Clearwire 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As the Company was considered a nonpublic entity at the date of adoption and used the minimum value

method for pro forma disclosures under SFAS No. 123, Accounting for Stock-Based Compensation

(“SFAS No. 123”), the Company is required to apply the prospective transition method and has estimated the

fair value of options granted on or after January 1, 2006 using the Black-Scholes option pricing model. The

Company has applied the provisions of SFAS No. 123(R) to employee stock options granted, modified, repur-

chased, cancelled or settled on or after January 1, 2006. The estimate of compensation expense requires complex

and subjective assumptions, including the Company’s stock price volatility, employee exercise patterns (expected

life of the options), future forfeitures, and related tax effects.

Prior to the adoption of SFAS No. 123(R), the Company accounted for share-based compensation expense in

accordance with Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees

(“APB No. 25”), and related Interpretations, as permitted by SFAS No. 123.

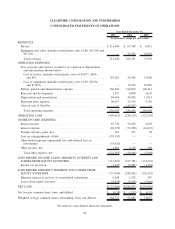

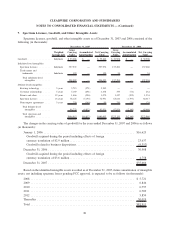

Total share-based compensation expense recorded during the year ended December 31, 2007 was $42.8 million

compared to $14.2 million during December 31, 2006. Of these amounts, $42.7 million and $12.5 million for the

years ended December 31, 2007 and 2006, respectively, related to option grants recorded under SFAS No. 123(R)

and $113,000 and $1.7 million under APB No. 25 for grants before January 1, 2006 for which the requisite service

was not fully satisfied as of January 1, 2006.

Operating Leases — The Company has operating leases for certain facilities, equipment and spectrum

licenses for use in its operations. Certain of the Company’s spectrum licenses are leased from third-party holders

of Educational Broadband Service (“EBS”) spectrum licenses granted by the Federal Communications Commis-

sion (“FCC”). EBS licenses authorize the provision of certain communications services on the EBS channels in

certain markets throughout the United States. The Company accounts for these spectrum leases as executory

contracts which are similar to operating leases. Leases that are pending FCC approval are not amortized until final

approval is received and are included in prepaid spectrum license fees in the accompanying consolidated balance

sheets. The Company accounts for its leases in accordance with SFAS No. 13, Accounting for Leases, and Financial

Accounting Standards Board (“FASB”) Technical Bulletin 85-3, Accounting for Operating Leases with Scheduled

Rent Increases (as amended). For leases containing scheduled rent escalation clauses the Company records

minimum rental payments on a straight-line basis over the terms of the leases, including the renewal periods as

appropriate. For leases containing tenant improvement allowances and rent incentives, the Company records

deferred rent, which is a liability, and that deferred rent is amortized over the term of the lease, including the renewal

periods as appropriate, as a reduction to rent expense.

Foreign Currency — The Company’s international subsidiaries generally use their local currency as their

functional currency. Assets and liabilities are translated at exchange rates in effect at the balance sheet date.

Resulting translation adjustments are recorded as a separate component of accumulated other comprehensive (loss)

income. Income and expense accounts are translated at the average monthly exchange rates. The effects of changes

in exchange rates between the designated functional currency and the currency in which a transaction is

denominated are recorded as foreign currency transaction gains (losses) and recorded in the consolidated statement

of operations.

Concentration of Risk — The Company believes that the geographic diversity of its customer base and retail

nature of its product minimizes the risk of incurring material losses due to concentrations of credit risk.

NextNet, the Company’s previously wholly-owned subsidiary, purchased by Motorola on August 29, 2006, is

currently the sole supplier of the base stations and CPE the Company uses to provide services to its customers. If

NextNet is unable to continue to develop or provide the equipment on a timely cost-effective basis, the Company

may not be able to adequately service existing customers or add new customers and offer competitive pricing.

71

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)