Cigna 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

e commercial mortgage portfolio contains approximately 165 loans,

including four impaired loans, totaling $195million, that are classied

as problem loans, resulting in an aggregate default rate of 5.9%. All

of the remaining loans continue to perform under their contractual

terms. e Company has $529million of loans maturing in the next

twelve months. Given the quality and diversity of the underlying real

estate, positive debt service coverage and signicant borrower cash

investment averaging nearly 30%, the Company remains condent

that the vast majority of borrowers will continue to perform as expected

under the contract terms.

Other Long-Term Investments

e Company’s other long-term investments include $963million in

security partnership and real estate funds as well as direct investments

in real estate joint ventures. e funds typically invest in mezzanine

debt or equity of privately held companies (securities partnerships)

and equity real estate. Given its subordinate position in the capital

structure of these underlying entities, the Company assumes a higher

level of risk for higher expected returns. To mitigate risk, investments

are diversied across approximately 70 separate partnerships, and

approximately 45 general partners who manage one or more of these

partnerships. Also, the funds’ underlying investments are diversied

by industry sector or property type, and geographic region. No single

partnership investment exceeds 8% of the Company’s securities and

real estate partnership portfolio.

Although the total fair values of investments exceeded their carrying

values as of December31,2011, the fair value of the Company’s

ownership interest in certain funds that are carried at cost was less

than carrying value by $44million. Fund investment values continued

to improve, but remained at depressed levels reecting the impact of

declines in value experienced predominantly during 2008 and 2009

due to economic weakness and disruption in the capital markets,

particularly in the commercial real estate market. e Company expects

to recover its carrying value over the average remaining life of these

investments of approximately 6years. Given the current economic

environment, future impairments are possible; however, management

does not expect those losses to have a material eect on the Company’s

results of operations, nancial condition or liquidity.

Problem and Potential Problem Investments

“Problem” bonds and commercial mortgage loans are either delinquent

by 60days or more or have been restructured as to terms, which could

include concessions by the Company for modication of interest rate,

principal payment or maturity date. “Potential problem” bonds and

commercial mortgage loans are considered current (no payment more

than 59days past due), but management believes they have certain

characteristics that increase the likelihood that they may become

problems. e characteristics management considers include, but are

not limited to, the following:

•request from the borrower for restructuring;

•

principal or interest payments past due by more than 30 but fewer

than 60days;

•downgrade in credit rating;

•collateral losses on asset-backed securities; and

•

for commercial mortgages, deterioration of debt service coverage

below 1.0 or value declines resulting in estimated loan-to-value ratios

increasing to 100% or more.

e Company recognizes interest income on problem bonds and

commercial mortgage loans only when payment is actually received

because of the risk prole of the underlying investment. e amount

that would have been reected in net income if interest on non-accrual

investments had been recognized in accordance with the original terms

was not signicant for 2011 or 2010.

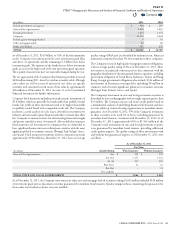

e following table shows problem and potential problem investments

at amortized cost, net of valuation reserves and write-downs:

(In millions)

December31,2011 December31,2010

Gross Reserve Net Gross Reserve Net

Problem bonds $ 40 $ (13) $ 27 $ 86 $ (39) $ 47

Problem commercial mortgage loans(1) 224 (19) 205 90 (4) 86

Foreclosed real estate 34 - 34 59 - 59

TOTAL PROBLEM INVESTMENTS $ 298 $ 32 $ 266 $ 235 $ 43 $ 192

Potential problem bonds $ 36 $ (10) $ 26 $ 40 $ (10) $ 30

Potential problem commercial mortgage loans 141 - 141 305 (8) 297

TOTAL POTENTIAL PROBLEM

INVESTMENTS $ 177 $ 10 $ 167 $ 345 $ 18 $ 327

(1) At December31,2011, includes a $10million restructured loan classified in Other long-term investments that was previously reported in commercial mortgage loans.

Net problem investments represent 1.3% of total investments excluding

policy loans at December31,2011. Net problem investments increased

by $74million during 2011 due primarily to deterioration of commercial

mortgage loans previously considered in good standing or reclassied

from potential problem loans, partially oset by the partial sale of a

foreclosed real estate property.

Net potential problem investments represent .8% of total investments

excluding policy loans at December31,2011. Net potential problem

investments decreased by $160million during 2011, reecting results

from the annual in-depth commercial mortgage loan portfolio review

and loan modication, payo, and renancing activity.

During the second quarter 2011, the Company restructured a $65million

potential problem mortgage loan into two loans, including a $55million

loan at current market terms and a $10million loan at a below market

interest rate. is restructure resulted in a $65million reduction to

potential problem mortgage loans and a $10million increase to problem

mortgage loans. See Note11 to the Consolidated Financial Statements

for further information.

Contents

Q