Cigna 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

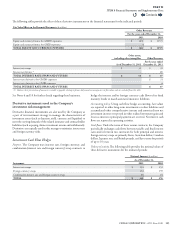

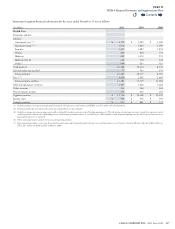

2009

(In millions)

Pre-Tax

Tax (Expense)

Benet After-Tax

Net unrealized appreciation, securities:

Net unrealized appreciation on securities arising during the year $ 843 $ (292) $ 551

Reclassication adjustment for (gains) included in net income (14) 3 (11)

Net unrealized appreciation, securities $ 829 $ (289) $ 540

Net unrealized depreciation, derivatives $ (30) $ 13 $ (17)

Net translation of foreign currencies $ 76 $ (28) $ 48

Postretirement benets liability adjustment:

Reclassication adjustment for amortization of net losses from past experience and prior service costs $ 7 $ (3) $ 4

Curtailment gain (46) 16 (30)

Reclassication adjustment included in shareholders’ net income (39) 13 (26)

Net change arising from assumption and plan changes and experience (107) 36 (71)

Net postretirement benets liability adjustment $ (146) $ 49 $ (97)

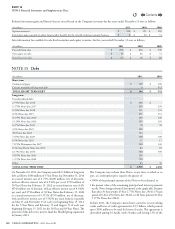

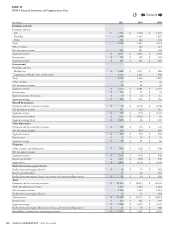

NOTE 18 Shareholders’ Equity and Dividend Restrictions

State insurance departments and foreign jurisdictions that regulate

certain of the Company’s subsidiaries prescribe accounting practices

(which dier in some respects from GAAP) to determine statutory

net income and surplus. e Company’s life insurance and HMO

company subsidiaries are regulated by such statutory requirements. e

statutory net income for the years ended, and statutory surplus as of,

December31 of the Company’s life insurance and HMO subsidiaries

were as follows:

(In millions)

2011 2010 2009

Net income $ 953 $ 1,697 $ 1,088

Surplus $ 5,286 $ 5,107 $ 4,728

As of December31,2011, statutory surplus for each of the Company’s

life insurance and HMO subsidiaries is sucient to meet the minimum

required by regulators. As of December31,2011, the Company’s life

insurance and HMO subsidiaries had investments on deposit with state

departments of insurance with statutory carrying values of $306million.

e Company’s life insurance and HMO subsidiaries are also subject

to regulatory restrictions that limit the amount of annual dividends or

other distributions (such as loans or cash advances) insurance companies

may extend to the parent company without prior approval of regulatory

authorities. e maximum dividend distribution that the Company’s

life insurance and HMO subsidiaries may make during 2012 without

prior approval is approximately $0.9billion. Restricted net assets of the

Company as of December31,2011, were approximately $7.2billion.

One of the Company’s life insurance subsidiaries is permitted to loan

up to $600million to the parent company without prior approval.

NOTE 19 Income Taxes

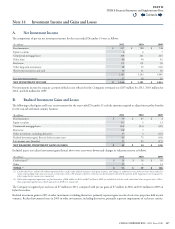

A. Income Tax Expense

e components of income taxes for the years ended December31 were as follows:

(In millions)

2011 2010 2009

Current taxes

U.S. income $ 320 $ 267 $ 211

Foreign income 58 45 48

State income 20 19 16

398 331 275

Deferred taxes (benets)

U.S. income 198 182 279

Foreign income 43 15 39

State income 1 (7) 1

242 190 319

TOTAL INCOME TAXES $ 640 $ 521 $ 594

Contents

Q