Clearwire 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

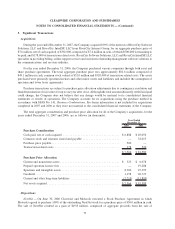

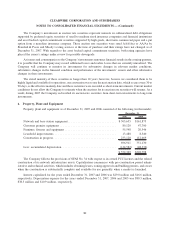

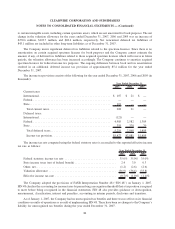

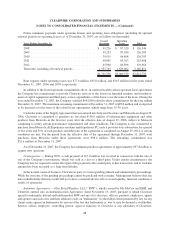

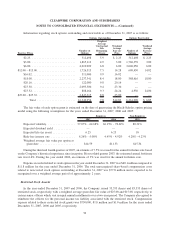

8. Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses as of December 31, 2007 and 2006 consisted of the following (in

thousands):

2007 2006

December 31,

Accounts payable ............................................ $ 42,327 $ 41,710

Accrued interest ............................................. 11,643 27,272

Salaries and benefits .......................................... 17,697 12,095

Other ..................................................... 30,780 27,139

$102,447 $108,216

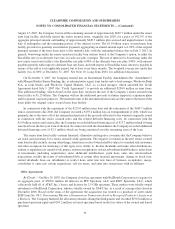

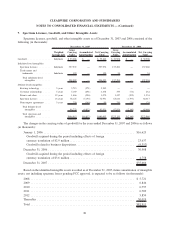

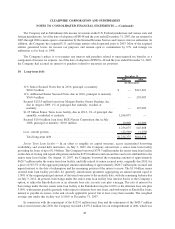

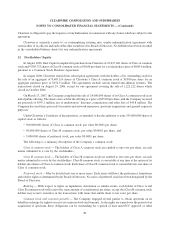

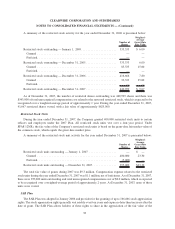

9. Income Taxes

Components of deferred tax assets and liabilities as of December 31, 2007 and 2006 were as follows (in

thousands):

2007 2006

December 31,

Current deferred tax assets . ................................... $ 6,981 $ 4,233

Noncurrent deferred tax assets:

Net operating loss carryforward ............................... 430,345 184,771

Other .................................................. 21,535 5,012

Total deferred tax assets . . . ................................... 458,861 194,016

Valuation allowance ......................................... (441,432) (170,797)

Net deferred tax assets ....................................... 17,429 23,219

Noncurrent deferred tax liabilities:

Spectrum licenses ......................................... 33,673 28,938

Property, equipment and other long-term assets ................... 25,791 7,150

Bond issuance cost — warrant valuation......................... 753 4,225

Other intangibles .......................................... — 124

Total deferred tax liabilities . ................................... 60,217 40,437

Net deferred tax liabilities . . ................................... $ 42,788 $ 17,218

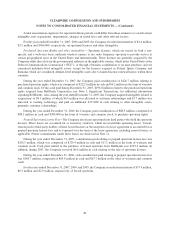

As of December 31, 2007, the Company had federal tax net operating loss carryforwards in the United States of

approximately $969.2 million. A portion of the net operating loss carryforward will be subject to certain annual

limitations imposed under Section 382 of the Internal Revenue Code of 1986. The net operating loss carryforwards

begin to expire in 2021. The Company had approximately $224.2 million of tax net operating loss carryforwards in

foreign jurisdictions as of December 31, 2007. Of the $224.2 million of tax net operating loss carryforwards in

foreign jurisdictions, $114.9 million has no statutory expiration date, $94.5 million begins to expire in 2015, and the

remainder of $14.8 million begins to expire in 2010.

The Company has recorded a valuation allowance against a substantial portion of the deferred tax assets.

Management has reviewed the facts and circumstances, including the limited history and the projected future tax

losses, and determined that it is appropriate to reduce a portion of the gross deferred tax assets. The remaining

deferred tax asset will be reduced by schedulable deferred tax liabilities. The net deferred tax liabilities are related

83

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)