Cigna 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 CIGNA CORPORATION2011 Form10K

PART II

ITEM 8 Financial Statements and Supplementary Data

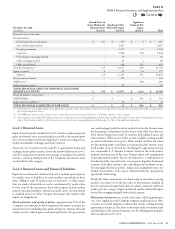

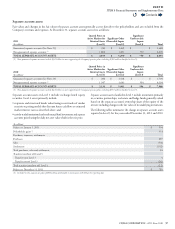

e above table includes investments with a fair value of $3billion supporting the Company’s run-o settlement annuity business, with gross unrealized

appreciation of $851million and gross unrealized depreciation of $25million at December31,2011. Such unrealized amounts are required to support future

policy benet liabilities of this business and, as such, are not included in accumulated other comprehensive income. At December31,2010, investments

supporting this business had a fair value of $2.5billion, gross unrealized appreciation of $476million and gross unrealized depreciation of $33million.

As of December31,2011, the Company had commitments to purchase $16million of xed maturities bearing interest at a xed market rate.

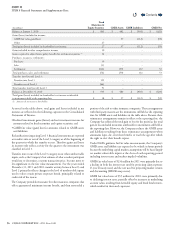

Review of declines in fair value

Management reviews xed maturities with a decline in fair value from cost for impairment based on criteria that include:

•length of time and severity of decline;

•nancial health and specic near term prospects of the issuer;

•changes in the regulatory, economic or general market environment of the issuer’s industry or geographic region; and

•the Company’s intent to sell or the likelihood of a required sale prior to recovery.

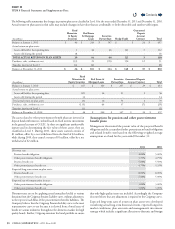

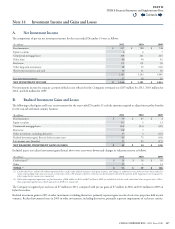

Excluding trading and hybrid securities, as of December31,2011, xed maturities with a decline in fair value from amortized cost (which were

primarily investment grade corporate bonds) were as follows, including the length of time of such decline:

(Dollars in millions)

December31,2011

Fair Value Amortized Cost

Unrealized

Depreciation

Number of

Issues

Fixed maturities:

One year or less:

Investment grade $ 572 $ 591 $ (19) 167

Below investment grade $ 75 $ 80 $ (5) 52

More than one year:

Investment grade $ 268 $ 300 $ (32) 62

Below investment grade $ 28 $ 37 $ (9) 13

As of December31,2011, the unrealized depreciation of investment grade xed maturities is primarily due to increases in market yields since

purchase. Excluding trading and hybrid securities, equity securities with a fair value lower than cost were not material at December31,2011.

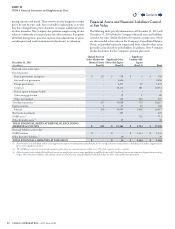

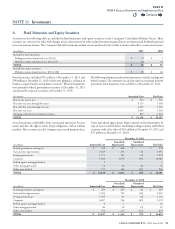

B. Commercial Mortgage Loans

Mortgage loans held by the Company are made exclusively to commercial borrowers and are diversied by property type, location and borrower.

Loans are secured by high quality, primarily completed and substantially leased operating properties, generally carried at unpaid principal balances

and issued at a xed rate of interest.

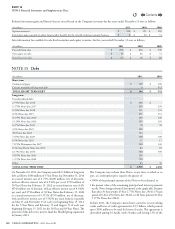

At December31, commercial mortgage loans were distributed among the following property types and geographic regions:

(In millions)

2011 2010

Property type

Oce buildings $ 1,014 $ 1,043

Apartment buildings 705 835

Industrial 670 619

Hotels 542 533

Retail facilities 297 418

Other 73 38

TOTAL $ 3,301 $ 3,486

Geographic region

Pacic $ 893 $ 931

South Atlantic 870 752

New England 450 585

Central 511 519

Middle Atlantic 391 385

Mountain 186 314

TOTAL $ 3,301 $ 3,486

Contents

Q