Clearwire 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

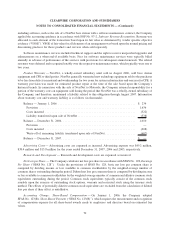

$47.1 million less the book value of net assets sold of $26.1 million and transaction related costs of $1.2 million,

which consists of legal fees and employee related termination costs. The transaction closed on August 29, 2006.

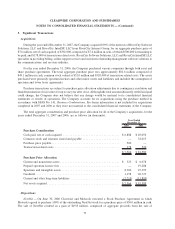

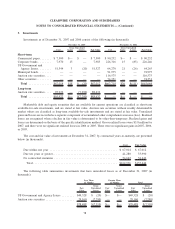

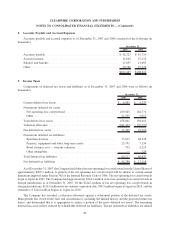

The carrying value of the assets and liabilities sold during 2006 are as follows (in thousands):

Inventory ............................................................. $ 8,895

Property, plant and equipment.............................................. 4,620

Other current and long-term assets .......................................... 8,387

Intangible assets ........................................................ 5,211

Goodwill ............................................................. 9,352

Total assets ........................................................... 36,465

Current liabilities ....................................................... 9,888

Other long-term liabilities................................................. 490

Total liabilities ......................................................... 10,378

Net assets disposed ..................................................... $26,087

In connection with the sale of NextNet, Clearwire and Motorola also entered into agreements for the purchase

of certain infrastructure and supply inventory from NextNet (“Supply Agreement”). These agreements cover a

number of topics, including, but not limited to, certain technology development projects and future Clearwire

purchase commitments and a maximum Motorola pricing schedule for network equipment from NextNet. The

aggregate price paid by Clearwire in any calendar year will be no less favorable than the aggregate price paid by

other customers contemporaneously buying similar or lesser aggregate purchases. Clearwire is committed to

purchase no less than $150.0 million of equipment products from Motorola in the first two years after the effective

date of the Supply Agreement. Clearwire is also committed to purchase no less than 25.0% of its Worldwide

Interoperability for Microwave Access (“WiMAX”) subscriber handsets from Motorola as long as the capabilities

and costs of the handsets (and the availability of such handsets) are equal for a given product in similar quantities or

service offered by Motorola and another supplier or suppliers. These commitments are effective for an initial term

of eight years and will be automatically renewed for consecutive one year terms unless either party notifies the other

party in writing of its intent to terminate the agreements at least one hundred and twenty days prior to the expiration

of the initial term or any renewal thereof. Clearwire has also committed to use Motorola as its 100.0% exclusive

supplier for specified Wireless Broad Band Infrastructure products until the fifth anniversary date of the agreement.

After the fifth anniversary date the commitment is reduced to 51.0% until the term ends on August 29, 2014. For the

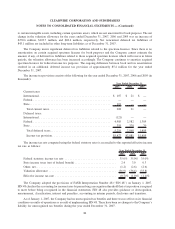

period from the effective date of the agreement of August 29, 2006, through December 31, 2007, total purchases

from Motorola under these agreements were $98.4 million. The remaining commitment was $51.6 million at

December 31, 2007.

Due to Clearwire’s continuing involvement in NextNet through the various agreements described above, the

sale of NextNet was not classified as discontinued operations in the financial statements as it did not meet the

discontinued operations criteria specified in SFAS No. 144, Accounting for the Impairment or Disposal of Long-

Lived Assets and EITF Issue No. 03-13, Applying the Conditions in Paragraph 42 of SFAS No. 144 in Determining

whether to report Discontinued Operations.

Financing

In an effort to simply its capital structure, access incremental borrowing availability, and extend debt

maturities, on July 3, 2007, the Company entered into a senior term loan facility providing for loans of up to

$1.0 billion. The Company borrowed $379.3 million under the senior term loan facility on the date of closing and

repaid obligations under its existing $125.0 million term loan and fees and costs attributable to the senior term loan

facility. The remainder is being used for capital expenditures, working capital and general corporate purposes. On

74

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)