Cigna 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

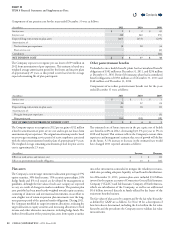

equity securities as well as real estate, securities partnerships and hedge

funds. Expected long-term market conditions take into consideration

certain key macroeconomic trends including expected domestic and

foreign GDP growth, employment levels and ination. Based on the

Company’s current outlook, the expected return assumption is considered

reasonable. e actual investment allocation at December31,2011

is more heavily weighted towards equity securities than targeted. e

Company expects the allocation of equity securities to move closer

to target during 2012 as additional attractive alternative investments

(securities partnerships and hedge funds) can be identied.

To measure pension costs, the Company uses a market-related asset

valuation for domestic pension plan assets invested in non-xed income

investments. e market-related value of these pension assets recognizes

the dierence between actual and expected long-term returns in the

portfolio over 5 years, a method that reduces the short-term impact

of market uctuations on pension cost. At December31,2011, the

market-related asset value was approximately $3.4billion compared

with a market value of approximately $3.3billion.

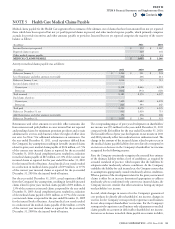

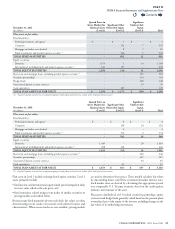

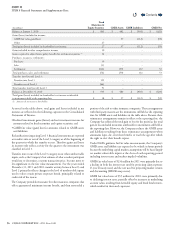

Benefit payments

e following benet payments, including expected future services, are expected to be paid in:

(In millions)

Pension Benets

Other Postretirement Benets

Gross

Net of Medicare

PartD Subsidy

2012 $ 516 $ 43 $ 39

2013 $ 338 $ 41 $ 39

2014 $ 340 $ 40 $ 38

2015 $ 327 $ 39 $ 38

2016 $ 323 $ 38 $ 37

2017-2021 $ 1,577 $ 169 $ 162

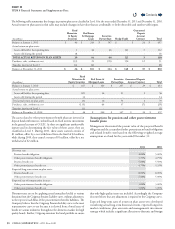

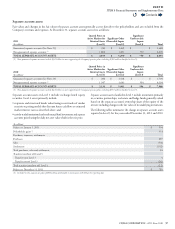

B. 401(k) Plans

e Company sponsors a 401(k) plan in which the Company matches

a portion of employees’ pre-tax contributions. Another 401(k) plan

with an employer match was frozen in 1999. Participants in the active

plan may invest in various funds that invest in the Company’s common

stock, several diversied stock funds, a bond fund or a xed-income

fund. In conjunction with the action to freeze the domestic dened

benet pension plans, eective January1,2010, the Company increased

its matching contributions to 401(k) plan participants.

e Company may elect to increase its matching contributions if the

Company’s annual performance meets certain targets. A substantial

amount of the Company’s matching contributions are invested in the

Company’s common stock. e Company’s expense for these plans was

$72million for 2011, $69million for 2010 and $36million for 2009.

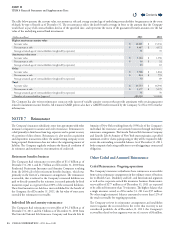

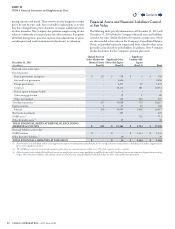

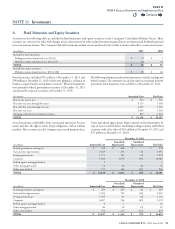

NOTE 10 Fair Value Measurements

e Company carries certain nancial instruments at fair value in

the nancial statements including xed maturities, equity securities,

short-term investments and derivatives. Other nancial instruments are

measured at fair value under certain conditions, such as when impaired.

Fair value is dened as the price at which an asset could be exchanged

in an orderly transaction between market participants at the balance

sheet date. A liability’s fair value is dened as the amount that would

be paid to transfer the liability to a market participant, not the amount

that would be paid to settle the liability with the creditor.

Fair values are based on quoted market prices when available. When

market prices are not available, fair value is generally estimated using

discounted cash ow analyses, incorporating current market inputs

for similar nancial instruments with comparable terms and credit

quality. In instances where there is little or no market activity for

the same or similar instruments, the Company estimates fair value

using methods, models and assumptions that the Company believes

a hypothetical market participant would use to determine a current

transaction price. ese valuation techniques involve some level of

estimation and judgment by the Company which becomes signicant

with increasingly complex instruments or pricing models.

e Company’s nancial assets and liabilities carried at fair value have

been classied based upon a hierarchy dened by GAAP. e hierarchy

gives the highest ranking to fair values determined using unadjusted

quoted prices in active markets for identical assets and liabilities (Level1)

and the lowest ranking to fair values determined using methodologies

and models with unobservable inputs (Level3). An asset’s or a liability’s

classication is based on the lowest level of input that is signicant to

its measurement. For example, a nancial asset or liability carried at

fair value would be classied in Level3 if unobservable inputs were

signicant to the instrument’s fair value, even though the measurement

may be derived using inputs that are both observable (Levels 1 and 2)

and unobservable (Level3).

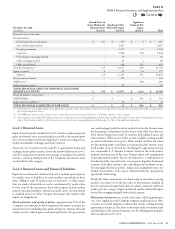

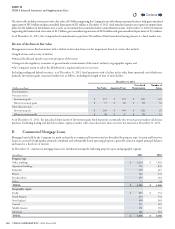

e prices the Company uses to value its investment assets are

representative of prices that would be received to sell the assets at the

measurement date (exit prices) and are classied appropriately in the

fair value hierarchy. e Company performs ongoing analyses of prices

used to value invested assets to determine that they represent appropriate

estimates of fair value. is process involves quantitative and qualitative

analysis that is overseen by the Company’s investment professionals,

including reviews of pricing methodologies, judgments of valuation

inputs, and assessments of the signicance of any unobservable inputs,

Contents

Q