Clearwire 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Internally Developed Software — Clearwire capitalizes costs related to computer software developed or

obtained for internal use in accordance with Statement of Position (“SOP”) No. 98-1, Accounting for the Costs of

Computer Software Developed or Obtained for Internal Use. Software obtained for internal use has generally been

enterprise-level business and finance software customized to meet specific operational needs. Costs incurred in the

application development phase are capitalized and amortized over the useful life of the software, which is generally

three years. Costs recognized in the preliminary project phase and the post-implementation phase are expensed as

incurred.

Intangible Assets — Intangible assets consist primarily of Federal Communications Commission (“FCC”)

spectrum licenses and other intangible assets related to Clearwire’s acquisition of NextNet in March 2004, which

was subsequently disposed in August 2006, and Banda Ancha S.A. (“BASA”) in December 2005 and February

2006. As further described in Note 7, Spectrum Licenses, Goodwill and Other Intangible Assets, the Company

accounts for its spectrum licenses and other intangible assets in accordance with the provisions of SFAS No. 142,

Goodwill and Other Intangible Assets (“SFAS No. 142). In accordance with SFAS No. 142, intangible assets with

indefinite useful lives are not amortized but must be assessed for impairment annually or more frequently if an event

indicates that the asset might be impaired. The Company performed its annual impairment test of indefinite lived

intangible assets on October 1, 2007 and concluded that there was no impairment of these intangible assets.

Goodwill — Goodwill represents the excess of the purchase price over the estimated fair value of net assets

acquired from Clearwire’s acquisitions. In accordance with SFAS No. 142, the Company completes a two-step

process to determine the amount of goodwill impairment. The first step involves comparison of the fair value of the

reporting unit to its carrying value to determine if any impairment exists. If the fair value of the reporting unit is less

than the carrying value, goodwill is considered to be impaired and the second step is performed. The second step

involves comparison of the implied fair value of goodwill to its carrying value. The implied fair value of goodwill is

determined by allocating fair value to the various assets and liabilities within the reporting unit in the same manner

goodwill is recognized in a business combination. In calculating an impairment charge, the fair value of the

impaired reporting units are estimated using a discounted cash flow valuation methodology or by reference to recent

comparable transactions. In making this assessment, the Company relies on a number of factors, including operating

results, business plans, economic projections, and anticipated future cash flows. There are inherent uncertainties

related to these factors and judgment in applying these factors to the goodwill impairment test. The Company

performed its annual impairment tests of goodwill as of October 1, 2007, and concluded that there was no

impairment of goodwill.

Long-Lived Assets — Long-lived assets to be held and used, including property, plant and equipment and

intangible assets with definite useful lives, are assessed for impairment whenever events or changes in circum-

stances indicate that the carrying amount of an asset may not be recoverable. If the total of the expected

undiscounted future cash flows is less than the carrying amount of the asset, a loss, if any, is recognized for

the difference between the fair value and carrying value of the assets. Impairment analyses, when performed, are

based on the Company’s business and technology strategy, management’s views of growth rates for its business,

anticipated future economic and regulatory conditions and expected technological availability. For purposes of

recognition and measurement, the Company groups its long-lived assets at the lowest level for which there are

identifiable cash flows which are largely independent of other assets and liabilities.

Deferred Financing Costs — Deferred financing costs consists primarily of investment banking fees, legal,

accounting and printing costs associated with the issuance of the Company’s long-term debt. Deferred financing

fees are amortized over the life of the corresponding debt facility. In relation to the issuances of the long-term debt

discussed in Note 10, Long-Term Debt, the Company incurred $30.2 million of deferred financing costs in 2007 for

its $1.25 billion senior term loan facility entered into during 2007 and an additional $39.3 million related to the

repayment of its $125.0 million term loan and the retirement of its $620.7 million senior secured notes due 2010,

compared to $21.8 million in 2006. For the years ended December 31, 2007 and 2006, $6.7 million and $3.9 million,

68

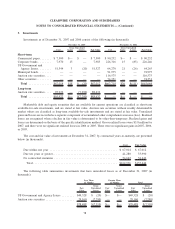

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)