Cigna 2011 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FS-7CIGNA CORPORATION2011 Form10K

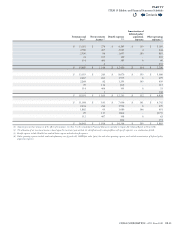

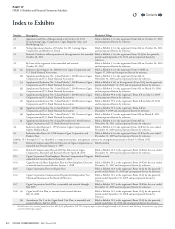

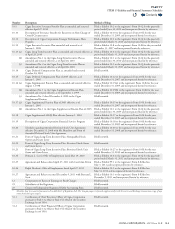

ITEM 15 Exhibits and Financial Statement Schedules

PART IV

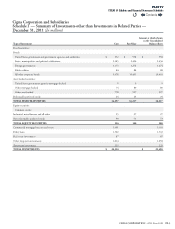

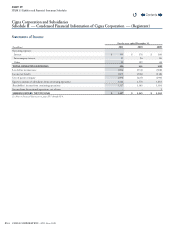

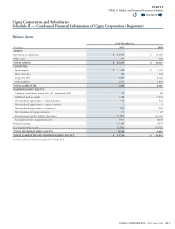

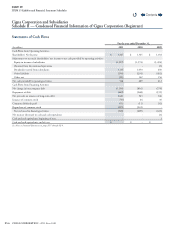

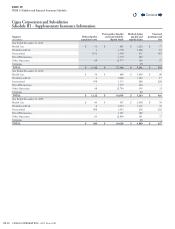

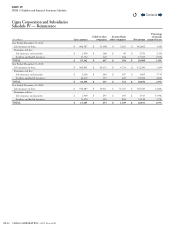

Cigna Corporation and Subsidiaries

Schedule II — Condensed Financial Information of Cigna Corporation (Registrant)

Notes to Condensed Financial Statements

e accompanying condensed nancial statements should be read

in conjunction with the Consolidated Financial Statements and the

accompanying notes thereto in the Annual Report on Form10-K.

Note1—For purposes of these condensed nancial statements, Cigna

Corporation’s (the Company) wholly owned and majority owned

subsidiaries are recorded using the equity basis of accounting. Certain

reclassications have been made to prior years’ amounts to conform

to the 2011 presentation.

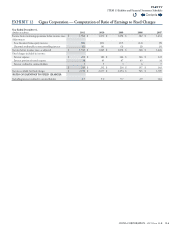

Note2—Short-term and long-term debt consisted of the following

at December31:

(In millions)

December31,2011 December31,2010

Short-term:

Commercial Paper $ 100 $ 100

Current maturities of long-term debt - 448

TOTAL SHORTTERM DEBT $ 100 $ 548

Long-term:

Uncollateralized debt:

2.75% Notesdue 2016 $ 600 $ -

5.375% Notesdue 2017 250 250

6.35% Notesdue 2018 131 131

8.5% Notesdue 2019 251 251

4.375% Notesdue 2020 249 249

5.125% Notesdue 2020 299 299

4.5% Notesdue 2021 298 -

4% Notesdue 2022 743 -

7.65% Notesdue 2023 100 100

8.3% Notesdue 2023 17 17

7.875% Debentures due 2027 300 300

8.3% Step Down Notesdue 2033 83 83

6.15% Notesdue 2036 500 500

5.875% Notesdue 2041 298 -

5.375% Notesdue 2042 750 -

TOTAL LONGTERM DEBT $ 4,869 $ 2,180

On November10,2011, the Company issued $2.1billion of long-term

debt as follows: $600million of 5-Year Notesdue November15,2016

at a stated interest rate of 2.75% ($600million, net of discount,

with an eective interest rate of 2.936% per year), $750million of

10-Year Notesdue February15,2022 at a stated interest rate of 4%

($743million, net of discount, with an eective interest rate of 4.346%

per year) and $750million of 30-Year Notesdue February15,2042 at

a stated interest rate of 5.375% ($750million, net of discount, with

an eective interest rate of 5.542% per year). Interest is payable on

May15 and November15 of each year beginning May15,2012 for the

5-Year Notesand February15 and August15 of each year beginning

February15,2012 for the 10-Year and 30-Year Notes. e proceeds

of this debt were used to reduce the intercompany payable balance

with Cigna Holdings and ultimately used to fund the HealthSpring

acquisition in 2012.

Contents

Q