Cigna 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

e Health Care segment’s adjustedincome from operations increased

18% in 2010, as compared with 2009 reecting:

•

revenue growth in the commercial risk businesses, particularly in

the targeted market segments, as evidenced by a 15% increase in

commercial risk membership. In addition, adjusted income from

operations was favorably impacted by increased penetration of the

Company’s specialty products;

•

a lower guaranteed cost medical care ratio driven by lower medical

cost trend, reecting lower utilization levels, as well as favorable prior

year development; and

•

higher investment income due to higher security partnership results,

higher real estate income and increased assets driven by membership

growth.

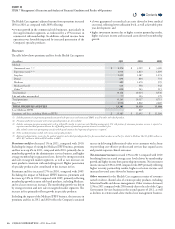

Revenues

e table below shows premiums and fees for the Health Care segment:

(In millions)

2011 2010 2009

Medical:

Guaranteed cost (1)(2) $ 4,176 $ 3,929 $ 3,380

Experience-rated(2)(3) 1,934 1,823 1,699

Stop loss 1,451 1,287 1,274

Dental 894 804 731

Medicare 489 1,470 595

Medicare PartD 624 558 342

Other(4) 600 543 515

Total medical 10,168 10,414 8,536

Life and other non-medical 77 103 179

Total premiums 10,245 10,517 8,715

Fees(2)(5) 2,936 2,802 2,669

TOTAL PREMIUMS AND FEES 13,181 13,319 11,384

Less: Medicare IPFFS - 827 -

Premiums and fees, excluding Medicare IPFFS $ 13,181 $ 12,492 $ 11,384

(1) Includes guaranteed cost premiums primarily associated with open access and commercial HMO, as well as other risk-related products.

(2) Premiums and/or fees associated with certain specialty products are also included.

(3) Includes minimum premium arrangements with a risk profile similar to experience-rated funding arrangements. The risk portion of minimum premium revenue is reported in

experience-rated medical premium whereas the self funding portion of minimum premium revenue is recorded in fees.

Also, includes certain non-participating cases for which special customer level reporting of experience is required.

(4) Other medical premiums include risk revenue and specialty products.

(5) Represents administrative service fees for medical members and related specialty product fees for non-medical members as well as fees related to Medicare PartD of $61million in

2011, $57million in 2010 and $41million in 2009.

Premiums and fees decreased 1% in 2011, compared with 2010.

Excluding the impact of exiting the Medicare IPFFS business, premiums

and fees were up 6% in 2011, compared with 2010, primarily due to

membership growth in the administrative services business, and higher

average membership in guaranteed cost, driven by strong retention

and sales in targeted market segments, as well as rate increases on

most products consistent with underlying trend. Higher penetration

of specialty products also contributed to the increase in fees.

Premiums and fees increased 17% in 2010, compared with 2009.

Excluding the impact of Medicare IPFFS business, premiums and

fees were up 10% in 2010 compared with 2009, primarily reecting

membership growth in most risk-based products, including Medicare,

and to a lesser extent rate increases. e membership growth was driven

by strong retention and new sales in targeted market segments. e

increase in fees primarily reects growth in specialty products.

Excluding the impact of the Medicare IPFFS business, the increases in

premiums and fees in 2011 and 2010 reect the Company’s sustained

success in delivering dierentiated value to its customers with a focus

on providing cost-eective products and services that expand access

and provide superior clinical outcomes.

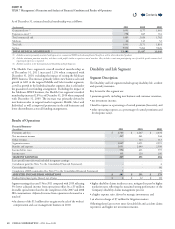

Net investment incomeincreased 13% in 2011 compared with 2010

beneting from increased average asset levels driven by membership

growth and higher income from partnership investments. Net investment

income increased 34% in 2010 compared with 2009 primarily reecting

higher security partnership results, higher real estate income and

increased invested assets driven by business growth.

Other revenues for the Health Care segment consist of revenues

earned on direct channel sales of certain specialty products, including

behavioral health and disease management. Other revenues decreased

12% in 2011 compared with 2010 mostly due to the sale of the Cigna

Government Services business in the second quarter of 2011, as well

as declines in certain stand-alone medical cost management business.

Contents

Q