Cigna 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

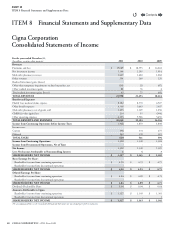

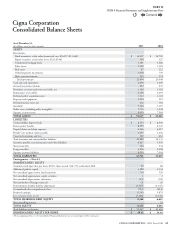

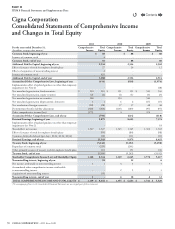

75CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

D. Cash and Cash Equivalents

Cash equivalents consist of short-term investments with maturities of

three months or less from the time of purchase that are classied as held

to maturity and carried at amortized cost. e Company reclassies

cash overdraft positions to accounts payable, accrued expenses and

other liabilities when the legal right of oset does not exist.

E. Premiums, Accounts

and Notes Receivable and Reinsurance

Recoverables

Premiums, accounts and notes receivable are reported net of an allowance

for doubtful accounts of $45million as of December31,2011 and

$49million as of December31,2010. Reinsurance recoverables are

estimates of amounts that the Company will receive from reinsurers

and are recorded net of an allowance for unrecoverable reinsurance

of $5million as of December31,2011 and $10million as of

December31,2010. e Company estimates these allowances for

doubtful accounts for premiums, accounts and notes receivable, as

well as for reinsurance recoverables, using management’s best estimate

of collectibility, taking into consideration the aging of these amounts,

historical collection patterns and other economic factors.

F. Deferred Policy Acquisition Costs

Acquisition costs include sales compensation, commissions, direct

response marketing, telemarketing, premium taxes and other costs that

the Company incurs in connection with new and renewal business.

Depending on the product line they relate to, the Company records

acquisition costs in dierent ways. Acquisition costs for:

•

Universal life products are deferred and amortized in proportion to

the present value of total estimated gross prots over the expected

lives of the contracts.

•

Supplemental health, life and accidentinsurance (primarilyindividual

internationalproducts) and group healthand accidentinsurance

products are deferred and amortized, generally in proportion to the

ratio of periodic revenue to the estimated total revenues over the

contract periods.

•Other products are expensed as incurred.

For universal life and other individual products, management estimates

the present value of future revenues less expected payments. For group

health and accident insurance products, management estimates the

sum of unearned premiums and anticipated net investment income

less future expected claims and related costs. If management’s estimates

of these sums are less than the deferred costs, the Company reduces

deferred policy acquisition costs and records an expense. e Company

recorded amortization for policy acquisition costs of $334million

in 2011, $312million in 2010 and $299million in 2009 in other

operating expenses. ere are no deferred policy acquisition costs

attributable to the sold individual life insurance and annuity and

retirement businesses or the run-o reinsurance and settlement annuity

operations. e accounting for acquisition costs will change in 2012.

See Recent Accounting Pronouncements for additional information.

G. Property and Equipment

Property and equipment is carried at cost less accumulated depreciation.

When applicable, cost includes interest, real estate taxes and other costs

incurred during construction. Also included in this category is internal-use

software that is acquired, developed or modied solely to meet the Company’s

internal needs, with no plan to market externally. Costs directly related to

acquiring, developing or modifying internal-use software are capitalized.

e Company calculates depreciation and amortization principally using

the straight-line method generally based on the estimated useful life

of each asset as follows: buildings and improvements, 10 to 40years;

purchased software, one to ve years; internally developed software,

three to seven years; and furniture and equipment (including computer

equipment), three to 10years. Improvements to leased facilities are

depreciated over the remaining lease term or the estimated life of the

improvement. e Company considers events and circumstances that

would indicate the carrying value of property, equipment or capitalized

software might not be recoverable. If the Company determines the

carrying value of a long-lived asset is not recoverable, an impairment

charge is recorded. See Note8 for additional information.

H. Goodwill

Goodwill represents the excess of the cost of businesses acquired over

the fair value of their net assets. Goodwill primarily relates to the Health

Care segment ($2.9billion) and, to a lesser extent, the International

segment ($290million). e Company evaluates goodwill for impairment

at least annually during the third quarter at the reporting unit level,

based on discounted cash ow analyses and writes it down through

results of operations if impaired. Consistent with prior years, the

Company’s evaluations of goodwill associated with the Health Care and

International segments used the best information available at the time,

including reasonable assumptions and projections consistent with those

used in its annual planning process. e discounted cash ow analyses

used a range of discount rates that correspond with the Company’s,

or, in the case of International, the reporting unit’s weighted average

cost of capital, consistent with that used for investment decisions

considering the specic and detailed operating plans and strategies

within the segment or reporting unit. e resulting discounted cash

ow analysis indicated an estimated fair value for the Health Care

segmentand International’s reporting unit exceeding their carrying

values, including goodwill and other intangibles. Finally, the Company

determined that no events or circumstances occurred subsequent to the

annual evaluation of goodwill that would more likely than not reduce

the fair value of the Health Care segment or International’s reporting

unit below their carrying values. See Note8 for additional information.

I. Other Assets, including Other Intangibles

Other assets consist of various insurance-related assets and the gain position of

certain derivatives, primarily GMIB assets. e Company’s other intangible

assets include purchased customer and producer relationships, provider

networks, and trademarks. e Company amortizes other intangibles

on an accelerated or straight-line basis over periods from 1 to 30years.

Management revises amortization periods if it believes there has been a

change in the length of time that an intangible asset will continue to have

value. Costs incurred to renew or extend the terms of these intangible assets

are generally expensed as incurred. See Note8 for additional information.

Contents

Q