Cigna 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

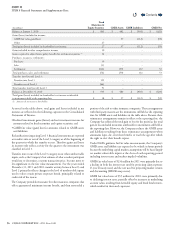

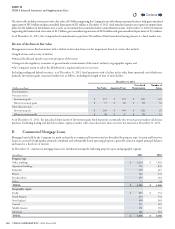

At December31,2011, scheduled commercial mortgage loan maturities

were as follows (inmillions): $529 in 2012, $525 in 2013, $329 in

2014, $372 in 2015 and $1,546 thereafter. Actual maturities could dier

from contractual maturities for several reasons: borrowers may have the

right to prepay obligations, with or without prepayment penalties; the

maturity date may be extended; and loans may be renanced.

As of December31,2011, the Company had commitments to extend

credit under commercial mortgage loan agreements of $162million

that were diversied by property type and geographic region.

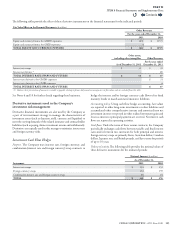

Credit quality

e Company applies a consistent and disciplined approach to evaluating

and monitoring credit risk, beginning with the initial underwriting of a

mortgage loan and continuing throughout the investment holding period.

Mortgage origination professionals employ an internal rating system

developed from the Company’s experience in real estate investing and

mortgage lending. A quality rating, designed to evaluate the relative risk

of the transaction, is assigned at each loan’s origination and is updated

each year as part of the annual portfolio loan review. e Company

monitors credit quality on an ongoing basis, classifying each loan as

a loan in good standing, potential problem loan or problem loan.

Quality ratings are based on internal evaluations of each loan’s specic

characteristics considering a number of key inputs, including real

estate market-related factors such as rental rates and vacancies, and

property-specic inputs such as growth rate assumptions and lease

rollover statistics. However, the two most signicant contributors to

the credit quality rating are the debt service coverage and loan-to-value

ratios. e debt service coverage ratio measures the amount of property

cash ow available to meet annual interest and principal payments on

debt. A debt service coverage ratio below 1.0 indicates that there is not

enough cash ow to cover the loan payments. e loan-to-value ratio,

commonly expressed as a percentage, compares the amount of the loan

to the fair value of the underlying property collateralizing the loan.

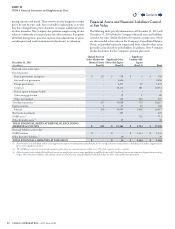

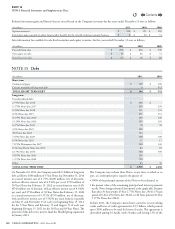

e following tables summarize the credit risk prole of the Company’s

commercial mortgage loan portfolio using carrying values classied

based on loan-to-value and debt service coverage ratios, as of

December31,2011 and 2010:

Loan-to-Value Ratios

(In millions)

December31,2011

Debt Service Coverage Ratio

Total1.30x or Greater 1.20x to 1.29x 1.10x to 1.19x 1.00x to 1.09x Less than 1.00x

Below 50% $ 225 $ 55 $ 3 $ 50 $ 9 $ 342

50% to 59% 444 47 26 - 53 570

60% to 69% 646 140 42 - 77 905

70% to 79% 117 132 120 159 33 561

80% to 89% 99 81 79 72 71 402

90% to 99% 36 35 30 58 116 275

100% or above - 10 50 51 135 246

TOTAL $ 1,567 $ 500 $ 350 $ 390 $ 494 $ 3,301

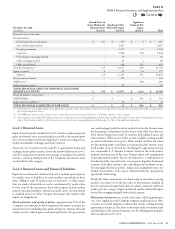

Loan-to-Value Ratios

(In millions)

December31,2010

Debt Service Coverage Ratio

Total1.30x or Greater 1.20x to 1.29x 1.10x to 1.19x 1.00x to 1.09x Less than 1.00x

Below 50% $ 324 $ - $ - $ - $ 29 $ 353

50% to 59% 409 54 56 - - 519

60% to 69% 533 73 5 28 25 664

70% to 79% 138 79 57 55 11 340

80% to 89% 267 186 165 151 69 838

90% to 99% 15 54 181 185 135 570

100% or above - - 47 43 112 202

TOTAL $ 1,686 $ 446 $ 511 $ 462 $ 381 $ 3,486

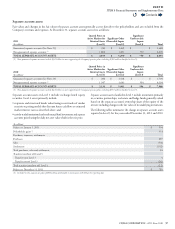

e Company’s annual in-depth review of its commercial mortgage

loan investments is the primary mechanism for identifying emerging

risks in the portfolio. e most recent review was completed by the

Company’s investment professionals in the second quarter of 2011

and included an analysis of each underlying property’s most recent

annual nancial statements, rent rolls, operating plans, budgets,

a physical inspection of the property and other pertinent factors.

Based on historical results, current leases, lease expirations and rental

conditions in each market, the Company estimates the current year

and future stabilized property income and fair value, and categorizes

the investments as loans in good standing, potential problem loans or

problem loans. Based on property valuations and cash ows estimated

as part of this review, and considering updates for loans where material

changes were subsequently identied, the portfolio’s average loan-to-

value ratio improved to 70% at December31,2011, decreasing from

74% as of December31,2010. e portfolio’s average debt service

coverage ratio was estimated to be 1.40 at December31,2011, a slight

increase from 1.38 at December31,2010.

Quality ratings are adjusted between annual reviews if new property

information is received or events such as delinquency or a borrower

request for restructure cause management to believe that the Company’s

estimate of nancial performance, fair value or the risk prole of the

underlying property has been impacted.

Contents

Q