Clearwire 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

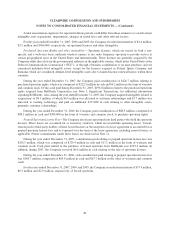

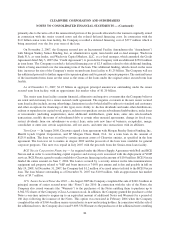

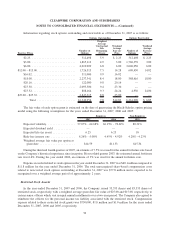

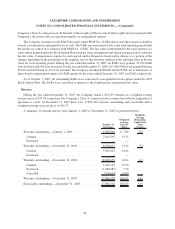

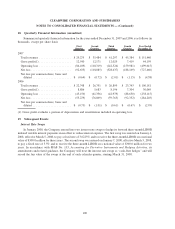

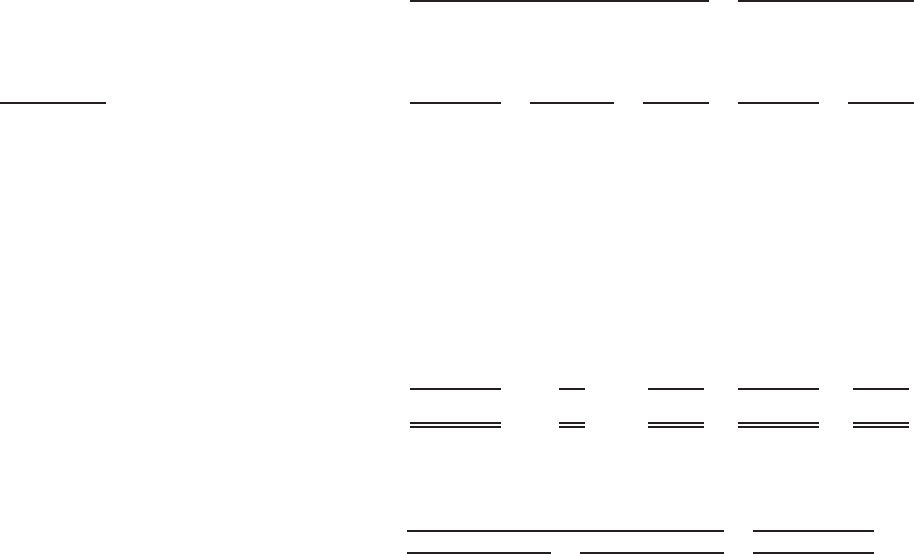

Information regarding stock options outstanding and exercisable as of December 31, 2007 is as follows:

Exercise Prices

Number of

Options

Weighted

Average

Contractual

Life

Remaining

(Years)

Weighted

Average

Exercise

Price

Number of

Options

Weighted

Average

Exercise

Price

Options ExercisableOptions Outstanding

$2.25 ............................ 312,498 5.9 $ 2.25 312,498 $ 2.25

$3.00 ............................ 1,865,112 4.9 3.00 1,760,359 3.00

$6.00 ............................ 4,019,909 6.8 6.00 3,006,050 6.00

$12.00 – $15.00........................ 1,726,315 7.5 14.28 609,430 14.02

$16.02 ........................... 311,000 9.9 16.02 — —

$18.00 ........................... 2,237,341 8.4 18.00 568,616 18.00

$20.16 ........................... 122,000 9.8 20.16 — —

$23.30 ........................... 2,093,300 9.4 23.30 — —

$23.52 ........................... 808,164 9.3 24.24 4,956 24.00

$25.00 – $25.33........................ 2,847,315 8.8 25.00 — —

Total ........................ 16,342,954 7.8 $14.83 6,261,909 $ 6.85

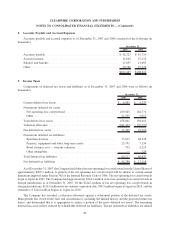

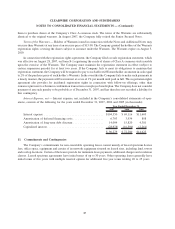

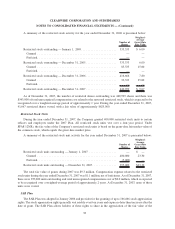

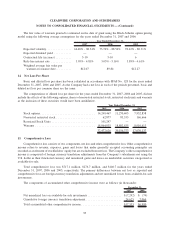

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing

model using the following assumptions for the years ended December 31, 2007, 2006 and 2005:

2007 2006 2005

Employee Non-Employee

Expected volatility.................. 57.07% - 64.68% 66.15% - 78.62% 80.31%

Expected dividend yield ............. — — —

Expected life (in years) .............. 6.25 6.25 10

Risk-free interest rate ............... 4.26% - 5.00% 4.45% - 4.92% 4.20% - 4.23%

Weighted average fair value per option at

grant date ...................... $14.59 $11.53 $15.36

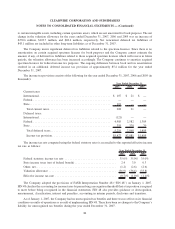

During the third and fourth quarters of 2007, an estimate of 7.5% was used for the annual forfeiture rate based

on the Company’s historical experience since inception. Prior to third quarter 2007, the estimated annual forfeiture

rate was 6.4%. During the year ended 2006, an estimate of 3% was used for the annual forfeiture rate.

Expense recorded related to stock options in the year ended December 31, 2007 was $40.1 million compared to

$11.8 million for the year ended December 31, 2006. The total unrecognized share-based compensation costs

related to non-vested stock options outstanding at December 31, 2007 was $77.8 million and is expected to be

recognized over a weighted average period of approximately 2 years.

Restricted Stock Awards

In the year ended December 31, 2007 and 2006, the Company issued 33,333 shares and 83,333 shares of

restricted stock, respectively, with a weighted average grant date fair value of $25.00 and $15.00, respectively, to

certain senior officers which vest in equal annual installments over a two-year period. The Company also agreed to

reimburse the officers for the personal income tax liability associated with the restricted stock. Compensation

expense related to these restricted stock grants was $750,000, $1.0 million and $1.0 million for the years ended

December 31, 2007, 2006 and 2005, respectively.

92

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)