Clearwire 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

them to purchase shares of the Company’s Class A common stock. The terms of the Warrants are substantially

identical to the original warrants. In August 2007, the Company fully retired the Senior Secured Notes.

Terms of the Warrants — Holders of Warrants issued in connection with the Notes and Additional Notes may

exercise their Warrants at any time at an exercise price of $15.00. The Company granted the holders of the Warrants

registration rights covering the shares subject to issuance under the Warrants. The Warrants expire on August 5,

2010.

In connection with the registration rights agreement, the Company filed a resale registration statement, which

was effective on August 28, 2007, on Form S-1 registering the resale of shares of Class A common stock issuable

upon the exercise of the Warrants. The Company must maintain the registration statement in effect (subject to

certain suspension periods) for at least two years. If the Company fails to meet its obligations to maintain that

registration statement, the Company will be required to pay to each affected Warrant holder an amount in cash equal

to 2% of the purchase price of such holder’s Warrants. In the event that the Company fails to make such payments in

a timely manner, the payments will bear interest at a rate of 1% per month until paid in full. This registration rights

agreement also provides for incidental registration rights in connection with follow-on offerings, other than

issuances pursuant to a business combination transaction or employee benefit plan. The Company does not consider

payment of any such penalty to be probable as of December 31, 2007, and has therefore not recorded a liability for

this contingency.

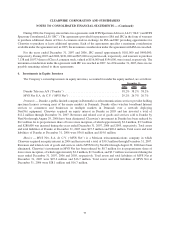

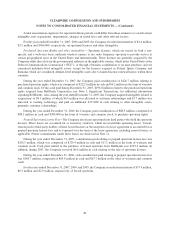

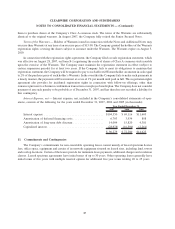

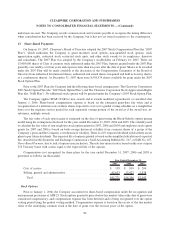

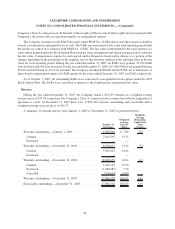

Interest Expense, net — Interest expense, net, included in the Company’s consolidated statements of oper-

ations, consists of the following for the years ended December 31, 2007, 2006 and 2005 (in thousands):

2007 2006 2005

Year Ended December 31,

Interest expense ..................................... $104,550 $ 69,116 $11,605

Amortization of deferred financing costs ................... 6,703 3,934 898

Amortization of long-term debt discount ................... 14,004 15,820 4,381

Capitalized interest ................................... (28,978) (16,590) (2,261)

$ 96,279 $ 72,280 $14,623

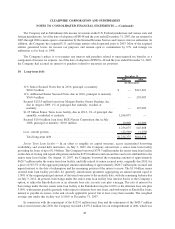

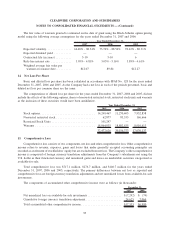

11. Commitments and Contingencies

The Company’s commitments for non-cancelable operating leases consist mainly of leased spectrum license

fees, office space, equipment and certain of its network equipment situated on leased sites, including land, towers

and rooftop locations. Certain of the leases provide for minimum lease payments, additional charges and escalation

clauses. Leased spectrum agreements have initial terms of up to 30 years. Other operating leases generally have

initial terms of five years with multiple renewal options for additional five-year terms totaling 20 to 25 years.

87

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)