Clearwire 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

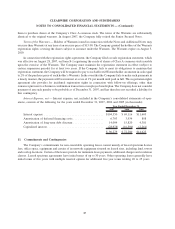

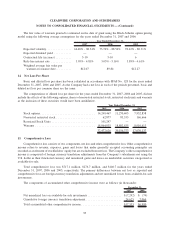

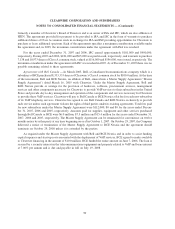

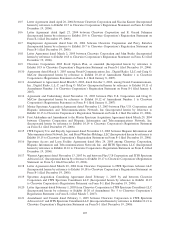

2007 2006

December 31,

Long-lived assets(a)

United States ............................................ $1,350,418 $661,444

International ............................................. 150,555 103,782

$1,500,973 $765,226

(a) Consists of property, plant and equipment and prepaid spectrum and spectrum licenses attributable to the

business segment.

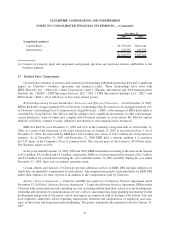

17. Related Party Transactions

Clearwire has a number of strategic and commercial relationships with third-parties that have had a significant

impact on Clearwire’s business, operations and financial results. These relationships have been with

ERH, Motorola, Inc. (“Motorola”), Intel Corporation (“Intel”), Hispanic Information and Telecommunications

Network, Inc. (“HITN”), ITFS Spectrum Advisors, LLC (“ISA”), ITFS Spectrum Consultants LLC (“ISC”) and

Bell Canada (“Bell”), all of which are or have been related parties.

Relationships among Certain Stockholders, Directors, and Officers of Clearwire — As of December 31, 2007,

ERH is the holder of approximately 65% of Clearwire’s outstanding Class B common stock and approximately 13%

of Clearwire’s outstanding Class A common stock. Eagle River Inc. (“ERI”) is the manager of ERH. Each entity is

controlled by Craig McCaw. Mr. McCaw and his affiliates have significant investments in other telecommuni-

cations businesses, some of which may compete with Clearwire currently or in the future. Mr. McCaw and his

affiliates will likely continue to make additional investments in telecommunications businesses.

ERH also held 0% as of December 31, 2007 and 3.1% of the Company’s long-term debt as of December 31,

2006, as a result of the retirement of all senior secured notes on August 15, 2007 as described in Note 3. As of

December 31, 2006, the notes held by ERH had a $23.0 million face value, or $19.3 million net of discounts for

warrants. As of December 31, 2007 and December 31, 2006 ERH held a warrant entitling it to purchase

613,333 shares of the Company’s Class A common stock. The exercise price of the warrant is $15.00 per share.

The Warrants expire in 2010.

In the years ended December 31, 2007, 2006 and 2005, ERH earned interest relating to the notes in the amount

of $1.6 million, $4.1 million and $3.1 million, respectively. ERH received payments in the amount of $2.5 million

and $3.8 million for accrued interest during the years ended December 31, 2007 and 2006. During the year ended

December 31, 2005, there were no interest payments made.

Certain officers and directors of Clearwire provide additional services to ERH, ERI and their affiliates for

which they are separately compensated by such entities. Any compensation paid to such individuals by ERH, ERI

and/or their affiliates for their services is in addition to the compensation paid by Clearwire.

Advisory Services Agreement — Clearwire and ERI were parties to an Advisory Services Agreement, dated

November 13, 2003 (the “Advisory Services Agreement”). Under the Advisory Services Agreement, ERI provided

Clearwire with certain advisory and consulting services, including without limitation, advice as to the development,

ownership and operation of communications services, advice concerning long-range planning and strategy for the

development and growth of Clearwire, advice and support in connection with its dealings with federal, state and

local regulatory authorities, advice regarding employment, retention and compensation of employees and assis-

tance in short-term and long-term financial planning. The parties terminated this agreement effective January 31,

2007.

97

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)