Clearwire 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.respectively of total deferred financing costs were amortized using the effective interest method and included in

interest expense, net.

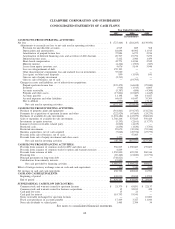

Interest Capitalization — The Company follows the provisions of SFAS No. 34, Capitalization of Interest

Cost (“SFAS No. 34”), with respect to its FCC licenses and the related construction of its network infrastructure

assets. Capitalization commences with pre-construction period administrative and technical activities, which

includes obtaining leases, zoning approvals and building permits, and ceases when the construction is substantially

complete and available for use (generally when a market is launched). Interest is capitalized on property, plant and

equipment, improvements under construction, and FCC spectrum licenses accounted for as intangible assets with

indefinite useful lives. Interest capitalization is based on rates applicable to borrowings outstanding during the

period and the weighted average balance of qualified assets under construction during the period. Capitalized

interest is reported as a cost of the network assets and amortized over the useful life of those assets.

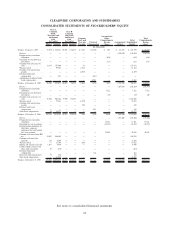

Comprehensive Loss — Comprehensive loss consists of two components, net loss and other comprehensive

income (loss). Other comprehensive income (loss) refers to revenue, expenses, gains and losses that under generally

accepted accounting principles are recorded as an element of stockholders’ equity but are excluded from net loss.

The Company’s other comprehensive income (loss) is comprised of foreign currency translation adjustments from

its subsidiaries not using the U.S. dollar as their functional currency and unrealized gains and losses on marketable

securities categorized as available-for-sale.

Income Taxes — The Company accounts for income taxes in accordance with the provisions of SFAS No. 109,

Accounting for Income Taxes, which requires that deferred income taxes be determined based on the estimated

future tax effects of differences between the financial statement and tax basis of assets and liabilities using the tax

rates expected to be in effect when the temporary differences reverse. Valuation allowances, if any, are recorded to

reduce deferred tax assets to the amount considered more likely than not to be realized. We also apply FASB

Interpretation Number 48 (“FIN 48”) which prescribes a recognition threshold that a tax position is required to meet

before being recognized in the financial statements.

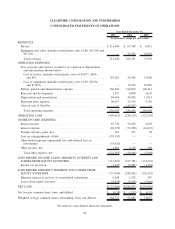

Revenue Recognition — The Company primarily earns service revenue by providing access to its high-speed

wireless network. Also included in service revenue are equipment rentals and optional services, including personal

and business email and static Internet Protocol. Service revenue from customers are billed in advance and

recognized ratably over the service period. Revenues associated with the shipment of customer premise equipment

(“CPE”) and other equipment to customers are recognized when title and risk of loss transferred to the customer.

Shipping and handling costs billed to customers are recorded to service revenue.

The Company recognizes revenues in accordance with SAB 104, Revenue Recognition, and Emerging Issues

Task Force (“EITF”) Issue No. 00-21, Accounting for Revenue Arrangements with Multiple Deliverables.

EITF Issue No. 00-21 addresses how to account for arrangements that may involve the delivery or performance

of multiple products, services and/or rights to use assets. Revenue arrangements with multiple deliverables are

required to be divided into separate units of accounting based on the deliverables relative fair value if the

deliverables in the arrangement meet certain criteria. Activation fees charged to the customer are deferred and

recognized as service revenues on a straight-line basis over the average expected life of the customer relationship of

3.5 years.

Revenue is deferred for any undelivered elements and revenue is recognized when the product is delivered or

over the period in which the service is performed. If the Company cannot objectively determine the fair value of any

undelivered element included in the bundled product and software maintenance arrangements, revenue is deferred

until all elements are delivered and services have been performed, or until fair value can objectively be determined

for any remaining undelivered elements.

Through August 2006, the Company earned equipment revenue primarily from sales of CPE and related

infrastructure, system services and software maintenance contracts by the Company’s formerly wholly-owned

subsidiary, NextNet (See Note 3, Significant Transactions). In arrangements that included multiple elements,

69

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)