Cigna 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

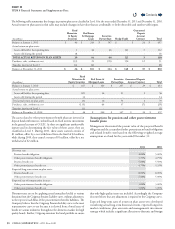

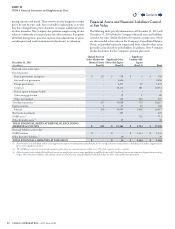

NOTE 9 Pension and Other Postretirement Benefit Plans

A. Pension and Other Postretirement Benefit

Plans

e Company and certain of its subsidiaries provide pension, health

care and life insurance dened benets to eligible retired employees,

spouses and other eligible dependents through various domestic and

foreign plans. e eect of its foreign pension and other postretirement

benet plans is immaterial to the Company’s results of operations,

liquidity and nancial position. Eective July1,2009, the Company

froze its primary domestic dened benet pension plans. A curtailment

of benets occurred as a result of this action since it eliminated the

accrual of benets for the future service of active employees enrolled in

these domestic pension plans. Accordingly, the Company recognized a

pre-tax curtailment gain of $46million ($30million after-tax) in 2009.

e Company measures the assets and liabilities of its domestic pension

and other postretirement benet plans as of December31. e following

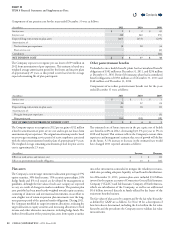

table summarizes the projected benet obligations and assets related

to the Company’s domestic and international pension and other

postretirement benet plans as of, and for the year ended, December31:

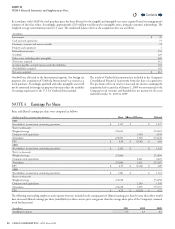

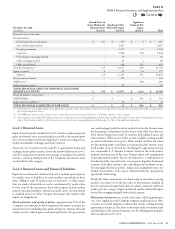

(In millions)

Pension Benets Other Postretirement Benets

2011 2010 2011 2010

Change in benet obligation

Benet obligation, January1 $ 4,691 $ 4,363 $ 444 $ 419

Service cost 2 2 2 1

Interest cost 228 240 20 22

Loss from past experience 453 379 16 36

Benets paid from plan assets (273) (258) (2) (2)

Benets paid - other (34) (35) (28) (32)

Benet obligation, December31 5,067 4,691 452 444

Change in plan assets

Fair value of plan assets, January1 3,163 2,850 23 24

Actual return on plan assets 156 357 1 1

Benets paid (273) (258) (2) (2)

Contributions 252 214 - -

Fair value of plan assets, December31 3,298 3,163 22 23

Funded Status $ (1,769) $ (1,528) $ (430) $ (421)

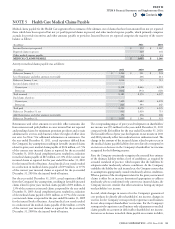

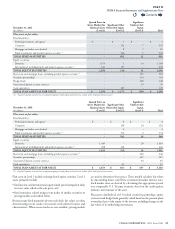

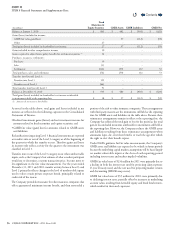

e postretirement benets liability adjustment included in accumulated other comprehensive loss consisted of the following as of December31:

(In millions)

Pension Benets Other Postretirement Benets

2011 2010 2011 2010

Unrecognized net gain (loss) $ (2,331) $ (1,805) $ (30) $ (14)

Unrecognized prior service cost (5) (5) 35 51

POSTRETIREMENT BENEFITS LIABILITY ADJUSTMENT $ 2,336 $ 1,810 $ 5 $ 37

During 2011, the Company’s postretirement benets liability adjustment increased by $558million pre-tax ($360million after-tax) resulting in

a decrease to shareholders’ equity. e increase in the liability was primarily due to a decrease in the discount rate and actual investment returns

signicantly less than expected in 2011.

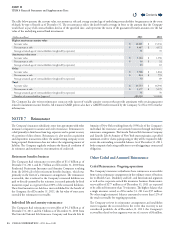

Pension benefits

e Company’s pension plans were underfunded by $1.8billion in

2011 and $1.5billion in 2010 and had related accumulated benet

obligations of $5.1billion as of December31,2011 and $4.7billion

as of December31,2010.

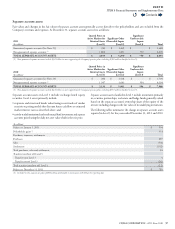

e Company funds its qualied pension plans at least at the minimum

amount required by the Employee Retirement Income Security Act of

1974 and the Pension Protection Act of 2006. For 2012, the Company

expects to make minimum required and voluntary contributions totaling

approximately $250million. Future years’ contributions will ultimately

be based on a wide range of factors including but not limited to asset

returns, discount rates, and funding targets.

Contents

Q