Cigna 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Benefits and Expenses

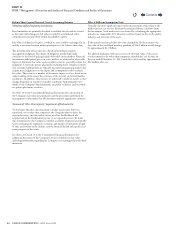

Health Care segment benets and expenses consist of the following:

(In millions)

2011 2010 2009

Medical claims expense - excluding Medicare IPFFS $ 8,201 $ 7,798 $ 6,927

Medical claims expense - Medicare IPFFS (19) 772 -

Medical claims expense 8,182 8,570 6,927

Other benet expenses 83 100 169

Mail order pharmacy cost of goods sold 1,203 1,169 1,036

Other operating expenses:

Medical operating expenses 2,757 2,739 2,723

Operating expenses (excluding Medicare IPFFS) 1,364 1,251 1,124

Other operating expenses (excluding Medicare IPFFS) 4,121 3,990 3,847

Operating expenses - Medicare IPFFS - 82 -

Total other operating expenses 4,121 4,072 3,847

TOTAL BENEFITS AND EXPENSES $ 13,589 $ 13,911 $ 11,979

Medical claims expense decreased 5% in 2011 compared with 2010.

Excluding the impact of exiting the Medicare IPFFS business, medical

claims expense increased 5% in 2011 compared with 2010, largely due

to medical cost ination, tempered by low medical services utilization

trend in commercial risk businesses.

Medical claims expense increased 24% in 2010 compared with 2009.

Excluding the impact of Medicare IPFFS business, medical claims

expenses increased 13% in 2010 compared with 2009 largely due

to higher medical membership, particularly in the commercial risk

business. e increase also reects medical cost ination.

Other operating expenses. One measure of the segment’s overall operating

eciency is the operating expense ratio calculated as total operating

expenses divided by segment revenues. is measure can be signicantly

inuenced by the mix of business between fully-insured and fee-based

business, since the expense ratio on fee-based business, which comprises

most of the segment’s business is higher than the corresponding ratio

for fully-insured business. e ratio is also inuenced by the level of

xed versus variable expenses. e segment’s variable expenses include

premium taxes and commissions, while the xed component consists

primarily of infrastructure costs and certain strategic investments.

e variable component uctuates due to changes in revenue, mix of

business, and other items.

Excluding the impact of the Medicare IPFFS business, the operating

expense ratio improved from 27.7% in 2010 to 27.2% in 2011,

driven largely by continued focus on expense management. On a

reported basis, the operating expense ratio increased from 26.7%

in 2010 to 27.2% in 2011 primarily driven by a change in business

mix resulting from the Company’s decision to exit the non-strategic

Medicare IPFFS business, that was a fully-insured business. Because

fully-insured businesses collect premium revenue (compared with a

relatively lower administrative fee for ASO business), they typically

have a lower expense ratio than the Company’s current business mix

that is more heavily weighted toward fee-based products.

Excluding the impact of the Medicare IPFFS business, the operating

expense ratio improved from 29.3% in 2009 to 27.7% in 2010, driven

largely by continued focus on cost reduction initiatives including

stang, real estate and pension changes, as well as strong revenue

growth in the commercial risk businesses. ese favorable eects were

partially oset by investment in segment expansion, compliance and

higher management incentive compensation. On a reported basis, the

operating expense ratio decreased from 29.3% in 2009 to 26.7% in

2010 primarily due to the signicant revenue growth in the Medicare

IPFFS business in 2010. Since Medicare IPFFS was a fully-insured

business, it had a lower expense ratio than the business mix in 2009

that was more heavily weighted toward fee-based products.

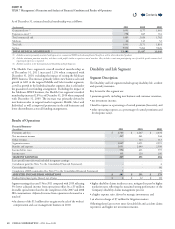

Other Items Affecting Health Care Results

Health Care Medical Claims Payable

Medical claims payable decreased by 12% in 2011, primarily reecting

the run-out of the Medicare IPFFS business that the Company exited

in 2011. Medical claims payable increased 35% for the year ended

December31,2010 largely driven by medical membership growth,

particularly in the Medicare IPFFS and commercial risk businesses.

See Note5 to the Consolidated Financial Statements for additional

information regarding the Health Care Medical Claims Payable.

Medical Membership

A medical member reported within the Health Care segment (excluding

members in the International and Disability and Life segments) is

dened as a person who falls within one of the following categories:

•is covered under an insurance policy or service agreement issued by

the Company;

•

has access to the Company’s provider network for covered services

under their medical plan;

•has medical claims that are administered by the Company; or

•

is covered under an insurance policy that is (i) marketed by the

Company and (ii) for which the Company assumes reinsurance of

at least 50%.

Contents

Q