use in pricing the security. The Company’s internally generated

pricing models may include its own data and require the Company to use its judgment in interpreting relevant

market data, matters of uncertainty and matters that are inherently subjective in nature. The Company uses many

factors that are necessary to estimate market values, including, interest rates, market risks, market spreads, and

timing of cash flows, market liquidity, and review of underlying collateral and principal, interest and dividend

payments. The use of different judgments and assumptions could result in different presentations of pricing and

security prices could change significantly based on market conditions.

Restricted Investments — Restricted investments consist of U.S. government securities. At December 31,

2006 restricted investments represented securities held as collateral for the interest payments through November 15,

2007 related to the Company’s long-term debt. These securities are classified as held-to-maturity and are stated at

amortized cost. Gross unrealized losses on these investments were $244,000 at December 31, 2006. There were no

gross unrealized gains as of December 31, 2006. As a result of repayment of long-term debt, there is no remaining

collateral requirement and no balance in restricted investments at December 31, 2007.

Fair Value of Financial Instruments — The Company has determined the estimated fair value of financial

instruments using available market information and management judgment. Accordingly, these estimates are not

necessarily indicative of the amounts that could be realized in a current market exchange. The carrying amounts of

cash and cash equivalents, accounts and notes receivable, accounts payable, accrued expenses and due to affiliates

are reasonable estimates of their fair values based on the liquidity of these financial instruments and their short-term

nature. The Company does not hold or issue any financial instruments for trading purposes. See Note 10, Long-

Term Debt, for the fair value of long-term debt.

Accounts Receivable — Accounts receivable are stated at amounts due from customers net of an allowance for

doubtful accounts. The Company specifically provides allowances for customers with known disputes or

collectibility issues. The remaining reserve recorded in the allowance for doubtful accounts is the Company’s

best estimate of the amount of probable losses in the remaining accounts receivable based upon an evaluation of the

age of receivables and historical experience. The allowance for doubtful accounts was approximately $787,000 and

$753,000 as of December 31, 2007 and 2006, respectively.

Inventory — Inventory primarily consists of finished goods and is stated at the lower of cost or net realizable

value. Cost is determined under the first-in, first-out inventory method. The Company records inventory write-

downs for obsolete and slow-moving items based on inventory turnover trends and historical experience.

Property, Plant and Equipment — Property, plant and equipment and improvements that extend the useful life

of an asset are stated at cost, net of accumulated depreciation. Depreciation is calculated on a straight-line basis over

the estimated useful lives of the assets. The Company capitalizes costs of additions and improvements, including

direct costs of constructing property, plant and equipment and interest costs related to construction. The estimated

useful life of property, plant and equipment are determined based on historical usage of that or similar equipment,

with consideration given to technological changes and industry trends that could impact the network architecture

and asset utilization. Leasehold improvements are recorded at cost and amortized over the lesser of their estimated

useful lives or the related lease term. Maintenance and repairs are expensed as incurred.

67

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)