Cigna 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Balance Sheet Caption/Nature of Critical Accounting Estimate Eect if Dierent Assumptions Used

Accounts payable, accrued expenses and other liabilities – pension

liabilities

ese liabilities are estimates of the present value of the qualied and

nonqualied pension benets to be paid (attributed to employee service to

date) net of the fair value of plan assets. e accrued pension benet liability

as of December31 was as follows (inmillions):

•2011 – $1,769

•2010 – $1,528

See Note9 to the Consolidated Financial Statements for assumptions and

methods used to estimate pension liabilities.

Using past experience, the Company expects that it is reasonably possible

that a favorable or unfavorable change in assumptions for the discount

rate or expected return on plan assets of 50basis points could occur. An

unfavorable change is a decrease in these key assumptions with resulting

impacts as discussed below.

If discount rates for the qualied and nonqualied pension plans decreased

by 50basis points:

•annual pension costs for 2012 would decrease by approximately

$4million, after-tax; and

•the accrued pension benet liability would increase by approximately

$256million as of December31,2011 resulting in an after-tax

decrease to shareholders’ equity of approximately $166million as of

December31,2011.

If the expected long-term return on domestic qualied pension plan assets

decreased by 50basis points, annual pension costs for 2012 would increase

by approximately $11million after-tax.

If the Company used the market value of assets to measure pension costs as

opposed to the market-related value, annual pension cost for 2012 would

increase by approximately $11million after-tax.

If the December31,2011 fair values of domestic qualied plan assets

decreased by 10%, the accrued pension benet liability would increase by

approximately $328million as of December31,2011 resulting in an after-

tax decrease to shareholders’ equity of approximately $213million.

An increase in these key assumptions would result in impacts to annual

pension costs, the accrued pension liability and shareholders’ equity in an

opposite direction, but similar amounts.

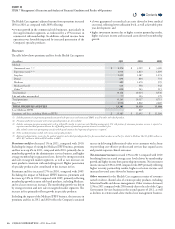

Health Care medical claims payable

Medical claims payable for the Health Care segment include both reported

claims and estimates for losses incurred but not yet reported.

Liabilities for medical claims payable as of December31 were as follows

(inmillions):

•2011 – gross $1,095; net $901

•2010 – gross $1,246; net $1,010

ese liabilities are presented above both gross and net of reinsurance and

other recoverables and generally exclude amounts for administrative services

only business.

See Notes2 and 5 to the Consolidated Financial Statements for additional

information regarding assumptions and methods used to estimate this

liability.

In 2011, actual experience diered from the Company’s key assumptions

as of December31,2010, resulting in $126million of favorable incurred

claims related to prior years’ medical claims payable or 1.5% of the current

year incurred claims as reported in 2010. In 2010, actual experience diered

from the Company’s key assumptions as of December31,2009, resulting

in $93million of favorable incurred claims related to prior years’ medical

claims, or 1.3% of the current year incurred claims reported in 2009.

Specically, the favorable impact is due to faster than expected completion

factors and lower than expected medical cost trends, both of which included

an assumption for moderately adverse experience.

e impact of this favorable prior year development was an increase to

shareholders’ net income of $53million after-tax ($82million pre-tax) in

2011. e change in the amount of the incurred claims related to prior years

in the medical claims payable liability does not directly correspond to an

increase or decrease in shareholders’ net income as explained in Note5 to

the Consolidated Financial Statements.

Contents

Q