Clearwire 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

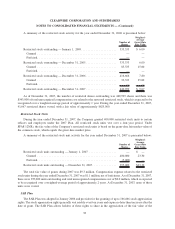

Company’s Class A common stock. Settlement of these rights will be in cash, but these rights may be replaced at the

Company’s discretion with an equivalent number of nonqualified options.

The Company accounts for the SAR Plan grants under SFAS No. 123(R) and records these grants as liability

awards, as settlement is anticipated to be in cash. The SARs are remeasured at fair value each reporting period until

the awards are settled in accordance with SFAS No. 123(R). The fair value is determined in the same manner as a

stock option granted under the Stock Option Plan using the same assumptions and option-pricing model to estimate

the fair value. Compensation expense for each period until settlement is based on the change (or a portion of the

change, depending on the percentage of the requisite service that has been rendered at the reporting date) in the fair

value for each reporting period. During the year ended December 31, 2007, no SARs were granted, 39,652 SARs

were forfeited and 600 were exercised. For the year ended December 31, 2006, 167,685 SARs were granted between

$15.00 and $18.00 and 21,131 were forfeited. The Company recorded $398,000 and $178,000, net of forfeitures, of

share-based compensation expense for SARs grants for the years ended December 31, 2007 and 2006, respectively.

As of October 1, 2007, all outstanding SARs were converted to non-qualified stock options under the 2007

Stock Option Plan. The SARs were converted to options at the fourth quarter remeasured fair value.

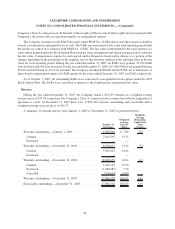

Warrants

During the year ended December 31, 2007, the Company issued 1,407,139 warrants at a weighted average

exercise price of $37.99 to purchase the Company’s Class A common stock in connection with the acquisition of

spectrum or assets. At December 31, 2007 there were 17,806,220 warrants outstanding and exercisable with a

weighted average exercise price of $16.57.

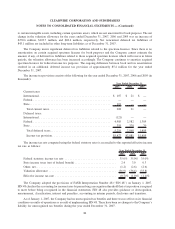

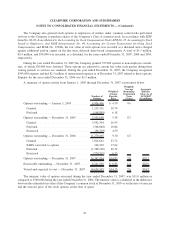

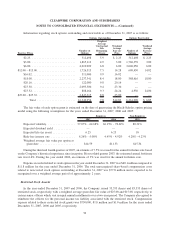

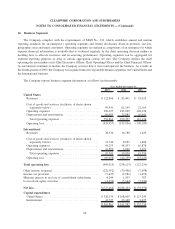

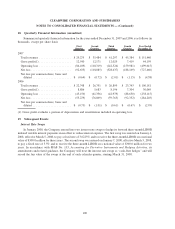

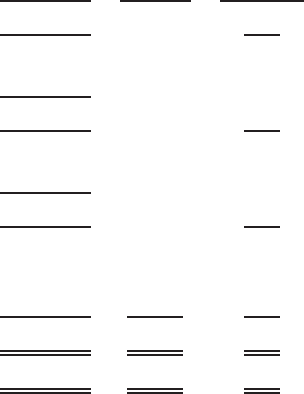

A summary of warrant activity from January 1, 2005 to December 31, 2007 is presented below:

Number of

Warrants

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

(Years)

Warrants outstanding — January 1, 2005 ................ 1,099,508 $ 7.80 8.9

Granted....................................... 7,811,105 13.74

Exercised ..................................... — —

Warrants outstanding — December 31, 2005 ............. 8,910,613 13.02 5.0

Granted....................................... 9,892,022 14.94

Exercised ..................................... — —

Warrants outstanding — December 31, 2006 ............. 18,802,635 14.02 4.2

Granted....................................... 1,407,139 37.99

Exercised ..................................... (1,882,887) 7.59

Cancelled ..................................... (520,667) 15.00

Warrants outstanding — December 31, 2007 ............. 17,806,220 $16.57 3.65

Exercisable outstanding — December 31, 2007 ........... 17,806,220 $16.57 3.65

94

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)