Cigna 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

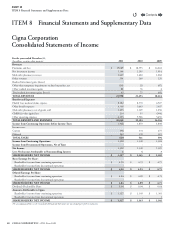

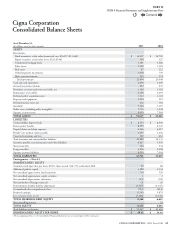

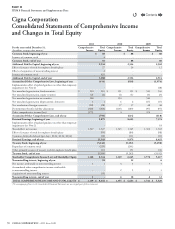

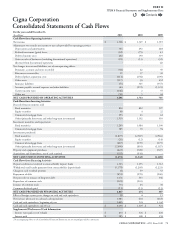

78 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

Premiums and fees received for the Company’s Medicare Advantage

Plans and Medicare PartD products from customers and the Centers

for Medicare and Medicaid Services (CMS) are recognized as revenue

ratably over the contract period. CMS provides risk adjusted premium

payments for the Medicare Advantage Plans and Medicare PartD

products, based on the demographics and health severity of enrollees.

e Company recognizes periodic changes to risk adjusted premiums

as revenue when the amounts are determinable and collection is

reasonably assured. Additionally, Medicare PartD includes payments

from CMS for risk sharing adjustments. e risk sharing adjustments,

that are estimated quarterly based on claim experience, compare actual

incurred drug benet costs to estimated costs submitted in original

contracts and may result in more or less revenue from CMS. Final

revenue adjustments are determined through an annual settlement

with CMS that occurs after the contract year.

Revenue for investment-related products is recognized as follows:

•

Net investment income on assets supporting investment-related

products is recognized as earned.

•

Contract fees, which are based upon related administrative expenses,

are recognized in premiums and fees as they are earned ratably over

the contract period.

Benets and expenses for investment-related products consist primarily of

income credited to policyholders in accordance with contract provisions.

Revenue for universal life products is recognized as follows:

•Net investment income on assets supporting universal life products

is recognized as earned.

•

Fees for mortality and surrender charges are recognized as assessed,

which is as earned.

•Administration fees are recognized as services are provided.

Benets and expenses for universal life products consist of benet claims

in excess of policyholder account balances. Expenses are recognized

when claims are submitted, and income is credited to policyholders

in accordance with contract provisions.

Contract fees and expenses for administrative services only programs

and pharmacy programs and services are recognized as services are

provided. Mail order pharmacy revenues and cost of goods sold are

recognized as each prescription is shipped.

S. Stock Compensation

e Company records compensation expense for stock awards and

options over their vesting periods primarily based on the estimated fair

value at the grant date. Compensation expense is recorded for stock

options over their vesting period based on fair value at the grant date

which is calculated using an option-pricing model. Compensation

expense is recorded for restricted stock grants and units over their

vesting periods based on fair value, which is equal to the market price

of the Company’s common stock on the date of grant. Compensation

expense for strategic performance shares is recorded over the performance

period. For strategic performance shares with payment dependent on

market condition, fair value is determined at the grant date using a

Monte Carlo simulation model and not subsequently adjusted regardless

of the nal outcome. For strategic performance shares with payment

dependent on performance conditions, expense is initially accrued based

on the most likely outcome, but evaluated for adjustment each period

for updates in the expected outcome. At the end of the performance

period, expense is adjusted to the actual outcome (number of shares

awarded times the share price at the grant date).

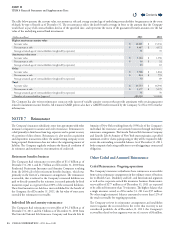

T. Participating Business

e Company’s participating life insurance policies entitle policyholders

to earn dividends that represent a portion of the earnings of the

Company’s life insurance subsidiaries. Participating insurance accounted

for approximately 1% of the Company’s total life insurance in force at

the end of 2011,2010 and 2009.

U. Income Taxes

e Company and its domestic subsidiaries le a consolidated

UnitedStates federal income tax return. e Company’s foreign

subsidiaries le tax returns in accordance with foreign law. U.S. taxation

of these foreign subsidiaries may dier in timing and amount from

taxation under foreign laws. Reportable amounts, including credits

for foreign tax paid by these subsidiaries, are reected in the U.S. tax

return of the aliates’ domestic parent.

e Company recognizes deferred income taxes when the nancial

statement and tax-based carrying values of assets and liabilities are

dierent and recognizes deferred income tax liabilities on the unremitted

earnings of foreign subsidiaries that are not permanently invested

overseas. For subsidiaries whose earnings are considered permanently

invested overseas, income taxes are accrued at the local foreign tax rate.

e Company establishes valuation allowances against deferred tax

assets if it is more likely than not that the deferred tax asset will not be

realized. e need for a valuation allowance is determined based on the

evaluation of various factors, including expectations of future earnings

and management’s judgment. Note19 contains detailed information

about the Company’s income taxes.

e Company recognizes interim period income taxes by estimating

an annual eective tax rate and applying it to year-to-date results. e

estimated annual eective tax rate is periodically updated throughout

the year based on actual results to date and an updated projection of

full year income. Although the eective tax rate approach is generally

used for interim periods, taxes on signicant, unusual and infrequent

items are recognized at the statutory tax rate entirely in the period the

amounts are realized.

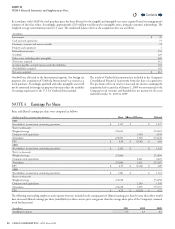

V. Earnings Per Share

e Company computes basic earnings per share using the weighted-

average number of unrestricted common and deferred shares outstanding.

Diluted earnings per share also includes the dilutive eect of outstanding

employee stock options and unvested restricted stock granted after

2009 using the treasury stock method and the eect of strategic

performance shares.

Contents

Q