Cigna 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

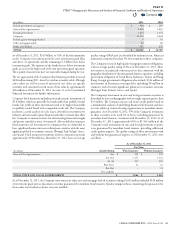

Commercial mortgage loans are considered impaired when it is probable

that the Company will not collect all amounts due according to the terms

of the original loan agreement. In the above table, problem and potential

problem commercial mortgage loans totaling $195million (net of valuation

reserves) at December31,2011, are considered impaired. During 2011,

the Company recorded a $16million pre-tax ($11million after-tax)

increase to valuation reserves on impaired commercial mortgage loans.

See Note11 to the Consolidated Financial Statements of this Form10-K

for additional information regarding impaired commercial mortgage loans.

Included in after-tax realized investment results were changes in valuation

reserves and asset write-downs related to commercial mortgage loans

and investments in real estate entities as well as other-than-temporary

impairments on xed maturity and equity securities as follows:

(In millions)

2011 2010

Credit-related(1) $ 18 $ 24

Other 16 1

TOTAL2 $ 34 $ 25

(1) Credit-related losses include other-than-temporary declines in fair value of fixed maturities and equity securities, and changes in valuation reserves and asset write-downs related to

commercial mortgage loans and investments in real estate entities. The amount related to credit losses on fixed maturities for which a portion of the impairment was recognized in

other comprehensive income was immaterial.

(2) Other-than-temporary impairments on fixed maturities of $17million in 2011 are included in both the credit related and other categories above. Other-than-temporary impairments

on fixed maturities in 2010 were immaterial.

Investment Outlook

e nancial markets continue to be impacted by economic uncertainty

in the UnitedStates and Europe, however, asset values increased during

2011, reecting a decrease in market yields. Future realized and unrealized

investment results will be impacted largely by market conditions that

exist when a transaction occurs or at the reporting date. ese future

conditions are not reasonably predictable. Management believes that

the vast majority of the Company’s xed maturity investments will

continue to perform under their contractual terms, and that declines

in their fair values below carrying value are temporary. Based on the

strategy to match the duration of invested assets to the duration of

insurance and contractholder liabilities, the Company expects to hold

a signicant portion of these assets for the long term. Future credit-

related losses are not expected to have a material adverse eect on the

Company’s nancial condition or liquidity.

While management believes the commercial mortgage loan portfolio is

positioned to perform well due to its solid aggregate loan-to-value ratio,

strong debt service coverage and minimal underwater positions, broad

commercial real estate market fundamentals continue to be under stress

reecting a slow economic recovery. Should these conditions remain

for an extended period or worsen substantially, it could result in an

increase in problem and potential problem loans. Given the current

economic environment, future impairments are possible; however,

management does not expect those losses to have a material adverse

eect on the Company’s nancial condition or liquidity.

Market Risk

Financial Instruments

e Company’s assets and liabilities include nancial instruments

subject to the risk of potential losses from adverse changes in market

rates and prices. e Company’s primary market risk exposures are:

•

Interest-rate risk on xed-rate, medium-term instruments. Changes

in market interest rates aect the value of instruments that promise a

xed return and impact the value of liabilities for reinsured GMDB

and GMIB contracts.

•

Foreign currency exchange rate risk of the U.S. dollar primarily to

the South Korean won, Euro, Taiwan dollar, and British pound. An

unfavorable change in exchange rates reduces the carrying value of

net assets denominated in foreign currencies.

•

Equity price risk for domestic equity securities and for the value of

reinsured GMDB and GMIB contracts resulting from unfavorable

changes in variable annuity account values based on underlying

mutual fund investments.

For further discussion of reinsured contracts, see Note6 for GMDB

contracts and Note10 for GMIB contracts in the Consolidated

Financial Statements.

e Company’s Management of Market Risks

e Company predominantly relies on three techniques to manage its

exposure to market risk:

•

Investment/liability matching. e Company generally selects

investment assets with characteristics (such as duration, yield, currency

and liquidity) that correspond to the underlying characteristics of its

related insurance and contractholder liabilities so that the Company

can match the investments to its obligations. Shorter-term investments

support generally shorter-term life and health liabilities. Medium-term,

xed-rate investments support interest-sensitive and health liabilities.

Longer-term investments generally support products with longer

pay out periods such as annuities and long-term disability liabilities.

•

Use of local currencies for foreign operations. e Company

generally conducts its international business through foreign operating

entities that maintain assets and liabilities in local currencies. While

this technique does not reduce the Company’s foreign currency

exposure of its net assets, it substantially limits exchange rate risk

to those net assets.

Contents

Q