Clearwire 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.intend to deploy networks based on the IEEE mobile Worldwide Interoperability of Microwave Access

802.16e-2005, or mobile WiMAX, standard in all new markets. As with our current pre-WiMAX network

infrastructure equipment, we expect mobile WiMAX technology to support fixed, portable and mobile service

offerings using a single network architecture. In addition, as mobile WiMAX is a standards-based technology, we

anticipate manufacturers will offer a number of handheld communications and consumer electronic devices that

will be enabled to communicate using our mobile WiMAX network, including notebook computers, ultramobile

personal computers, or UMPCs, personal data assistants, or PDAs, gaming consoles, MP3 players, and other

handheld devices. We expect to launch our first mobile WiMAX markets in the second half of 2008, provided the

WiMAX technologies satisfactorily pass our ongoing field trials.

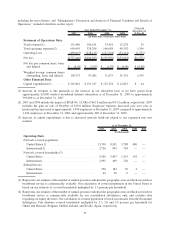

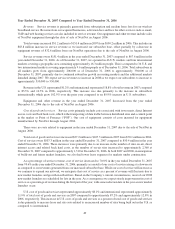

We launched our first broadband market in August 2004 and are growing rapidly in terms of the number of

markets served, number of people covered by our network, and number of total subscribers. As of December 31,

2007 we offered our service for sale to an estimated 13.6 million people, or POPs, in the United States and to nearly

2.7 million POPs internationally in Ghent and Brussels, Belgium; Dublin, Ireland; and Seville, Spain.

We believe that our subscriber growth rates reflect robust customer demand for our services. We ended 2007 with

approximately 394,000 total subscribers worldwide representing a 91.3% increase in subscribers or approximately

188,000 net new subscribers from the approximately 206,000 total subscribers we had as of December 31, 2006. Our

subscriber base grew by 332,000 from the approximately 62,000 total subscribers we had as of December 31, 2005.

As of December 31, 2007, we had approximately 350,000 customers in the United States, representing an increase

of 166,000 or 90.2% increase from the approximately 184,000 U.S. subscribers we had as of December 31, 2006. This

also represents a 294,000 increase from the approximately 56,000 U.S. subscribers we had as of December 31, 2005.

Internationally, we ended 2007 with approximately 44,000 customers, representing a 22,000 or 100.0%

increase from the approximately 22,000 subscribers we had as of December 31, 2006 and a 38,000 increase from the

approximately 6,000 subscribers we had as of December 31, 2005.

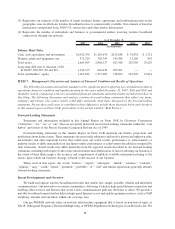

We are investing heavily in building networks and growing our subscriber base. Our efforts also include

offering premium services and applications in order to make our service more attractive, such as VoIP telephony and

our recently introduced PC card. This expansion will require significant capital expenditures as well as increased

sales and marketing expenses, and will likely be accompanied by significant operating losses over the next five

years or more as we expand the area covered by our network and invest to build our brand and develop subscriber

loyalty. We expect to launch additional markets in the United States during 2008. If introduced on the schedule we

anticipate, these market launches would expand our covered population in the United States to approximately 20.0

to 22.0 million in 2008. We believe we may have 510,000 to 530,000 total subscribers in both our U.S. and

international markets by the end of 2008.

We believe that we have the second largest spectrum position in the 2.5 GHz (2496-2690 MHz) band in the

United States with a spectrum portfolio that as of December 31, 2007 includes approximately 15.1 billion MHz-

POPs, an industry metric that represents the amount of spectrum in a given area, measured in Megahertz, multiplied

by the estimated population of that area. In Europe, as of December 31, 2007, we held approximately 8.7 billion

MHz-POPs of spectrum, predominantly in the 3.5 GHz band, in Belgium, Germany, Ireland, Poland, Romania and

Spain. We plan to continue acquiring spectrum in markets that we believe are attractive for our service offerings. If

demand increases for spectrum rights, our spectrum acquisition costs may increase, which may afford an advantage

to competitors with greater capital resources.

We engineer our networks to optimize both the services that we offer and the number of subscribers to whom

we can offer service. Consequently, we have not launched our services in a market using our current technology

unless we control a minimum of six channels of spectrum that contain at least 5 MHz of spectrum each. However,

we expect the spectral efficiency of technologies we deploy to continue to evolve, and as a result, we may decide to

deploy our services in some markets with less spectrum. Alternatively, we could find that new technologies and

subscriber usage patterns require us to have more spectrum available in our markets.

As a result of continued expansion and ongoing spectrum acquisitions, we expect to require significant

additional capital, which we intend to raise through subsequent equity offerings, by increasing our debt, or a

combination of the two. As of December 31, 2007, our total assets were $2.69 billion and our stockholders’ equity

39