Cigna 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

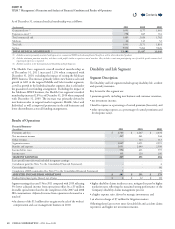

Balance Sheet Caption/Nature of Critical Accounting Estimate Eect if Dierent Assumptions Used

Accounts payable, accrued expenses and other liabilities, and Other

assets, including other intangibles - Guaranteed minimum income

benets

ese net liabilities are calculated with an internal model using many

scenarios to determine the fair value of amounts estimated to be paid, less

the fair value of net future premiums estimated to be received, adjusted for

risk and prot charges that the Company anticipates a hypothetical market

participant would require to assume this business. e amounts estimated

to be paid represent the excess of the anticipated value of the income benet

over the value of the annuitants’ accounts at the time of annuitization.

e assets associated with these contracts represent receivables in connection

with reinsurance that the Company has purchased from two external

reinsurers, which covers 55% of the exposures on these contracts.

Liabilities related to these contracts as of December31, were as follows

(inmillions):

•2011 – $1,333

•2010 – $ 903

As of December31, estimated amounts receivable related to these contracts

from two external reinsurers, were as follows (inmillions):

•2011 – $712

•2010 – $480

Current assumptions and methods used to estimate these liabilities are

detailed in Note10 to the Consolidated Financial Statements.

e Company’s results of operations are expected to be volatile in future

periods because most capital market assumptions will be based largely on

market-observable inputs at the close of each period including interest rates

and market-implied volatilities.

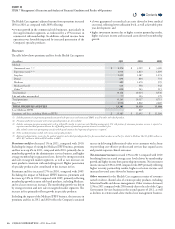

Based on current and historical market, industry and Company-specic

experience and management’s judgment, the Company believes that it is

reasonably likely that the unfavorable changes in the key assumptions and/

or conditions described below could occur. If these unfavorable assumption

changes were to occur, the approximate after-tax decrease in shareholders’

net income, net of estimated amounts receivable from reinsurers, would be

as follows:

•50basis point decrease in interest rates (rates aligned with LIBOR) used

for projecting market returns and discounting, net of the impact of

hedging programs – $20million

•50basis point decrease in interest rates used for projecting claim exposure

(7-year Treasury rates) – $20million

•20% increase in volatility – $5million

•5% decrease in mortality – $1million

•10% increase in annuity election rates – $2million

•10% decrease in lapse rates – $5million

•10% increase to the risk and prot charges – $5million

Market declines expose the Company to a larger net liability. Decreases

in annuitants’ account values resulting from a 10% equity market decline

could decrease shareholders’ net income by approximately $15million, net

of the impact of hedging programs. Decreases in annuitants’ account values

resulting from a 3% decline due to bond/money market performance could

decrease shareholders’ net income by approximately $2million.

If credit default swap spreads used to evaluate the nonperformance risk

of the Company were to narrow or the credit rating of its principal life

insurance subsidiary were to improve, it would cause a decrease in the

discount rate of the GMIB liability, resulting in an unfavorable impact to

earnings. If the discount rate decreased by 25basis points due to this, the

decrease in shareholders’ net income would be approximately $15million.

If credit default swap spreads used to evaluate the nonperformance

risk of the Company’s GMIB retrocessionaires were to widen or the

retrocessionaires’ credit ratings were to weaken, it would cause an increase

in the discount rate of the GMIB asset, resulting in an unfavorable impact

to earnings. If the discount rate increased by 25basis points due to this, the

decrease in shareholders’ net income would be approximately $5million.

All of these estimated impacts due to unfavorable changes in assumptions

and/or conditions could vary from quarter to quarter depending on actual

reserve levels, the actual market conditions or changes in the anticipated

view of a hypothetical market participant as of any future valuation date.

e amounts would be reected in the Run-o Reinsurance segment.

Contents

Q