Cigna 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 CIGNA CORPORATION2011 Form10K

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

ultimate payment obligations and corresponding ultimate collection

from retrocessionaires may not be known with certainty for some time.

e Company’s reserves for underlying reinsurance exposures assumed by

the Company, as well as for amounts recoverable from retrocessionaires,

are considered appropriate as of December31,2011, based on current

information. However, it is possible that future developments, which

could include but are not limited to worse than expected claim experience

and higher than expected volatility, could have a material adverse eect

on the Company’s consolidated results of operations and nancial

condition. e Company bears the risk of loss if its payment obligations

to cedents increase or if its retrocessionaires are unable to meet, or

successfully challenge, their reinsurance obligations to the Company.

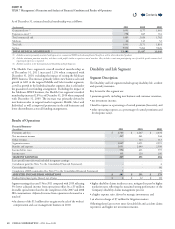

Other Operations Segment

Segment Description

Cigna’s Other Operations segment includes the results of the following

businesses:

•corporate-owned life insurance (“COLI”);

•

deferred gains recognized from the 1998 sale of the individual life

insurance and annuity business and the 2004 sale of the retirement

benets business; and

•run-o settlement annuity business.

COLI has contributed the majority of earnings in Other Operations

for the periods presented. e COLI regulatory environment continues

to evolve, with various federal budget related proposals recommending

changes in policyholder tax treatment. Although regulatory and

legislative activity could adversely impact our business and policyholders,

management does not expect the impact to materially aect the

Company’s results of operations, nancial condition or liquidity.

Results of Operations

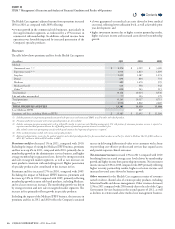

Financial Summary

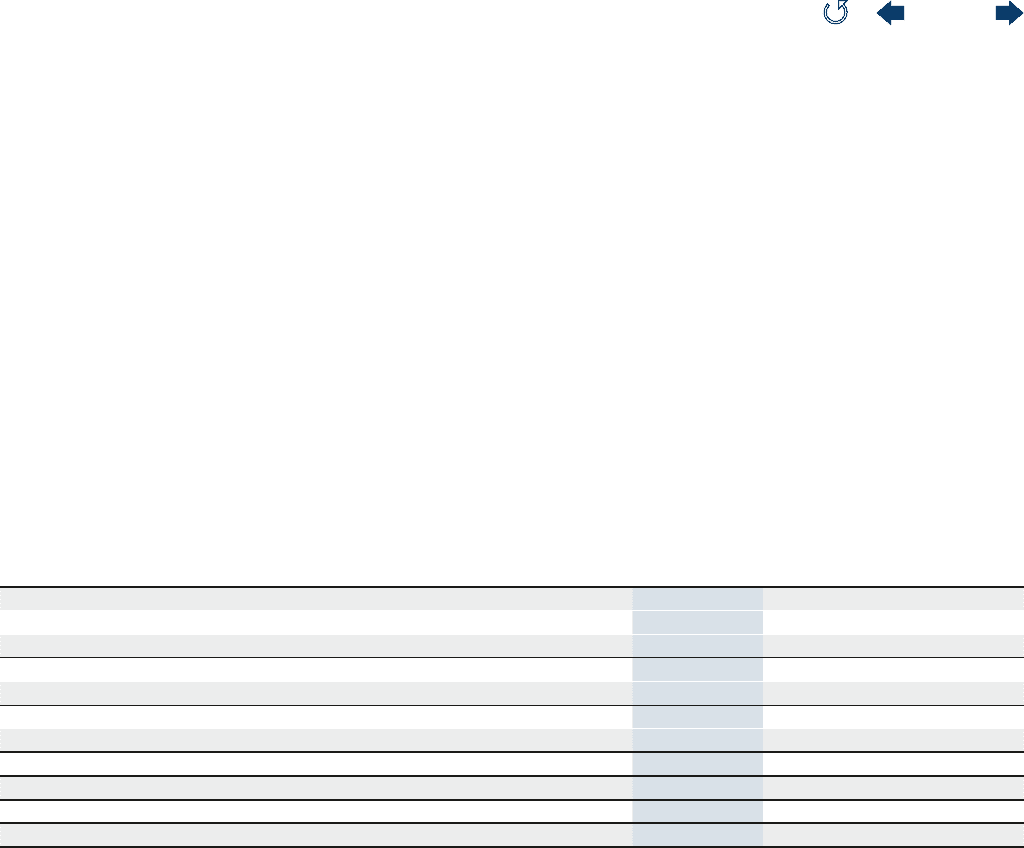

(In millions)

2011 2010 2009

Premiums and fees $ 114 $ 114 $ 112

Net investment income 400 404 407

Other revenues 55 60 64

Segment revenues 569 578 583

Benets and expenses 451 454 466

Income before taxes 118 124 117

Income taxes 29 39 31

SEGMENT EARNINGS 89 85 86

Completion of IRS examination (See Note19 to the Consolidated Financial Statements) 4 - 1

ADJUSTED INCOME FROM OPERATIONS $ 85 $ 85 $ 85

Realized investment gains (losses), net of taxes $ 6 $ 5 $ (6)

Segment earnings increased in 2011 compared with 2010, reecting a

$4million increase to earnings due to the completion of the Company’s

2007 and 2008 IRS examination during the rst quarter of 2011.

Adjusted income from operations were at in 2011 compared with

2010, reecting higher COLI earnings due to higher interest margins,

oset by lower earnings associated with the sold businesses due to the

continued decline in deferred gain amortization.

Segment earnings and adjusted income from operations were at in

2010 compared with 2009, reecting an increase in COLI earnings

driven by higher investment income and favorable mortality, primarily

oset by the continued decline in deferred gain amortization associated

with the sold businesses.

Revenues

Premiums and fees reect fees charged primarily on universal life

insurance policies in the COLI business. Such amounts were relatively

at reecting a stable block of business.

Net investment income decreased 1% in 2011 compared with 2010,

and decreased 1% in 2010 compared with 2009 due to lower portfolio

yields partially oset by higher average invested assets.

Other revenues decreased 8% in 2011 compared with 2010 and

decreased 6% in 2010 compared with 2009 primarily due to lower

deferred gain amortization related to the sold retirement benets and

individual life insurance and annuity businesses.

For more information regarding the sale of these businesses see Note7

of the Consolidated Financial Statements beginning on page84 of

this Form10-K.

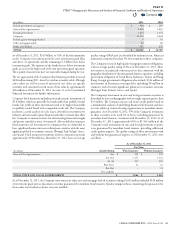

Corporate

Description

Corporate reects amounts not allocated to other segments, such as net

interest expense (dened as interest on corporate debt less net investment

income on investments not supporting segment operations), interest

on uncertain tax positions, certain litigation matters, intersegment

eliminations, compensation cost for stock options and certain corporate

overhead expenses such as directors’ expenses and, beginning in 2010,

pension expense related to the Company’s frozen pension plans.

Contents

Q