Cigna 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67CIGNA CORPORATION2011 Form10K

PART II

ITEM 7A Quantitative and Qualitative Disclosures About Market Risk

18. signicant deterioration in economic conditions and signicant

market volatility, that could have an adverse eect on the businesses

of our customers (including the amount and type of health care

services provided to their workforce, loss in workforce and our

customers’ ability to pay their obligations) and our vendors

(including their ability to provide services);

19. adverse changes in state, federal and international laws and

regulations, including health care reform legislation and regulation

that could, among other items, aect the way the Company does

business, increase costs, limit the ability to eectively estimate,

price for and manage medical costs, and aect the Company’s

products, services, market segments, technology and processes;

20. amendments to income tax laws, that could aect the taxation

of employer-provided benets, the taxation of certain insurance

products such as corporate-owned life insurance, or the nancial

decisions of individuals whose variable annuities are covered under

reinsurance contracts issued by the Company;

21. potential public health epidemics, pandemics, natural disasters

and bio-terrorist activity, that could, among other things, cause

the Company’s covered medical and disability expenses, pharmacy

costs and mortality experience to rise signicantly, and cause

operational disruption, depending on the severity of the event

and number of individuals aected;

22. risks associated with security or interruption of information systems,

that could, among other things, cause operational disruption;

23. challenges and risks associated with the successful management

of the Company’s outsourcing projects or key vendors; and

24. the unique political, legal, operational, regulatory and other

challenges associated with expanding our business globally.

is list of important factors is not intended to be exhaustive. Other

sections of the Form10-K, including the “Risk Factors” section, and

other documents led with the Securities and Exchange Commission

include both expanded discussion of these factors and additional risk

factors and uncertainties that could preclude the Company from

realizing the forward-looking statements. e Company does not

assume any obligation to update any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

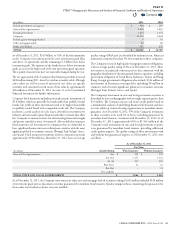

Management’s Annual Report on Internal

Control over Financial Reporting

Management of Cigna Corporation is responsible for establishing

and maintaining adequate internal controls over nancial reporting.

e Company’s internal controls were designed to provide reasonable

assurance to the Company’s management and Board of Directors

that the Company’s consolidated published nancial statements for

external purposes were prepared in accordance with generally accepted

accounting principles. e Company’s internal control over nancial

reporting include those policies and procedures that:

(i) pertain to the maintenance of records that, in reasonable detail,

accurately and fairly reect the transactions and dispositions of

the assets and liabilities of the Company;

(ii) provide reasonable assurance that transactions are recorded

as necessary to permit preparation of nancial statements in

accordance with generally accepted accounting principles, and that

receipts and expenditures of the Company are being made only

in accordance with authorization of management and directors

of the Company; and

(iii) provide reasonable assurance regarding prevention or timely

detection of unauthorized acquisitions, use or disposition of the

Company’s assets that could have a material eect on the nancial

statements.

Because of its inherent limitations, internal control over nancial

reporting may not prevent or detect misstatements.

Management assessed the eectiveness of the Company’s internal controls

over nancial reporting as of December31,2011. In making this

assessment, Management used the criteria set forth by the Committee

of Sponsoring Organizations of the Treadway Commission (“COSO”)

in Internal Control-Integrated Framework. Based on management’s

assessment and the criteria set forth by COSO, it was determined that

the Company’s internal controls over nancial reporting are eective

as of December31,2011.

e Company’s independent registered public accounting rm,

PricewaterhouseCoopers, has audited the eectiveness of the Company’s

internal control over nancial reporting, as stated in their report located

on page123 in this Form10-K.

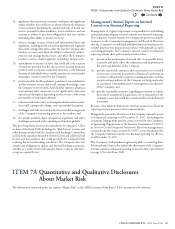

ITEM 7A Quantitative and Qualitative Disclosures

About Market Risk

e information contained under the caption “Market Risk” in the MD&A section of this Form10-K is incorporated by reference.

Contents

Q