Clearwire 2007 Annual Report Download - page 59

Download and view the complete annual report

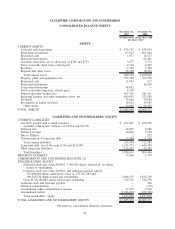

Please find page 59 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 31, 2006. We recorded amortization of original issuance discount of $14.0 million for the year ended

December 31, 2007 compared to $15.8 million for the year ended December 31, 2006. We recorded amortization of

deferred financing costs related to our secured notes and senior term loan facility of $6.7 million for the year ended

December 31, 2007 compared to $3.9 million for the year ended December 31, 2006. These amounts were partially

offset by capitalized interest of $29.0 million for year ended December 31, 2007 compared to $16.6 million for the

year ended December 31, 2006.

Loss on extinguishment of debt. In connection with the retirement of the $620.7 million senior secured notes

due 2010 and the repayment of the $125.0 million term loan, we recorded a $159.2 million loss on extinguishment

of debt, which was primarily due to the write-off of the unamortized portion of the proceeds allocated to the

warrants originally issued in connection with the senior secured notes and the related deferred financing costs.

Other-than-temporary impairment loss and realized loss on investments The increase in the other-than-

temporary impairment loss and realized loss on investment securities of $35.0 million for the year ended

December 31, 2007, as compared to the year ended December 31, 2006, is primarily due to the recognition of

a decline in value of investment securities which we determined to be other than temporary. At December 31, 2007,

we held available for sale short-term and long-term investments with a fair value of $155.6 million and a cost of

$162.9 million.

Included in our investments were auction rate securities with a fair value of $88.6 million and a cost of

$95.9 million. Auction rate securities are variable rate debt instruments whose interest rates are reset approximately

every 30 or 90 days through an auction process. The auction rate securities are classified as available for sale and are

recorded at fair value. At December 31, 2007, the estimated fair value of these auction rate securities no longer

approximates cost and we recorded other-than-temporary impairment losses and realized losses on our auction rate

securities of $32.3 million for the year ended December 31, 2007. For certain other auction rate securities, we

recorded an unrealized loss of $7.3 million in other comprehensive income reflecting the decline in the estimated

fair value of these securities. We consider these declines in fair value to be temporary given our consideration of the

collateral underlying these securities and our conclusion that the declines are related to changes in interest rates

rather than any credit concerns related to the underlying assets. Additionally, we have the intent and ability to hold

the investments until maturity or for a period of time sufficient to allow for any anticipated recovery in market value.

The Company’s investments in auction rate securities represent interests in collateralized debt obligations

supported by preferred equity securities of small to medium sized insurance companies and financial institutions

and asset backed capital commitment securities supported by high grade, short term commercial paper and a put

option from a monoline insurance company. These auction rate securities were rated AAA/Aaa or AA/Aa by

Standard & Poors and Moody’s rating services at the time of purchase and their ratings have not changed as of

December 31, 2007. With regards to the asset backed capital commitment securities, both rating agencies have

placed the issuers’ ratings under review for possible downgrade.

In addition to the above mentioned securities, we hold one commercial paper security issued by a structured

investment vehicle that was placed in receivership in September 2007 for which an insolvency event was declared

by the receiver in October 2007. The Issuer invests in residential and commercial mortgages and other structured

credits. Some of the assets consist of sub-prime mortgages. At December 31, 2007, the estimated fair value of this

security was $7.5 million based on prices provided from our internally generated pricing models and our evaluation

of the value of the underlying collateral and our position in the structured investment vehicle. During 2007 we had

realized other-than-temporary impairment losses of $2.5 million related to this commercial paper security. A

restructuring plan for this security is expected by mid 2008.

As issuers and counterparties to the Company’s investments announce financial results in the coming quarters,

it is possible that the Company may record additional losses and realize losses that are currently unrealized. The

Company will continue to monitor its investments for substantive changes in relevant market conditions,

51